IHS Screen Digest announced that subscriber revenue from PC massively multiplayer online games (MMOGs) and non-massive multiplayer online games (MOGs) in North America and Europe declined for the first time ever in 2010, marking a shift in industry emphasis away from subscriptions toward microtransactions.

IHS Screen Digest announced that subscriber revenue from PC massively multiplayer online games (MMOGs) and non-massive multiplayer online games (MOGs) in North America and Europe declined for the first time ever in 2010, marking a shift in industry emphasis away from subscriptions toward microtransactions.

For more information visit: www.isuppli.com

Unedited press release follows:

PC Multiplayer Online Games: Subscription Revenue Declines as Microtransactions Take Hold

El Segundo, Calif., September 14, 2011—Subscriber revenue in the combined markets for PC massively multiplayer online games (MMOGs) and non-massive multiplayer online games (MOGs) in North America and Europe declined for the first time ever in 2010, marking a historic shift in industry emphasis away from subscriptions and toward microtransactions, according to a new IHS Screen Digest Games Intelligence Report from information and analysis provider IHS (NYSE: IHS).

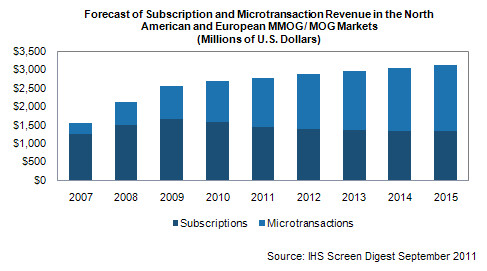

PC MMOGs and MOGs in North America and Europe generated subscription revenue amounting to $1.58 billion in 2010, down 5 percent from $1.66 billion in 2009. This decline contrasts markedly with the healthy 10 percent annual growth in 2009—and the booming 21.6 percent increase in 2008. The 2010 drop marks the beginning of an expected long-term reduction in the subscription segment, with the market decreasing on an annual basis through the year 2015, when revenue will dwindle to $1.33 billion.

“The 2010 decline in subscription revenue—the first annual contraction experienced by the market since our coverage of this segment started in 2002—represents an inflection point for the industry,” said Piers Harding-Rolls, senior analyst and head of games at IHS. “The focus of many PC game operators has clearly shifted to microtransaction-based models—in part due to competition in the subscription market especially in the high-end MMOG segment, but also because of the flexibility microtransactions offer operators in monetizing gamers.”

As the subscription segment weakens, revenue is heating up for microtransactions, i.e., in-game user purchases of virtual game currency or items. Microtransaction revenue in North America and Europe rose to $1.13 billion in 2010, up an impressive 24.2 percent from $909 million in 2009. This more than compensated for the decline in the subscription area and caused total Western MMOG/MOG market revenue—both subscriptions and microtransactions —to rise to $2.7 billion in 2010, up 5.3 percent from $2.57 billion in 2009.

Microtransaction revenue will continue to rise during the following years, expanding to $1.8 billion in 2015. This will drive up combined MMOG/MOG revenue in North America and Europe to $3.13 billion in 2015, as presented in the figure below.

MOGs outgrow MMOGs

Within the MMOG/MOG market, MMOGs still represent the majority of combined subscription/microtransaction revenue at $2.2 billion for North America and Europe. Because the MMOG segment is more severely impacted by declining subscription spending, growth in this area will stall during the coming years, with revenue staying at $2.2 billion in 2015.

In contrast, MOG revenue will rise robustly for the same period.

MOGs, such as Travian, Moshi Monsters, and selected games served on portals operated by Bigpoint and Gameforge, generated $500 million in revenue in 2010. By 2015, MOG revenue is expected to grow to $900 million.

“MOGs continue to rise in popularity with operators because they can cover a wider range of game genres than MMOGs, are generally less expensive to produce than full-blown MMOGs and are also being increasingly successfully monetized by the industry,” Harding-Rolls observed.

A massive market opportunity for MMOGs/MOGs

The combined MMOG/MOG segment accounted for a significant 9.6 percent share of North American and European spending on games content across the entire games sector – consisting of packaged, digital and mobile segments—and represented the biggest digital opportunity in games. Spending on all games content in North America and Europe reached $31 billion in 2010.

The other major digital games segments are PC social network games, PC casual games, the online console market and PC core download games. However, IHS does not expect these individual markets to expand to the scale of the MMOG/MOG segment during the next five years.

To learn more about this topic, see the new IHS Screen Digest report, entitled: “PC Multiplayer Online Games: MOGs & MMOGs in North America and Europe – 2010 Market Review.”

About IHS (www.ihs.com)

IHS (NYSE: IHS) is the leading source of information and insight in critical areas that shape today’s business landscape, including energy and power; design and supply chain; defense, risk and security; environmental, health and safety (EHS) and sustainability; country and industry forecasting; and commodities, pricing and cost. Businesses and governments in more than 165 countries around the globe rely on the comprehensive content, expert independent analysis and flexible delivery methods of IHS to make high-impact decisions and develop strategies with speed and confidence. IHS has been in business since 1959 and became a publicly traded company on the New York Stock Exchange in 2005. Headquartered in Englewood, Colorado, USA, IHS employs more than 5,100 people in more than 30 countries around the world.