IHS iSuppli announced it reckons that, after rising continuously during the previous four months, U.S. flat panel television prices declined slightly in August 2011.

IHS iSuppli announced it reckons that, after rising continuously during the previous four months, U.S. flat panel television prices declined slightly in August 2011.

For more information visit: www.isuppli.com

Unedited press release follows:

US Flat-Panel TV Pricing Declines in August for the First Time in Four Months

El Segundo, Calif., September 27, 2011—After rising continuously during the previous four months, U.S. flat-panel television prices declined slightly in August, as economic uncertainty and high inventories took their toll on the market, according to the IHS iSuppli U.S. TV & Specifications Tracker from information and analysis provider IHS (NYSE: IHS).

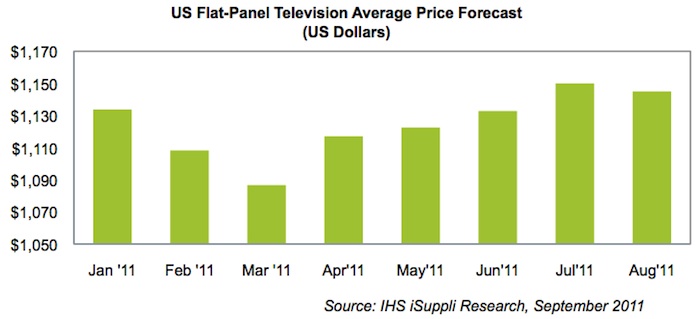

The average price in August for flat-panel TVs, a category covering both liquid crystal display (LCD) and plasma technologies, fell to $1,145, down $5—or 0.4 percent—from $1,150 in July. Although the decline was less than 1 percent, it was significant because it represented the first decrease since March, when prices fell $21.60 from February, as shown in the figure below.

The retreat in pricing was apparent especially among larger-sized TVs. Pricing was down 1 percent in the 30- to 39-inch range, down 3 percent in the 40- to 49-inch group, and down 2 percent in the larger-than- 50-inch category.

“Larger-sized televisions have been hard to sell given the slow economy and the absence in general of a big-enough price decline to motivate consumers to buy,” said Riddhi Patel, director for television systems and retail services at IHS.

For those few companies that dared to offer aggressive price reductions, consumers rewarded them with an increase in sales. This was case with Japan’s Sharp Corp., whose 60-inch TV sets sold well in the American market after discounting, even taking share away from 55-inch sets offered by rival companies.

In the 3-D television segment, pricing in the 30- to 39-inch group dipped below the $1,000 level in August for the first time since the size group was made available in 3-D in March. Other TV sizes in the 3-D category also suffered a dip in pricing, ranging from less than 1 percent in the over-50 size to 3 percent for both 30- to 39-inch and 40- to 49-inch models.

Only two categories of flat-panel TVs saw pricing increase in August—the 20-inch and smaller sector, as well as the 21- to 29-inch group. This was because advanced features like light-emitting diode (LED) technology were finally being offered on smaller sets, such as the 18.5-inch and 19-inch sizes.

Interest is rising in smaller-sized televisions, which are being placed by consumers in secondary areas of the home like the kitchen or the dining room, IHS research has determined.

A surprising development was an increase in the price of non-LED models—specifically, LCD TVs still featuring the older cold cathode fluorescent lamp (CCFL) technology—predominant among flat panel televisions before the advent of the currently more fashionable LED sets. Except for the 40-49-inch category, all other sizes for CCFL-based LCD TVs saw pricing increase in August, suggesting that the less-than-cutting-edge models continued to have a place in the market. Until CCFL models are phased out—expected within the next few years—brands will continue to ship them, especially because they are less expensive than their LED counterparts.

In the plasma flat-panel television segment, pricing in August fell by an average of $80 for 50-inch-and-larger sets and by $21 for 40- to 49-inch sizes, compared to their levels in July. Among consumers, only 21.5 percent chose to replace a plasma set with another plasma model—which means that the majority, or 78.5 percent, abandoned plasma for a different technology, such as LCD, according to a second quarter report from the IHS iSuppli U.S. TV Consumer Preference Analysis Service. In comparison, 90 percent of consumers chose to replace an LCD TV with another set of the same type of display technology that sported either CCFL or LED backlight technology.

Plasma 3-D TV prices suffered the same slippage occurring in other flat-panel TV areas, although they retained greater stability compared to pricing for non-3-D plasma sets, and were also cheaper than their 3-D LCD rivals.

Overall, inventories in August for flat-panel TVs increased to a manageable seven to eight weeks on average. For the 55-inch and larger models, however, inventory levels were much higher than normal, especially as they already were at 10 weeks by July, compared to an otherwise normal level of six to eight weeks for that size range.

To learn more about the latest developments in the U.S. TV space, see the IHS iSuppli report entitled: “TV Prices Stabilize to Meet Falling Demand.”

About IHS (www.ihs.com)

IHS (NYSE: IHS) is the leading source of information and insight in critical areas that shape today’s business landscape, including energy and power; design and supply chain; defense, risk and security; environmental, health and safety (EHS) and sustainability; country and industry forecasting; and commodities, pricing and cost. Businesses and governments in more than 165 countries around the globe rely on the comprehensive content, expert independent analysis and flexible delivery methods of IHS to make high-impact decisions and develop strategies with speed and confidence. IHS has been in business since 1959 and became a publicly traded company on the New York Stock Exchange in 2005. Headquartered in Englewood, Colorado, USA, IHS employs more than 5,100 people in more than 30 countries around the world.