NPD DisplaySearch announced that it expects spending on Flat panel display (FPD) manufacturing equipment to rise from $3.8 billion in 2012 to $8.3 billion in 2013.

NPD DisplaySearch announced that it expects spending on Flat panel display (FPD) manufacturing equipment to rise from $3.8 billion in 2012 to $8.3 billion in 2013.

For more information visit: www.displaysearch.com

Unedited press release follows:

Flat Panel Display Equipment Market Expected to Recover Substantially in 2013

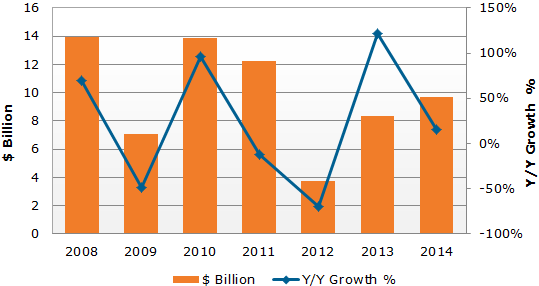

NPD DisplaySearch Forecasts 121% Y/Y Growth Driven by LTPS, AMOLED and China Investments

Santa Clara, Calif., October 29, 2012 — Flat panel display (FPD) manufacturing equipment spending fell 69% Y/Y in 2012 to $3.8 billion—making 2012 the weakest year in history for FPD equipment makers. Despite the challenges facing the FPD industry, including slow demand growth as TV and PC markets mature, 2013 offers hope of significantly improved conditions.

According to the latest NPD DisplaySearch Quarterly FPD Supply/Demand and Capital Spending Report, spending on manufacturing equipment for FPDs is forecast to rise 121% from $3.8 billion in 2012 to $8.3 billion in 2013.

“The majority of FPD equipment spending in 2013 will be used for new low temperature polysilicon (LTPS) fabs or conversion of a-Si (amorphous silicon) capacity to LTPS for use in both TFT LCD and AMOLED (active matrix OLED) production,” according to Charles Annis, Vice President of Manufacturing Research at NPD DisplaySearch. “One reason spending is increasing so much is because LTPS fabs cost substantially more than a-Si fabs to build. There are extra process requirements such as crystallization and doping, plus complicated processes that often necessitate more than 10 mask steps. LTPS fabs also require higher priced equipment, particularly high resolution photolithography tools,” Annis continued. “However, these technologies enable production of high-value displays for use in fast-growing applications such as smartphones and tablets.”

Figure 1: FPD Equipment Spending Forecast

Source: NPD DisplaySearch Quarterly FPD Supply/Demand and Capital Spending Report

As a consequence of the dramatic drop in capital investment in 2012, demand is expected to start catching up to supply by 2H’13. As a result, NPD DisplaySearch expects that 2013 will see a more balanced market, higher fab utilization rates and improved profitability for panel makers. At the same time, new manufacturing and panel technologies, such as oxide semiconductors, in-cell touch, flexible AMOLEDs, and AMOLED TVs, offer the hope of lower costs and higher value applications.

“Certainly, investment risks are related to several factors, including demand growth and the pace of new technology development. Specifically, new investments in AMOLED capacity could be delayed or even cancelled if performance and cost targets cannot be met fast enough. Yet, by most of the indicators that NPD DisplaySearch uses to track the FPD industry, 2013 is currently projected to be a much better year than 2012,” Annis concluded.

Further discussion of this topic can be found in the NPD DisplaySearch Quarterly FPD Supply/Demand and Capital Spending Report. The report is a comprehensive guide to the most important metrics used to evaluate supply, demand and capital spending for all major FPD technologies and applications. The report features in-depth analysis and critical data in user-friendly Excel pivot tables along with detailed interpretation of market and technical trends in PowerPoint. For more information on this report, please contact Charles Camaroto at 1.888.436.7673 or 1.516.625.2452, or contact@displaysearch.com or contact your regional DisplaySearch office in China, Japan, Korea or Taiwan.

About NPD DisplaySearch

Since 1996, NPD DisplaySearch has been recognized as a leading global market research and consulting firm specializing in the display supply chain, as well as the emerging photovoltaic/solar cell industries. NPD DisplaySearch provides trend information, forecasts and analyses developed by a global team of experienced analysts with extensive industry knowledge. In collaboration with The NPD Group, its parent company, DisplaySearch uniquely offers a true end-to-end view of the display supply chain from materials and components to shipments of electronic devices with displays to sales of major consumer and commercial channels. For more information on DisplaySearch analysts, reports and industry events, visit us at http://www.displaysearch.com/. Read our blog at http://www.displaysearchblog.com/ and follow us on Twitter at @DisplaySearch.

About The NPD Group, Inc.

The NPD Group is the leading provider of reliable and comprehensive consumer and retail information for a wide range of industries. Today, more than 2,000 manufacturers, retailers, and service companies rely on NPD to help them drive critical business decisions at the global, national, and local market levels. NPD helps our clients to identify new business opportunities and guide product development, marketing, sales, merchandising, and other functions. Information is available for the following industry sectors: automotive, beauty, entertainment, fashion, food, home and office, sports, technology, toys, video games, and wireless. For more information, contact us or visit http://www.npd.com/ and http://www.npdgroupblog.com/. Follow us on Twitter: @npdtech and @npdgroup.