IHS announced it reckons that the average retail price of flat panel televisions available in the U.S. rose to the highest level in two-and-a-half years during the second quarter of 2012.

IHS announced it reckons that the average retail price of flat panel televisions available in the U.S. rose to the highest level in two-and-a-half years during the second quarter of 2012.

For more information visit: www.isuppli.com

Unedited press release follows:

US Flat-Panel TV Retail Pricing Hits Highest Level in More Than Two Years

El Segundo, Calif. (July 30, 2012) — Average retail pricing for U.S. flat-panel televisions rose to the highest level in two-and-a-half years during the second quarter, driven by the growing proportion of TV sets bearing advanced features and large display sizes, according to an IHS iSuppli U.S. TV Price and Specifications Market Tracker Report from information and analytics provider IHS (NYSE: IHS).

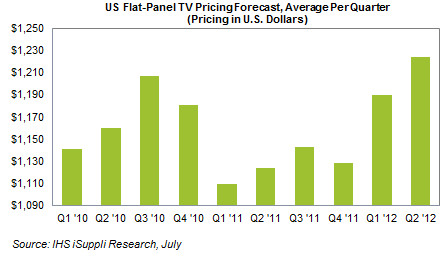

Pricing for U.S. flat-panel televisions reached $1,224 during the second quarter, up a healthy 3 percent from $1,190 in the previous quarter, and up by an even larger 9 percent from $1,124 a year ago in the second quarter of 2011. The second-quarter level represented the peak pricing point in the U.S. market for at least 10 quarters, dating to the beginning of 2010, as shown in the figure below.

The pricing figures account for all television technologies, dominated by the liquid crystal display televisions (LCD TVs), along with the smaller plasma segment.

“The climb in U.S. flat-panel TV prices is attributed to market gains in retail among new sets sporting advanced technologies, such as 3-D, integrated interactivity and light-emitting diode (LED) backlight technology used in LCD TV sets,” said Edward Border, analyst for TV technology at IHS. “Consumers also are buying a larger portion of sets with Web 2.0 features characteristic of Smart TVs. Moreover, some large-sized television models in both the LCD and plasma categories increased their share, contributing to overall growth in pricing.”

3-D on the rise

For instance, 3-D sets’ share of all televisions available at retail ascended to 30.9 percent in the second quarter, up from 27.8 percent in the earlier quarter. A similar increase occurred for Smart TVs, growing to 44.3 percent, up from 40.9 percent; and for LED-backlit LCD sets, rising to 63.5 percent, up from 59.2 percent.

Among specific set categories, increases also took place in some large sizes between the end of the first quarter and the close of the second.

The 46-inch LCD’s share in retail rose to 12.2 percent, up from 11.8 percent. Meanwhile, share for the 60-inch LCD increased to 5.2 percent, up from 4.2 percent. Plasma sets saw an even greater expansion, with the 50-inch rising to 23.8 percent, up from 21.2 percent; the 60-inch increasing to 23.6 percent, up from 18.6 percent; and the 65-inch growing to 6.9 percent, up from 6.1 percent.

Within the LCD TV space, the majority of the smaller, below-42-inch screen sizes saw their average retail price increase, as features including Full HD, LED and Internet connectivity became more widespread in 2012 models.

32-inch sets see market decline

One major exception to this trend was the continued price decline of the ever-popular 32-inch TV sector. By the second quarter, the average price of the set was just $435, down from $495 in the first quarter. In another notable development, pricing in June for the 42-inch LCD TV category plunged to an all-time low of $761, down from $807 in May, after two consecutive months of price hikes.

In the Smart TV sector, average pricing in June fell to $1,907 from $2,015 in May, but it was up significantly compared to $1,724 in June last year. From a pricing perspective then, the Smart TV can be considered a major technological success so far this year, appealing to consumers with its dynamic mix of interactive features, easy integration with set-top boxes, emphasis on online streaming capabilities and access to over-the-top cable content.

For plasma sets, pricing in the second quarter was up for sizes ranging from the 46-inch to the 60- inch models, retreating only in the 42-inch and 65-inch categories.

Average pricing in the second quarter for plasma displays as a whole reached $1,628, while that for LCD TVs amounted to $1,120 during the same period.

About IHS (www.ihs.com)

IHS (NYSE: IHS) is the leading source of information and insight in critical areas that shape today’s business landscape, including energy and power; design and supply chain; defense, risk and security; environmental, health and safety (EHS) and sustainability; country and industry forecasting; and commodities, pricing and cost. Businesses and governments around the globe rely on the comprehensive content, expert independent analysis and flexible delivery methods of IHS to make high-impact decisions and develop strategies with speed and confidence. IHS has been in business since 1959 and became a publicly traded company on the New York Stock Exchange in 2005. Headquartered in Englewood, Colorado, USA, IHS employs more than 6,000 people in more than 30 countries around the world.