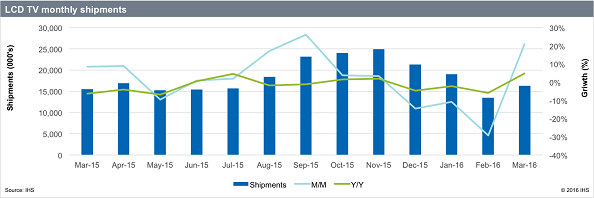

IHS Inc. announced it reckons that monthly LCD TV unit shipments returned to positive year-over-year growth in March 2016 after three months of declines.

IHS Inc. announced it reckons that monthly LCD TV unit shipments returned to positive year-over-year growth in March 2016 after three months of declines.

For more information visit: www.ihs.com

Unedited press release follows:

After Three Months of Declines, Monthly LCD TV Unit Shipments Resumed Growth in March, IHS Says

Chinese brands contributed to an increase in LCD unit shipments, reaching 16.2 million units in March 2016

ENGLEWOOD, Colo. (May 9, 2016) – Chinese brands have had a significant impact on the global TV market recently, due to their aggressive pursuit of export growth. In large part because of these efforts, monthly liquid crystal display (LCD) TV unit shipments returned to positive year-over-year growth in March 2016 after three months of declines, increasing by 4.8 percent to 16.2 million units, according to IHS Inc. (NYSE: IHS), the leading global source of critical information and insight. Every Chinese brand experienced positive growth in March, offsetting the drop in shipments in February.

“Major global TV brands have adjusted their strategy this year to focus on profitability, avoiding severe competition in pursuit of market share,” said Ken Park, Principal Analyst of TV Sets Research for IHS Technology. “Chinese brands, in particular, have started to play a more critical role in the global TV market over the last year.”

Chinese TV brand shipments, which fell 63.5 percent month over month in February, rebounded 88.9 percent in March, from 2.4 million to 4.5 million units. In fact, Chinese brands accounted for 28 percent of all LCD TV shipments in March, an increase of 11 percentage points from the previous month.

“After cleaning up carried-over stock from the Chinese New Year holiday in February, Chinese TV brands began to restock retail inventory in March for upcoming promotional events on the Web and May Labor Day holiday sales,” Park said. “E-commerce-focused brands like LeEco, Xiaomi and newcomer FunTV have also been aggressive in increasing production and shipments in the TV market this year, leveraging their online content portals to attract new customers.”

In contrast, year-over-year South Korean TV brands’ shipments dropped 7.8 percent in March, according to the IHS TV Sets Intelligence Service. Both Samsung Electronics and LG Electronics recorded contraction in March, but their reported operating margins in the first quarter of 2016 increased relative to a year ago. “These two companies were able to benefit from the drop in panel prices and relatively conservative sales targets, targeting profits over absolute market share growth,” Park said.

The 50-inch and larger share of monthly LCD TV shipments increased by more than 6 percentage points in March to 22.4 percent, compared to a year earlier. During the same period, the 4K TV share grew to a record 20.9 percent of unit shipments. “Both of these factors are driving worldwide growth as consumers upgrade from older TVs,” Park said.

TV displays will be a key theme in the coming SID Display Week 2016 Business Track, which is co-organized by IHS and the Society for Information Display. For more information, visit SID Display Week.

The IHS TV Sets Intelligence Service provides analysis of the trends affecting the global TV set market. For more information, contact the sales department at IHS in the Americas at +1 844 301 7334 or AmericasLeads@ihs.com; in Europe, Middle East and Africa (EMEA) at +44 1344 328 300 or technology_emea@ihs.com; or Asia-Pacific (APAC) at +604 291 3600 or technology_APAC@ihs.com.

About IHS (www.ihs.com)

IHS (NYSE: IHS) is the leading source of insight, analytics and expertise in critical areas that shape today’s business landscape. Businesses and governments in more than 140 countries around the globe rely on the comprehensive content, expert independent analysis and flexible delivery methods of IHS to make high-impact decisions and develop strategies with speed and confidence. IHS has been in business since 1959 and became a publicly traded company on the New York Stock Exchange in 2005. Headquartered in Englewood, Colorado, USA, IHS is committed to sustainable, profitable growth and employs nearly 9,000 people in 33 countries around the world.