IHS Technology announced that LCD television panel shipments enjoyed unexpected growth in the first half of this year but production issues loom.

IHS Technology announced that LCD television panel shipments enjoyed unexpected growth in the first half of this year but production issues loom.

For more information visit: www.ihs.com

Unedited press release follows:

Defying Expectations, Global LCD TV Market Rises in First Half

El Segundo, Calif. (Aug. 7, 2014) — Liquid-crystal-display television (LCD TV) panels enjoyed unexpected growth in the first half of this year, tied to enthusiastic TV viewing because of the World Cup and other factors that benefited the market, according to a new report from IHS Technology (NYSE: IHS).

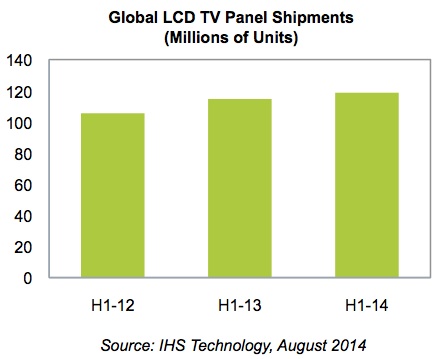

Global LCD TV panel shipments during the first six months of 2014 rose 3 percent from the same period a year ago, as shown in the attached figure. Although growth this year was much less than the 9 percent expansion logged during the first six months of 2013, achieving any increase at all was unforeseen.

“What a surprising result this was, as the television industry doubted that shipments could increase during this time,” said Ricky Park, director for large displays at IHS. “It was unclear whether any growth would occur because of signs earlier in the year that appeared to be discouraging. However, the market has righted itself, to everyone’s delight.”

Among the variables fueling the market, perhaps none were more dazzling than the month-long, glittery affair known as the World Cup. Starting in June, the world’s premiere soccer event drove up demand for televisions, especially in Europe and South America.

Sports extravaganzas long have been reliable drivers of television sales—and by extension, the LCD TV panels that make up the sets. And for events of global interest like the World Cup or the Olympics, staged once every four years, keen anticipation usually helps propel the market upward.

Still, the athletics spectacle alone was no guarantee of growth. But other factors also kicked in, helping create an overall favorable environment for the global LCD TV trade in the first half. These included signs of a continuing economic recovery in North America, one of the world’s two largest markets for LCD TVs alongside China; a subsidy program initiated by the Mexican government for its citizens to buy new LCD TVs; and the continued phasing out of bulky, tube-type analog televisions, now obsolete in many areas of the world.

These findings are available in the report entitled, “LCD Supply and Demand Market Tracker – Q2 2014,” from the Displays service of IHS Technology.

But strong demand is blunted by production problems

Despite the stronger-than-expected demand for the January to June period, a drop in yields and a loss in capacity due to production line modifications caused a shortage of supply of LCD TVs. The effects were felt especially in the ultra-high-definition television (UHD TV) segment of the industry.

Issues related to quality have cropped up, for instance, in the production of so-called PenTile RGBW UHD panels, which are aimed at the 40-inch segment of the UHD space. A Samsung-patented technology, PenTile panels add a subpixel with no color filtering material that allows the backlight through, resulting in white (W) being added to the traditional red, green and blue (RGB) subpixels. The technology makes brighter images possible with the same amount of power used for RGB.

The production headache is becoming a problem, Park added, because the price of PenTile RGBW UHD TVs was supposed to be coming down in order to better compete with non-UHD sets. With four times the resolution of 1080p sets, UHD TVs are also priced far higher than conventional high-definition television models.

Also facing trouble was the production method known as multi-model on a glass (MMG). Low production efficiencies resulted in reduced capacity for MMG, especially in the advanced production lines for eighth-generation fabs.

On top of those problems, a growing share of the manufacturing base that once had enjoyed maximized glass efficiency—lines producing TV panels in sizes of 39.5, 42.5, 48 and 48.5 inches—experienced deteriorating yields.

Production issues of a different nature are likely to occur in the second half, IHS believes, extending current manufacturing woes. A substantial loss in production capacity is expected during the remainder of the year because panel makers in China and Taiwan are slated to use different electrode materials from those currently deployed, ostensibly to improve their UHD products. The makers affected include AU Optronics, Innolux and BOE Optoelectronics.

Change is also afoot at Korean suppliers Samsung Display and LG Display.

Samsung Display will reduce the thickness of its front-pane glass to 0.5 millimeters as the company increases the production of curved TVs. LG Display, meanwhile, reportedly is converting part of an eighth-generation line to oxide thin-film transistor technology in order to produce organic light-emitting-diode (OLED) panels, a rival t echnology to UHD LCDs that the maker hopes will start picking up among consumers.

All the same, TV prices are not expected to dip in the months to come in spite of the ongoing production problems, which will serve to constrict the supply of LCD TVs.

About IHS (www.ihs.com)

IHS (NYSE: IHS) is the leading source of information, insight and analytics in critical areas that shape today’s business landscape. Businesses and governments in more than 165 countries around the globe rely on the comprehensive content, expert independent analysis and flexible delivery methods of IHS to make high-impact decisions and develop strategies with speed and confidence. IHS has been in business since 1959 and became a publicly traded company on the New York Stock Exchange in 2005. Headquartered in Englewood, Colorado, USA, IHS is committed to sustainable, profitable growth and employs more than 8,000 people in 31 countries around the world.