IHS announced it reckons that the global 3D consumer market is thriving, with clear and discernible growth across its major platforms, including cinema, home video and pay television Video-on-Demand (VOD).

IHS announced it reckons that the global 3D consumer market is thriving, with clear and discernible growth across its major platforms, including cinema, home video and pay television Video-on-Demand (VOD).

For more information visit: www.screendigest.com

Unedited press release follows:

Global 3-D Market Flourishes Across Cinema, Home Video and TV VoD Platforms

El Segundo, Calif., Dec. 20, 2012 — The global 3-D consumer market is thriving in a dynamic environment marked by clear and discernible growth across its major platforms, including cinema, home video and pay-TV video on demand, with international markets continuing to make major contributions to the industry, according to an IHS Screen Digest Cross Platform Intelligence report from information and analytics provider IHS.

Worldwide metrics are on the rise for 3-D technology as a whole. The number of 3-D screens is up fourfold over a period of three years, while 3-D box office climbed in the double digits from 2010 to 2011. The 3-D home-video market is also showing strong growth, bucking the overall trend of a declining physical video market, with U.S spending on Blu-ray 3-D nearly doubling in 2012 from last year’s levels. More 3-D TV channels worldwide are likewise now available, including one just launched in China, with plenty of potential for expansion in the years ahead for 3-D Video-on-Demand service.

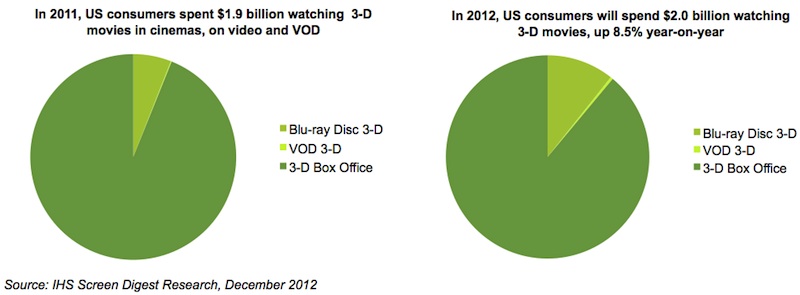

The attached figure illustrates the strides made by the 3-D consumer market in the United States in particular, in which the principal metric used for tracking is consumer spending.

“In an age where consumers have at their easy disposal a virtual treasure trove of entertainment options to draw from, the encouraging growth of the 3-D medium is remarkable to behold,” said Tony Gunnarsson, analyst for video at IHS Screen Digest. “The continuing expansion of the industry is especially significant when one considers that 3-D is but a small niche of overall digital viewing, and that consumers have to shell out considerably more money for 3-D products, which are priced at a premium and not necessarily an easy sell in these economically uncertain times.”

3-D cinema shows growth in both revenue and number of new screens

The number of 3-D screens worldwide has grown dramatically in three years, rising by more than a factor of four from approximately 9,000 screens at the end of 2009 to 43,000 by the third quarter this year. The U.S. continues to have the lion’s share of 3-D screens, followed by China, France, the United Kingdom and Germany.

Meanwhile, global 3-D box-office revenue hit $7.0 billion in 2011—the last full year for which full figures are available—up 16 percent from $6.0 billion in 2010. 3-D accounted for 22 percent of total world box-office receipts in 2011, up from 19 percent the previous year.

In particular, 3-D is stabilizing in mature cinema markets like the U.S., where its share of the overall box office is no longer growing as rapidly compared to the earlier years of the format or in other countries where 3-D cinema is just taking off. Increasingly, 3-D revenue prospects rely on the quality of the 3-D film slate, and the wealth—or relative dearth—of titles during a particular period could spell a big difference in 3-D revenue prospects in the mature cinema markets.

3-D screen growth is also slowing dramatically in the developed regions, where exhibitors have already made a significant investment in 3-D screen infrastructure. The opposite is true in China and other emerging international markets, where the continued expansion of new-cinema screen infrastructure as well as the subsequent up-conversion rate from 2-D to 3-D is pushing further growth of 3-D screens.

Overall, international markets continue to account for a rising share of the worldwide 3-D box office—73 percent in 2011, up from 66 percent in 2010 and 54 percent in 2009, with the balance held by North America.

3-D home video defies overall down trend of physical video market

In the 3-D home-video segment, the U.S. continues to make up the largest market for Blu-ray 3-D (BD 3-D), equivalent to 51 percent of global BD 3-D spending. And while both value and volume for traditional physical video are decreasing, BD 3-D is an exception to the trend, with forecasts showing strong growth even out to 2016. Spending by U.S. consumers on the medium is up 94 percent this year from 2011 levels, to $220 million, with BD 3-D unit sales set to climb 105 percent, to 9.9 million units.

“Despite the relatively small market for BD 3-D, the format plays an important role for overall physical video,” Gunnarsson noted. “BD 3-D is already being marketed as the ultimate home-video experience, and studios are pricing 3-D home-video well above Blu-ray 2-D versions.”

Growth is also forecast for the BD 3-D home-video market in the three big European markets of the United Kingdom, Germany and France.

Trends in 3-D Broadcast and VoD show promise

A total of 37 unique dedicated 3-D channels have been launched worldwide since 2010, plus another 38 dedicated 3-D event broadcasts. Nonetheless, 3-D TV launches slowed considerably in 2012, due to uncertainty about investing in, and maintaining, dedicated linear 3-D channels. On the plus side were the positive developments on programming, such as the formation of 3Net, a joint venture among Sony, Imax and Discovery to focus on 3-D output including documentaries and other niche genres.

Some pay-TV operators have also sought to provide 3-D movies on a Video-on-Demand basis. Movies and documentaries—not live or original content—are the basis for 3-D VoD, but the overall limited slate as well as the higher price of 3-D video-on-demand (VoD) movies—as much as 30 percent over HD titles—may serve to discourage some consumers from adopting the service in the short term.

Even so, the 3-D VoD market will overcome such obstacles in the years ahead. U.S. consumers, for instance, will spend $76.1 million for 3-D VoD by 2016, up from $11.1 million this year. European viewers, meanwhile, will fork out $32.4 million, compared to just $3.5 million during the same period.

The addressable market for 3-D in the US, Europe and China

Penetration for 3-D remains highest in 2012 across cinema-screen infrastructure, driven by higher per-ticket revenue and the continued practice of major studios releasing blockbuster titles in 3-D.

In homes, 3-D penetration is dependent on households upgrading to 3-D TVs as well as 3-D BD players and the associated 3-D glasses. 3-D features are becoming a standard on high-end HDTV sets and BD players in the forecast period to 2016, resulting in a growing segment of households in developed markets being ripe for 3-D movies viewing. By 2016, the penetration of 3-D ready TV households will have surpassed that of 3-D cinema screens in select markets worldwide.

The largest international footprint overall for 3-D cinema this year belongs to China, where more than 8,000 screens had been installed as of the third quarter—more than double from a year earlier—as the rapidly growing screen infrastructure makes a significant contribution.

The country’s BD 3-D space, however, is still in infancy, owing to the lack of a legitimate physical video market in the country in light of rampant piracy. The ability of Chinese manufacturers to integrate 3-D as standard feature will also have a significant impact on 3-D TV broadcasts moving forward, after Chinese public broadcaster CCTV launched the first 3-D TV channel in the country on a trial basis earlier this year.

Learn more about this topic with the IHS Screen Digest Insight Report entitled: “Cross Platform 3-D Movies Market Monitor.”

About IHS (www.ihs.com)

IHS (NYSE: IHS) is the leading source of information, insight and analytics in critical areas that shape today’s business landscape. Businesses and governments in more than 165 countries around the globe rely on the comprehensive content, expert independent analysis and flexible delivery methods of IHS to make high-impact decisions and develop strategies with speed and confidence. IHS has been in business since 1959 and became a publicly traded company on the New York Stock Exchange in 2005. Headquartered in Englewood, Colorado, USA, IHS is committed to sustainable, profitable growth and employs more than 6,000 people in 31 countries around the world.