IHS iSuppli announced it reckons that worldwide flat-panel TV shipments dipped 1.3% in the second quarter of 2011.

IHS iSuppli announced it reckons that worldwide flat-panel TV shipments dipped 1.3% in the second quarter of 2011.

For more information visit: www.isuppli.com

Unedited press release follows:

Economic Concerns Reduce TV Shipments in Q2

El Segundo, Calif., October 13, 2011—Worldwide shipments of flat-panel televisions dipped slightly in the second quarter due to soft demand from consumers amid an uncertain global economic climate, with the plasma segment performing much better than the dominant liquid crystal display (LCD) space, according to a new IHS iSuppli Worldwide TV Market Tracker report from information and analysis provider IHS (NYSE: IHS).

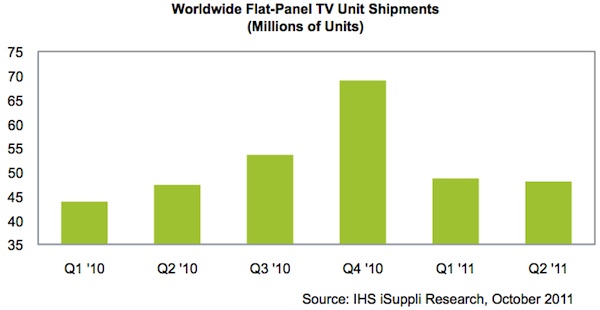

Global flat-panel TV shipments in the second quarter amounted to 48.0 million units, down 1.3 percent from 48.7 million in the first quarter, as shown in the figure below. Of that total, LCD TV shipments accounted for 43.4 million units, down 2.7 percent from 44.6 million. Meanwhile, shipments of the rival plasma technology reached 4.7 million units, up a solid 13.9 percent from 4.1 million.

“Although the second quarter of the year usually is stronger than the first, that was not the case for flat-panel TVs this year,” said Lisa Hatamiya, displays researcher for IHS. “Anxiety over the economy dampened demand in the mature TV markets of North America, Europe and Japan, where purchasing power and discretionary income are highest. And even strong sales in the emerging markets in the Asia-Pacific region were insufficient to offset the slowdown suffered by the developed regions.”

Also contributing to the slowdown was the impact of China’s seasonal sales slump. China, a major television market, typically sees a sluggish second quarter after the end of a major sales period during Lunar New Year celebrations in either late January or early February.

Larger sets deliver larger revenue

Despite the second-quarter contraction in global TV shipments, flat-panel revenue grew during the period, thanks to the introduction of larger TV sizes and feature-rich sets that command a premium in pricing. Such TV sets, offering features like 3-D, Internet connectivity, higher frequencies and light-emitting diode (LED) backlight technology, helped to shore up revenue. Total flat-panel revenue worldwide in the second quarter amounted to $31.5 billion, up 3.6 percent from $30.4 billion in the first quarter.

Within the LCD space, the 32-inch size category dominated overall, though its share of the total LCD market is expected to fall this year to 36 percent, down from 41 percent in 2010. China was the biggest LCD TV market during the period, with 19 percent market share, followed by North America and Western Europe, each with 18 percent share. Japan was fourth with 12 percent.

In the plasma sector, the second-quarter growth in shipments depended heavily on the availability of larger sizes at aggressive prices. But with LCD models mounting highly competitive pricing of their own, plasma’s price advantage is likely to decline after this year, IHS believes. North America remained the key plasma market with 33 percent market share, followed by Western Europe with 18 percent and the Asia-Pacific region at 12 percent. In fourth place was China with 11 percent.

To learn more about this topic, see the IHS iSuppli report entitled: “Mature Markets Suffering a Slowdown in TV Demand.”

About IHS (www.ihs.com)

IHS (NYSE: IHS) is the leading source of information and insight in critical areas that shape today’s business landscape, including energy and power; design and supply chain; defense, risk and security; environmental, health and safety (EHS) and sustainability; country and industry forecasting; and commodities, pricing and cost. Businesses and governments in more than 165 countries around the globe rely on the comprehensive content, expert independent analysis and flexible delivery methods of IHS to make high-impact decisions and develop strategies with speed and confidence. IHS has been in business since 1959 and became a publicly traded company on the New York Stock Exchange in 2005. Headquartered in Englewood, Colorado, USA, IHS employs more than 5,100 people in more than 30 countries around the world.