DisplaySearch announced results from its new Global TV Replacement Study.

DisplaySearch announced results from its new Global TV Replacement Study.

For more information visit: www.displaysearch.com

Unedited press release follows:

Flat Panel TV Owners Likely To Own More TVs, Regardless of Country

Developed Countries Have a Greater Number of TVs per Person, but Households are Not Necessarily Replacing TVs More Often than Those in Emerging Countries

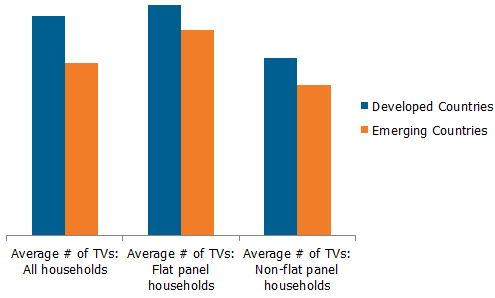

Santa Clara, California, May 4, 2011—Recent findings from the new DisplaySearch Global TV Replacement Study show that the commonly-held assumption that households in richer countries own more TVs is true: the study found that households in developed countries own 28% more TVs on average than households in emerging countries. However, DisplaySearch found that, within nearly every region, the number of TVs per household for flat panel TV owners is greater than non-flat panel TV owners. In fact, the tendency for flat panel TV adopters to own more TVs was even stronger in emerging markets, indicating a stronger separation of buying power among upper and lower income classes.

“Whether a consumer resides in an economically developed or emerging country, those who are willing to adopt new TV technologies possess greater interest in owning TVs in general, have higher incomes, and can afford more TVs, or both,” noted Paul Gagnon, DisplaySearch Director of North America TV Market Research.

Gagnon added, “Owners of at least one flat panel TV in developed countries owned 30% more TVs per household than households that didn’t own any flat panel TVs. In emerging countries, the difference was even higher on average, with flat panel owners having 37% more TVs than non-flat panel owners.”

Figure 1. Number of TVs Owned Per Household

Developed countries in this study include the US, UK, Japan, Italy, France, and Germany; emerging countries include China (urban and rural), India, Brazil, Mexico, Turkey, Russia, and Indonesia.

Source: DisplaySearch Global TV Replacement Study

Number of TVs per Person Closely Relates to a Country’s Socio-Economic Standing

When looking at the number of TVs per household, the US has the highest number, while India has the fewest, as one might expect from a country with fewer households able to afford a TV. Despite this, some countries have a higher number of TV sets per household than might be expected, like Mexico, which ranked fourth among the countries studied. When considering the higher number of people per household, however, around 3.8 persons per household on average compared with 2.9 on average in the United States, the average number of TVs per person in Mexico drops towards the middle of the pack among countries in the study.

“When looking at the distribution of average number of TVs per person among the countries in the study, the top six were developed countries, with the emerging countries in the bottom eight. This shows a fairly linear relationship with socio-economic status, with India and rural China accounting for the fewest number of TVs per person,” observed Gagnon.

Weak Relationship Between a Country’s Economic Status and Replacement Frequency

The UK and Japan have been the most active in replacing TVs over the last three years among the countries included in the study. European countries have been active in general as well, with the end of analog TV broadcasts coming soon, necessitating the upgrades to a digital tuner equipped TVs.

However, some emerging countries, like Indonesia and urban China, have also been very active in replacing TV sets. Since these countries generally have less history of TV purchasing in general, the average age of TVs overall is lower than in very mature TV markets, like the US, so any replaced TV is likely to be younger.

On the other hand, countries like India and rural China, which are very different in terms of TV ownership profiles and replacement behaviors than urban China, have a very low level of replacement activity. This reflects a lower level of household income, as well as a tendency to be more frugal TV owners, preferring to hang on to TVs until failure, which can be a very long time.

DisplaySearch Global TV Replacement Study Now Available

How quickly are consumers replacing their TVs? Which countries have the shortest replacement cycles? And what key factors are driving TV sales? The DisplaySearch Global TV Replacement Study offers a focused view of TV replacement trends in 14 global markets. This study also provides insight into the reasons why consumers are replacing their CRT and flat panel TVs.

Important information in this report helps businesses to:

• Identify which markets are replacing and adding the most TVs and why

• Understand the TVs currently in the home, by technology, brand, size, age, and location

• Determine which devices, besides TVs, consumers are using to watch TV, movies, and video, such as iPads, smart phones, notebook PCs, and more

• Identify how local TV replacement trends will impact product planning and the supply chain

• Reveal plans for TV purchases over the next 12 months.

The report is available for all 14 markets or by individual market:

China – Urban

China – Rural

India

Indonesia

Japan

UK

France

Turkey

Germany

Italy

Brazil

US

Mexico

Russia

This unique global study provides clients with country-level insights and information based on nationally representative samples of more than 14,000 TV owners. The study combines DisplaySearch TV analyst expertise with the advanced consumer survey design expertise of its parent company, The NPD Group.

For more information, contact Charles Camaroto at 1.888.436.7673 or 1.516.625.2452, e-mail contact@displaysearch.com, or contact your regional DisplaySearch office in China, Japan, Korea or Taiwan for more information.

About DisplaySearch

Since 1996, DisplaySearch has been recognized as a leading global market research and consulting firm specializing in the display supply chain, as well as the emerging photovoltaic/solar cell industries. DisplaySearch provides trend information, forecasts and analyses developed by a global team of experienced analysts with extensive industry knowledge. In collaboration with The NPD Group, its parent company, DisplaySearch uniquely offers a true end-to-end view of the display supply chain from materials and components to shipments of electronic devices with displays to sales of major consumer and commercial channels. For more information on DisplaySearch analysts, reports and industry events, visit us at http://www.displaysearch.com/. Read our blog at http://www.displaysearchblog.com/ and follow us on Twitter at @DisplaySearch.

About The NPD Group, Inc.

The NPD Group is the leading provider of reliable and comprehensive consumer and retail information for a wide range of industries. Today, more than 1,800 manufacturers, retailers, and service companies rely on NPD to help them drive critical business decisions at the global, national, and local market levels. NPD helps our clients to identify new business opportunities and guide product development, marketing, sales, merchandising, and other functions. Information is available for the following industry sectors: automotive, beauty, commercial technology, consumer technology, entertainment, fashion, food and beverage, foodservice, home, office supplies, software, sports, toys, and wireless. For more information, contact us or visit http://www.npd.com/ and http://www.npdgroupblog.com/. Follow us on Twitter at @npdtech and @npdgroup.