IHS iSuppli offered further commentary on the possible impact the earthquake in Japan may have on the semiconductor and electronic components businesses.

IHS iSuppli offered further commentary on the possible impact the earthquake in Japan may have on the semiconductor and electronic components businesses.

Unedited press release follows: www.isuppli.com

For more information visit:

IHS iSuppli Issues Updates on Japan Earthquake

Semiconductor facilities in Japan that had suspended manufacturing activities after the earthquake cannot truly commence full production again until the aftershocks cease. Earthquakes ranging from 4 to 7 on the Richter scale will make it impossible to fully restart these fabs until the earthquakes stop happening with such frequency, IHS iSuppli research indicates. Every time a quake tops 5, the equipment automatically shuts down.

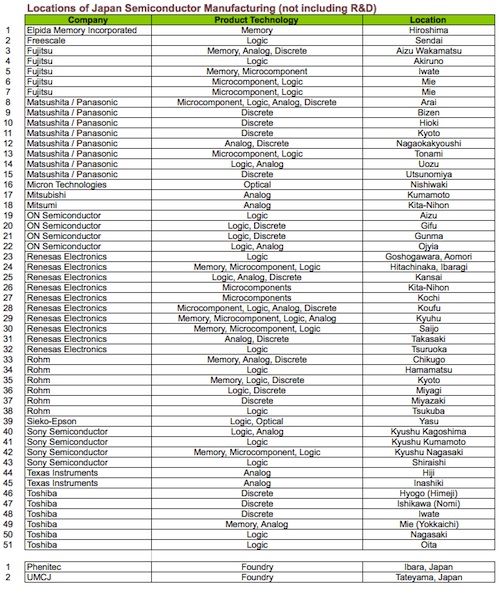

The attached table lists the locations engaged in volume production for semiconductor manufacturing operations in Japan. It does not include R&D fabs. There are 130 production semiconductor fab lines located in 53 locations in Japan.

Many electronic original equipment manufacturers (OEMs) worldwide could be engaging in panic buying of semiconductors and electronic components, spurred by fears of supply disruptions from Japan. Electronic distributors are reporting a surge in orders from OEM customers, trying to ensure they have sufficient inventory on hand to ride out any interruption in supply.

While the semiconductor supply disruptions are bad, they could have been worse; the recent buildup in global semiconductor inventory may serve to mitigate the impact of reduced supply from Japan. IHS iSuppli in February warned global semiconductor inventory levels had risen to alarmingly high levels, surging to a two–and-a-half year high in the fourth quarter of 2010. Although not completely compensating for supply disruptions from Japan, these excessive inventories may provide some cushion for global semiconductor supply.

Japan is facing rolling power outages, with frequent electricity supply interruptions in some areas. This represents a particular hazard in the production of raw materials for semiconductor manufacturing. Japan is the world’s leading producer of the main raw material used in semiconductor manufacturing: silicon. The country is also a major provider of chemicals for semiconductor production. Some of these chemicals are hazardous, and power interruptions could lead to dangerous events, such as explosions or the release of poisonous material. In these cases, semiconductor materials facilities facing power interruptions are likely to suspend some operations until a stable power supply can be restored.

While Japan is a major producer of electronic systems, it is a much smaller consumer of such goods, accounting for only about 5.2 percent of global PC consumption and 5 percent of worldwide cell phone consumption in 2010, IHS iSuppli research indicates.

About IHS iSuppli Products & Services

IHS iSuppli technology value chain research and advisory services range from electronic component research to device-specific application market forecasts, from teardown analysis to consumer electronics market trends and analysis and from display device and systems research to automotive telematics, navigation and safety systems research. More information is available at www.isuppli.com and by following on twitter.com/iSuppli.

About IHS (www.ihs.com)

IHS (NYSE: IHS) is a leading source of information and insight in pivotal areas that shape today’s business landscape: energy, economics, geopolitical risk, sustainability and supply chain management. Businesses and governments around the globe rely on the comprehensive content, expert independent analysis and flexible delivery methods of IHS to make high-impact decisions and develop strategies with speed and confidence. IHS has been in business since 1959 and became a publicly traded company on the New York Stock Exchange in 2005. Headquartered in Englewood, Colorado, USA, IHS employs more than 4,400 people in more than 30 countries around the world.