IHS iSuppli announced that, according to its latest forecast, worldwide shipments of large-sized LCD panels will expand by 14% in 2011, compared to 23.4% in 2010 and 20.8% in 2009.

IHS iSuppli announced that, according to its latest forecast, worldwide shipments of large-sized LCD panels will expand by 14% in 2011, compared to 23.4% in 2010 and 20.8% in 2009.

For more information visit: www.isuppli.com

Unedited press release follows:

Global LCD Market Decelerates in 2011 on Weak Consumer Demand in Q1

El Segundo, Calif., May 16, 2011—Weak consumer demand for televisions, desktop computer monitors and notebook PCs in the first quarter will cause unit shipment growth in the global market for large-sized liquid crystal display (LCD) panels to decelerate in 2011 compared to 2010 and 2009, new IHS iSuppli (NYSE: IHS) research indicates.

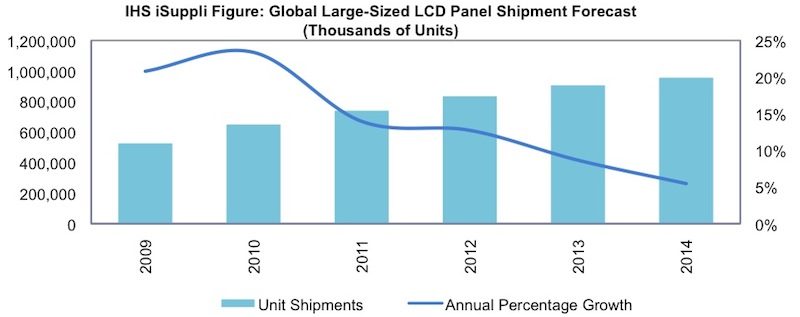

Worldwide shipments for large-sized LCD panels will expand by only 14 percent in 2011, compared to 23.4 percent in 2010, and 20.8 percent in 2009. Unit shipments this year will amount to 740 million, up from 649.3 million in 2010.

The attached figure presents the global forecast for shipments of large-sized LCDs, defined as panels that are 10.1 inches or larger in the diagonal dimension.

The first quarter of 2011 will be the weakest part of the year, with shipments declining by 9.2 percent compared to the fourth quarter of 2010, and decreasing 0.8 percent from the first quarter of 2010. While the first quarter is typically the sluggish annual period for the large-sized LCD panel as demand dips following the peak holiday selling season, the slowdown in 2011 is particularly pronounced compared to 2010.

“The sharp sequential drop in shipments in the first quarter was spurred by slow sales of the three major products that use large-sized LCDs: televisions, monitors and notebook PCs,” said Sweta Dash, senior director for displays research at IHS. “Consumer spending on such items has stalled on account of the sluggish pace of economic recovery. And while demand is starting to recover in the second quarter, the rebound will not progress quickly enough to generate the level of annual growth seen in recent years.”

Supply-side struggles

Exacerbating the slow consumer demand, shipments in the first quarter were further reduced by efforts to clip inventories among branded vendors. Starting in December, when demand started to decline following the holiday buying season, branded vendors started an inventory correction, decreasing panel orders to clear out stockpiles.

This contributed to sequential decreases in panel shipments in January and February and forced panel suppliers to cut production.

Average LCD prices declined throughout the first quarter, especially for television panels. Most panel suppliers reported financial losses in the first quarter.

The utilization rate for large-sized LCD fabs in March was reported at only 80.9 percent, lower than the 85.8 percent seen in January.

U.S. and Europe see slow television sales

Both the United States and Europe experienced slow television sales in the first quarter. Consumer demand in the regions has not been stimulated by recent price declines.

New television demand mostly is coming from emerging economies. However, even sales in these areas could be threatened by high oil prices and high inflation rates.

Given these developments, most television brands are concerned about 2011 demand and are starting to cut their sales targets for this year.

Meanwhile, notebook demand has been diminished by the rising sales of tablets. Furthermore, the CRT replacement cycle in the desktop PC monitor market has finished, causing sales of LCD panels to this segment to slow. Suppliers are hoping some demand may be driven by the replacement of monitors employing cold cathode fluorescent lamp (CCFL) backlight with new LED-backlit monitors.

Recovery commences

Panel demand started to recover in March as branded vendors started to buy panels for inventory replenishment. Also, because of concerns about component shortages resulting from the Japan earthquake, some television brands in the second quarter began to pull in panel orders early to reduce the risk of supply chain disruptions.

As notebook and monitor panel pricing is seeing some improvements, panel suppliers are increasing the utilization ratio at Gen 5 and Gen 6 fabs. Meanwhile, fab utilization at Gen 8 and above remains low. Panel production is expected to increase further in May due to improved demand, as branded vendors pull in orders to reduce the impact of component supply shortages.

Unit shipments in the second quarter are expected to rise by 12.1 percent, with some brands expected to pull in back-to-school panel demand for notebooks and desktop PC monitors for early preparation in the second quarter. And although end-market demand is still not that strong, branded vendors have begun to buy more panels.

Panel inventory at branded vendors is estimated to be healthy, with TV panel buyers—especially those in China—starting to buy panels again.

Learn more about what’s happening in the LCD space in the IHS report entitled: Large-Sized LCD Suppliers Control Production to Stabilize Prices.

About IHS iSuppli Products & Services

IHS iSuppli technology value chain research and advisory services range from electronic component research to device-specific application market forecasts, from teardown analysis to consumer electronics market trends and analysis and from display device and systems research to automotive telematics, navigation and safety systems research. More information is available at www.isuppli.com and by following on twitter.com/iSuppli.

About IHS (www.ihs.com)

IHS (NYSE: IHS) is the leading source of information and insight in critical areas that shape today’s business landscape, including energy and power; design and supply chain; defense, risk and security; environmental, health and safety (EHS) and sustainability; country and industry forecasting; and commodities, pricing and cost. Businesses and governments around the globe rely on the comprehensive content, expert independent analysis and flexible delivery methods of IHS to make high-impact decisions and develop strategies with speed and confidence. IHS has been in business since 1959 and became a publicly traded company on the New York Stock Exchange in 2005. Headquartered in Englewood, Colorado, USA, IHS employs approximately 5,100 people in more than 30 countries around the world.