DisplaySearch announced that it forecasts mobile PC shipment growth to slow in 2011 but pick up in the longer term.

DisplaySearch announced that it forecasts mobile PC shipment growth to slow in 2011 but pick up in the longer term.

For more information visit: www.displaysearch.com

Unedited press release follows:

Mobile PC Shipment Growth to Slow Down in 2011, but Market Set for Mid to Long Term Push

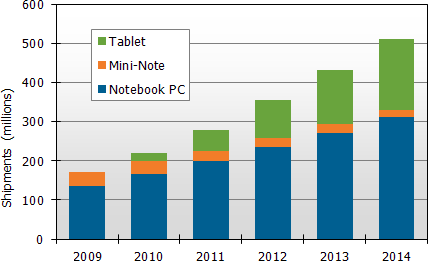

Shipment Growth Slows to 27% Y/Y in 2011 as Mini-Note and China Markets Decline; Tablets and Consumer Demand Rebound Lift Out Years

SANTA CLARA, CALIF, April 13, 2011 — Mobile PC shipment momentum is slowing, from 30% Y/Y growth in 2010, to 27% in 2011, when the market will reach 277.7 million units, according to the DisplaySearch Quarterly Mobile PC Shipment and Forecast Report. Decline in mini-note shipments and emerging regions is slowing growth, but notebook and tablet growth in mature markets is buoying the overall market. Shipment growth is expected to slow in the short term as compared to previous forecasts but pick up longer term, as emerging markets return to contributing at the high rates they have seen over the last several years.

Shipments into mature markets are expected to rise in the short to medium term with increasing demand from tablet PC shipments and a commercial market PC refresh cycle. Shipments into North American are expected to reach 91 million units in 2011 and 108.6 million units in 2012.

“Two of the main drivers for mobile PC shipment growth over the last few years are expected to sputter in 2011: mini-notes and emerging markets,” said Richard Shim, mobile computing analyst for DisplaySearch. “Only one of these segments is expected to bounce back. The mini-note market is falling rapidly as brands are looking to exit the mini-note segment and invest in the latest high-growth segment, tablet PCs.”

Mini-note shipment growth is dropping, down almost 20% Y/Y, to 25.4 million units in 2011. Mini-notes will continue to remain a segment of the market but it will be for price-sensitive areas, such as emerging markets and education.

Figure 1: Annual Mobile PC Shipment Forecast by Form Factor (millions)

Source: DisplaySearch Quarterly Mobile PC Shipment and Forecast Report

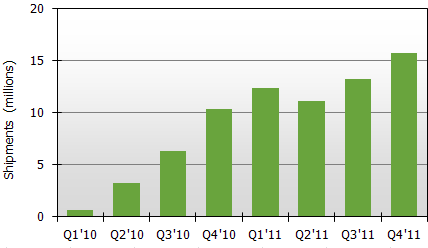

As expected, tablet shipments in the first half of 2011 will experience a hitch as competitors struggle to determine how best to market, sell and create demand for their initial offerings, while facing tough comparisons to the incumbent, Apple. By 2H’11, DisplaySearch expects the market needs and segmentation to be clearer, enabling a resumption of rapid growth. Despite the turbulence, tablet shipments are expected to reach 52.4 million units in 2011 with shipments into mature markets remaining strong, but weakening in emerging regions. Consumers in emerging regions continue to search for performance-oriented PCs and are tending to prefer notebooks over convenience-oriented tablet PCs.

Figure 2: Worldwide Tablet PC Shipments by Quarter (millions)

Source: DisplaySearch Quarterly Mobile PC Shipment and Forecast Report

Tablets will be a vital contributor to overall mobile PC shipment growth, but notebook PCs will remain the largest segment of the mobile PC market. The 20% Y/Y shipment growth rate of notebooks combined with the over 150% Y/Y shipment growth rate of tablet PC will result in healthy double-digit growth for mobile PCs in 2011 and throughout the forecast period.

The DisplaySearch Quarterly Mobile PC Shipment and Forecast Report covers the entire range of mobile PC products shipped worldwide and regionally. With analysis of global and regional brands, the Quarterly Mobile PC Shipment and Forecast Report provides an objective, expert view of the market with insight into historical shipments, revenues, forecasts and more. For more information about the report, please contact Charles Camaroto at 1.888.436.7673 or 1.516.625.2452, e-mail contact@displaysearch.com or contact your regional DisplaySearch office in China, Japan, Korea or Taiwan or more information.

About DisplaySearch

Since 1996, DisplaySearch has been recognized as a leading global market research and consulting firm specializing in the display supply chain, as well as the emerging photovoltaic/solar cell industries. DisplaySearch provides trend information, forecasts and analyses developed by a global team of experienced analysts with extensive industry knowledge. In collaboration with the NPD Group, its parent company, DisplaySearch uniquely offers a true end-to-end view of the display supply chain from materials and components to shipments of electronic devices with displays to sales of major consumer and commercial channels. For more information on DisplaySearch analysts, reports and industry events, visit us at http://www.displaysearch.com/. Read our blog at http://www.displaysearchblog.com/ and follow us on Twitter at @DisplaySearch.

About The NPD Group, Inc.

The NPD Group is the leading provider of reliable and comprehensive consumer and retail information for a wide range of industries. Today, more than 1,800 manufacturers, retailers, and service companies rely on NPD to help them drive critical business decisions at the global, national, and local market levels. NPD helps our clients to identify new business opportunities and guide product development, marketing, sales, merchandising, and other functions. Information is available for the following industry sectors: automotive, beauty, commercial technology, consumer technology, entertainment, fashion, food and beverage, foodservice, home, office supplies, software, sports, toys, and wireless. For more information, contact us or visit www.npd.com/ and http://www.npdgroupblog.com/. Follow us on Twitter at @npdtech and @npdgroup.