The Diffusion Group announced its latest research report identifies five distinct segments of TV viewers, two of which look beyond live broadcast TV as their first entertainment choice.

The Diffusion Group announced its latest research report identifies five distinct segments of TV viewers, two of which look beyond live broadcast TV as their first entertainment choice.

For more information visit: www.tdgresearch.com

Unedited press release follows:

TDG Introduces ‘First Glance’ Segmentation of TV Viewing Preferences

Analysis Identifies Five Distinct Viewing Preference Segments, Two Evolving Away From Traditional TV Sources

FRISCO, TX–(Dec 6, 2011) – While consumers have long ranked live TV programming as their top television content source, the arrival of new platforms and services including digital video recorders (DVRs), PayTV on-demand services, and online video has complicated the selection process. According to TDG’s new report, Viewing Preferences in the Age of Multi-Source Television, a growing number of TV viewers fall into segments inclined to first tune their TV to a source other than live broadcast TV.

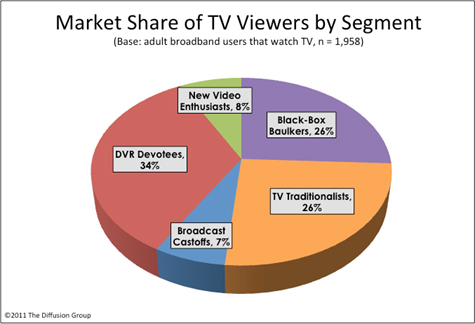

To better understand this shifting behavior, TDG developed a quantitative framework based on consumer ‘First Glance’ TV preferences among different television content sources, including live broadcast, DVR-recorded, on-demand, and online shows, as well as physical discs such as DVD or Blu-ray. Based on this analysis, TDG identified five key segments; non-overlapping groups that exhibit unique TV source preferences. The graphic below identifies the relative size of each segment among the adult broadband population.

The dominant characteristics of each segment are summarized below:

• Black-Box Baulkers – strongly prefer live broadcast and on-demand content, but shy away from adding new ‘black boxes’ to the TV system, especially devices they have to connect and configure. If a service is fully integrated into their one-device, on-remote experience (e.g., PayTV on-demand) they will bite. If not, forget about it.

• TV Traditionalists – prefer live broadcast programs and physical discs, but are much less likely than average viewers to subscribe to or use PayTV on-demand or other value-added services, much less to view DVR-recorded or online TV content. They want ‘regular’ TV and little more.

• DVR Devotees – all members of this segment own a DVR and exhibit a uniquely strong initial preference for DVR-recorded content. Despite this penchant for recorded material, however, this segment has very little interest in on-demand content, regardless of source. Interestingly, they are more likely than other segments to subscribe to satellite PayTV versus cable.

• Broadcast Castoffs – prefer DVR-recorded and Internet video for ‘First Glance’ TV viewing and have very little interest in live broadcast content. In fact, only 72% of this segment has access to live TV broadcasts on their TV. Similarly, they have absolutely no interest in PayTV on-demand services, be it free or transactional.

• New Video Enthusiasts – the ‘Early Adopters’ group in this segmentation, they prefer Internet video, PayTV on-demand, and DVR-recorded material, and are less likely to turn to live TV or physical discs (more traditional TV content sources).

TDG’s new report, Viewing Preferences in the Age of Multi-Source Television, uses advanced statistical methods to develop a unique and useful understanding of the TV viewing preferences of different consumer segments. The report offers a detailed discussion of segment characteristics, including demographics, technology affinity, advanced platform diffusion and use, and media consumption. For more information about this new report, please contact TDG’s Research Services Team at 469-287-8050.

About The Diffusion Group

TDG provides actionable intelligence on the quantum shifts impacting consumer technology and media behaviors. Since 2004, our market research and advisory services have helped hundreds of technology vendors, media companies, and service providers understand how consumers access, navigate, distribute, and consume broadband media — whenever and wherever they may be.

For more information about The Diffusion Group, visit our website at www.tdgresearch.com.