iSuppli announced that global prices for large-sized (10″+) liquid crystal display (LCD) panels used in televisions and computers are rising as holiday demand arrives.

iSuppli announced that global prices for large-sized (10″+) liquid crystal display (LCD) panels used in televisions and computers are rising as holiday demand arrives.

For more information visit: www.isuppli.com

Unedited press release follows:

Larger Prices Arrive for Larger-Sized LCD Panels

Global pricing for large-sized liquid crystal display (LCD) panels used in televisions and computers is rising in 2010 as holiday demand arrives, according to the market research firm iSuppli, now part of IHS Inc. (NYSE: IHS).

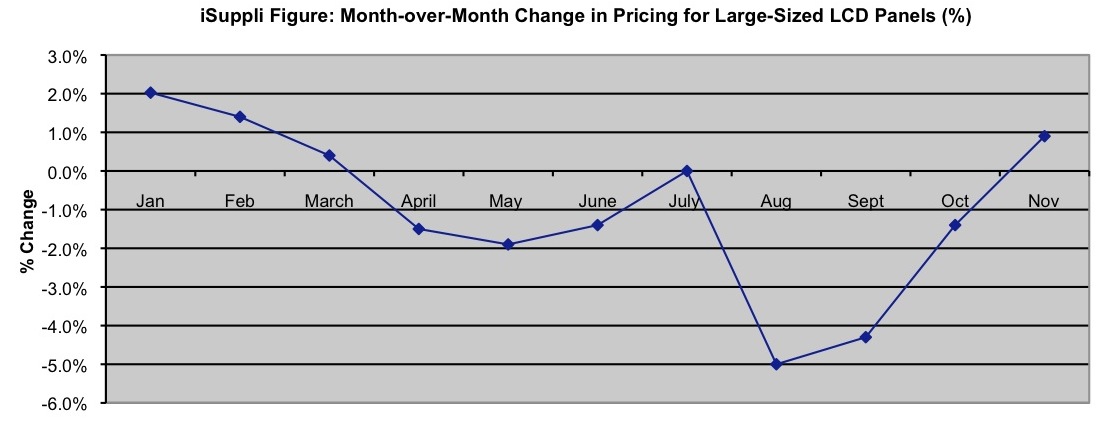

Pricing for large-sized LCD panels—defined as those 10-inches and larger diagonally—will climb by 0.9 percent when averaged out for the three key panel applications in desktop computer monitors, notebook computers and televisions.

While seeming like a miniscule increase, the slight move into positive territory represents the first increase in pricing for large-sized LCD panels since the end of the first quarter. Panel pricing has been falling every month since March, with the price declines greatest in July and August when levels contracted by approximately 5 percent sequentially from their respective previous months, iSuppli data show.

“With buyers preparing for this year’s holiday season, the introduction of new models in early 2011 and for the Lunar New Year in February, brands and manufacturers alike are starting to buy panels again after maintaining strict inventory control for several months,” said Sweta Dash, senior director for LCD research at iSuppli. “This, combined with lower level of panel inventories, is causing pricing to rise after several months of decline.”

Prices for some TV panels are expected to start to stabilize in November, helped by replenishment in demand from China that will compensate for a sluggish U.S. market. The average price for the 32-inch hi-definition (HD) HD panel—the mainstream size for promotions—is expected to fall to $161 in November, compared to $164 in September. Panel prices last month also dropped in the 40/42-inch bracket—down $10 to $15—as well as for light-emitting diode (LED)-backlit models—down $15 to $20.

In the monitor segment, suppliers are no longer willing to drop prices any further, especially as panel pricing has fallen to less than cash-cost levels. And with suppliers pushing for a rebound in price, an increase is expected in November. The victory for suppliers may be short-lived, however, as the price rebound may not extend very long in light of unpromising system demand.

Among notebook computers, panel pricing in November will be flat or slightly up. As demand rises for panel applications tailored after Apple Inc.’s iPad, a solid rebound is expected in the 10-inch panel size. Nonetheless, the mainstream 14.0-inch and 15.6-inch wide-version notebook panels may not register any strong increases given that suppliers have agreed to provide a flat price in exchange for a specific number of purchased quantities—profitability being sacrificed in the quest for quantity.

Overall, manufacturers are expected to escalate fab utilization during November to 83.0 percent, up from 76.8 percent in October. The outlook for the LCD fab utilization rate is still uncertain in December, in light of conservative orders for the last month of the year.

Fab utilization rates in November are projected to increase both for Taiwan and China, bringing rates to higher than 70 percent. In comparison, Korean fabs will continue to witness strong results and surpass 95 percent, boosted by production from Samsung Display and LG Display.

Learn more about LCD supply and demand dynamics in iSuppli’s LCD Pricetrak report, entitled Large-LCD Panels Stabilize Due to Controlled Production.

Display Materials & Systems

iSuppli’s market intelligence helps technology companies achieve market leadership. iSuppli’s compelling TV research, 3-D TV forecasts, touch screen displays analysis, etc can be used as essential tools for strategic planning and success in the electronic display market. Contact us on +1.310.524.4007 for more details.

About iSuppli Corporation

iSuppli Corporation is the global leader in technology value chain research and advisory services. Services afforded by iSuppli range from electronic component research to device-specific application market forecasts, from teardown analysis to consumer electronics and from display device and systems research to automotive telematics, navigation and safety systems research.

About IHS

IHS (NYSE: IHS) is a leading source of information and insight in pivotal areas that shape today’s business landscape: energy, economics, geopolitical risk, sustainability and supply chain management. Businesses and governments around the globe rely on the comprehensive content, expert independent analysis and flexible delivery methods of IHS to make high-impact decisions and develop strategies with speed and confidence. IHS has been in business since 1959 and became a publicly traded company on the New York Stock Exchange in 2005. Headquartered in Englewood, Colorado, USA, IHS employs more than 4,400 people in more than 30 countries around the world.