DisplaySearch announced that LCD TV brands and OEM/ODM makers plan to increase their Q3 2011 production in order to meet demand for the upcoming holiday season.

DisplaySearch announced that LCD TV brands and OEM/ODM makers plan to increase their Q3 2011 production in order to meet demand for the upcoming holiday season.

For more information visit: www.displaysearch.com

Unedited press release follows:

LCD TV Brands and OEMs Plan to Increase Production from July to September

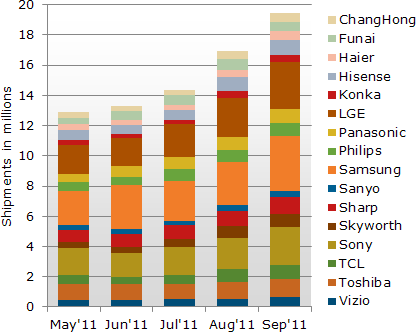

Production Forecast to Increase from 13.3M in June to 19.4M in September

SANTA CLARA, CALIF., July 11, 2011—TV brands have been adjusting their 2011 LCD TV business plans downward at a rapid pace, in acknowledgement of the fact that end-market demand is not what they had expected. However, TV brands and OEM/ODM makers are still planning to increase their Q3’11 production plans in order to meet demand for the upcoming holiday season. According the latest DisplaySearch MarketWise-LCD Industry Dynamics, the combined production plans for the top sixteen LCD TV brands will increase from 14.4 million in July to 16.9 million in August, and then 19.4 million in September. At the same time, LCD TV subcontract manufacturers (OEM/ODM) are planning to increase their production from 3.9 million in July to 4.7 million in August, and then 5.4 million units in September.

Figure 1: LCD TV Brand Production Plans

Source: DisplaySearch MarketWise- LCD Industry Dynamics

In May, the top brands missed their LCD TV set production targets by 10%, due to weaker-than-expected sell-through in the market, particularly in Western Europe and North America. To ease the inventory risk and better control over the supply chain, most TV brands are being cautious in their production plans, including Chinese TV vendors.

According to Deborah Yang, Research Director of DisplaySearch, “The slowing market demand, combined with competition for market share, has led LCD TV makers to focus on lower-cost models and price promotions in 2H’11.” Yang added, “It’s believed that price elasticity still exists in certain main regions, but LCD TV brands remain cautious in their plans. Many brands are struggling with weak sales in developed markets and are undertaking inventory clearance in Western Europe.”

May LCD TV production by the top seven Taiwan OEM makers increased by 13% M/M, which was in line with their forecast. Cost competitiveness and integrated business models are enabling OEM makers like Briview, Compal, Foxconn, Chimei Innolux, and TPV to increase orders from TV brands. In Q3’11 OEM makers are targeting 14 million, up 24% Q/Q from Q2’11.

The DisplaySearch MarketWise- LCD Industry Dynamics report delivers concise, relevant information for decision-makers who need to quickly understand the entire large-area TFT LCD supply chain. Presented in a dashboard format, this report highlights the status of every aspect of the supply chain, from components to the end-market, covering the ever-changing dynamics of panels, brands, capacity, production, prices and more.

For more information about the report, please contact Charles Camaroto at 1.888.436.7673 or 1.516.625.2452 or e-mail contact@displaysearch.com or contact your regional DisplaySearch office in China, Japan, Korea or Taiwan or more information.

About DisplaySearch

Since 1996, DisplaySearch has been recognized as a leading global market research and consulting firm specializing in the display supply chain, as well as the emerging photovoltaic/solar cell industries. DisplaySearch provides trend information, forecasts and analyses developed by a global team of experienced analysts with extensive industry knowledge and resources. In collaboration with The NPD Group, its parent company, DisplaySearch uniquely offers a true end-to-end view of the display supply chain from materials and components to shipments of electronic devices with displays to sales of major consumer and commercial channels. For more information on DisplaySearch analysts, reports and industry events, visit us at http://www.displaysearch.com/. Read our blog at http://www.displaysearchblog.com/and follow us on Twitter at @DisplaySearch.

About The NPD Group, Inc.

The NPD Group is the leading provider of reliable and comprehensive consumer and retail information for a wide range of industries. Today, more than 1,800 manufacturers, retailers, and service companies rely on NPD to help them drive critical business decisions at the global, national, and local market levels. NPD helps our clients to identify new business opportunities and guide product development, marketing, sales, merchandising, and other functions. Information is available for the following industry sectors: automotive, beauty, commercial technology, consumer technology, entertainment, fashion, food and beverage, foodservice, home, office supplies, software, sports, toys, and wireless. For more information, contact us or visit http://www.npd.com/and http://www.npdgroupblog.com/. Follow us on Twitter at @npdtech and @npdgroup.