NPD DisplaySearch announced that it expects the prices of televisions to reach new milestones over the holidays.

NPD DisplaySearch announced that it expects the prices of televisions to reach new milestones over the holidays.

For more information visit: www.displaysearch.com

Unedited press release follows:

Q4’11 Holiday TV Prices Expected To Reach New Milestones

Premiums Falling for LED, 120/240Hz and 3D, but Still High, NPD DisplaySearch Reports

Santa Clara, Calif., December 27, 2011—According to the latest NPD DisplaySearch Quarterly TV Cost and Price Forecast Model, average U.S. street prices for all LCD TV sizes up to 46” will be below $1,000 for the first time, and all 32”, including high frame-rate LED models, will be below $500. Many other pricing milestones will be reached during the holiday season in 2011 as well, including:

• 40” and 42” CCFL 2D LCD TVs will have average prices below $500 for the first time

• 40” active (shutter glasses) 3D LCD TV will fall below $1,000

• 47” passive (polarizer glasses) 3D LCD TV will fall below $1,000

• 60” LCD TV will fall below $1,500, with some promotions for less than $1,000

• 50” 1080p 3D plasma TV will fall below $1,000

These low prices reflect the difficult year many in the TV industry have faced. With slower than expected demand and excess production capacity, a persistent oversupply of inventory during 1H’11 led to a dramatic reduction in key component costs during Q3. As a result, these cost reductions enabled the bargains seen during Black Friday and beyond. However, the positive reaction by consumers to very low prices is also a challenge for TV makers.

“The flat panel TV industry is now in a very advanced state of maturity, and the rapid cost reductions seen in the mid-2000s due to enormous investments in panel production capacity have slowed considerably. Despite this, consumers still expect rapid continuous retail price reductions.” noted Paul Gagnon, NPD DisplaySearch Director of North America TV Market Research. “In an effort to offer more value and entice consumers to focus less on price as a motivating factor, a number of new technologies, like LED backlights, higher frame rates and even 3D, were introduced to boost demand without resorting to price-driven tactics.”

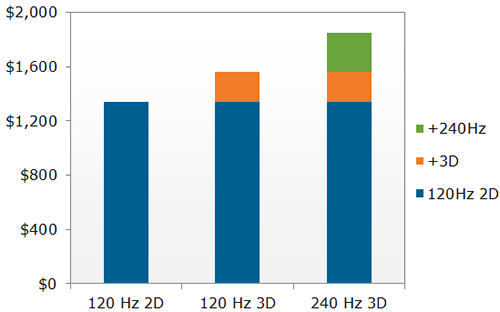

Premium Features Still Expensive

New features are indeed driving a premium, but consumers seem reluctant to step up, especially in the very price sensitive North America region. Adoption of 3D has been slower than expected in North America, totaling just 2.4M units, or 8% of units. The 3D premium for a 55” LCD TV is about 17%, down from over 30% in Q3’11, but still substantial. In many cases, consumers are opting to trade up in size, rather than features, for a similar amount of money. LED backlights alone carry premiums of 25-30%, so fully featured models can carry premiums of 50% or more over base models with 60 Hz refresh rates, 2D and CCFL backlights. That can amount to a 10” larger screen size for a similar price in some cases.

Outlook for Pricing in 2012

Based on an examination of component cost trends, NPD DisplaySearch predicts that price erosion will be less significant in 2012. Because the price of an LCD or plasma panel can account for 30-50% of the retail price for a TV set, the pricing outlook is highly dependent on panel price reductions, especially with narrower margins. CCFL LCD panel prices are currently expected to continue falling through Q1’12 before stabilizing and even starting a gradual increase in 2H’12. LED-backlit LCD panel prices will likely continue falling in 2012, but at a much slower pace than in 2H’11, which will slow retail price erosion. The gap between LED and CCFL LCD pricing will narrow, further encouraging adoption of LED. 3D premiums are also likely to continue declining, aided by the competition between active shutter and passive glasses technologies.

Figure 1. Premiums on a 55” Edge-Lit LED LCD TV (Q4’11)

Source: NPD DisplaySearch Quarterly TV Cost and Price Forecast Model

With extensive cost modeling, including LCD TVs by frame rate, backlight type, and now 3D type, the NPD DisplaySearch Quarterly TV Cost and Price Forecast Model forecasts average street prices for four years using panel prices, TV bill of materials (BOMs), brand and retail margins, logistics costs and more. This cost model includes historical and forecasted costs, price and margins for all major sizes and resolutions of CRTs, LCDs, PDPs, RPTV and OLED and leverages the NPD Group’s volume weighted average retailer pricing information.

For more information on this report, please contact Charles Camaroto at 1.888.436.7673 or 1.516.625.2452, or contact@displaysearch.com or contact your regional DisplaySearch office in China, Japan, Korea or Taiwan.

About NPD DisplaySearch

Since 1996, NPD DisplaySearch has been recognized as a leading global market research and consulting firm specializing in the display supply chain, as well as the emerging photovoltaic/solar cell industries. NPD DisplaySearch provides trend information, forecasts and analyses developed by a global team of experienced analysts with extensive industry knowledge and resources. In collaboration with The NPD Group, its parent company, NPD DisplaySearch uniquely offers a true end-to-end view of the display supply chain from materials and components to shipments of electronic devices with displays to sales of major consumer and commercial channels. For more information on NPD DisplaySearch analysts, reports and industry events, visit us at http://www.displaysearch.com/. Read our blog at http://www.displaysearchblog.com/ and follow us on Twitter at @DisplaySearch.

About The NPD Group, Inc.

The NPD Group is the leading provider of reliable and comprehensive consumer and retail information for a wide range of industries. Today, more than 1,800 manufacturers, retailers, and service companies rely on NPD to help them drive critical business decisions at the global, national, and local market levels. NPD helps our clients to identify new business opportunities and guide product development, marketing, sales, merchandising, and other functions. Information is available for the following industry sectors: automotive, beauty, commercial technology, consumer technology, entertainment, fashion, food and beverage, foodservice, home, office supplies, software, sports, toys, and wireless. For more information, contact us or visit http://www.npd.com/ and http://www.npdgroupblog.com/. Follow us on Twitter at @npdtech and @npdgroup.