NPD DisplaySearch announced it reckons that LCD TV production reached a monthly record high of 19.8 million units in October and expects the same in November.

NPD DisplaySearch announced it reckons that LCD TV production reached a monthly record high of 19.8 million units in October and expects the same in November.

For more information visit: www.displaysearch.com

Unedited press release follows:

Monthly Production of LCD TVs Rises to Record High, but Mobile PCs Falling

Low Inventories and Expectations for Strong Holiday Sales Drive LCD TV Production; Thailand Flood Impact on Hard Disk Drive Production Lowers Demand for Mobile PCs and Monitors

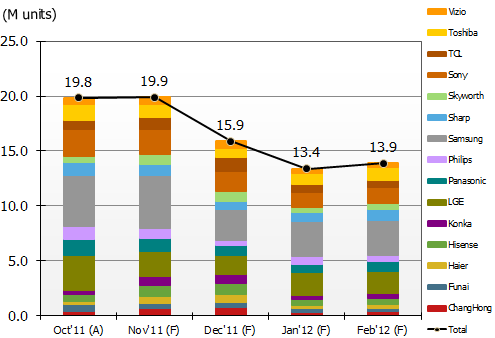

SANTA CLARA, Calif., December 14, 2011— As global LCD TV brands ramp up production for the Q4’11 holiday period, LCD TV production is nearing a record high. Of the TV brands surveyed by NPD DisplaySearch for its MarketWise – LCD Industry Dynamics report, production reached a record high of 19.8 million units in October, and is expected to maintain that level in November.

Even though production for most global TV brands typically slows down in November, LCD TV production is expected to be sustained as Chinese TV brands, aiming for monthly shipment growth in November and December, prepare for the Chinese New Year holiday. November is estimated to be the highest record with 19.9M units built by the surveyed brands globally. “In addition to supply chain pull-in for upcoming holidays, we expect Chinese TV brands to fight for market share to make up for shipment targets missed in the beginning of the year,” said Deborah Yang, Research Director for NPD DisplaySearch.

TV demand outlook is turning positive for unit volume in the near term, but the focus is on inexpensive and simple-feature sets. TV brands, including leading global vendors, are planning to carry new TV sizes and low-specification LCD TVs to create business opportunities and drive traffic in 2012. Yang added, “Prices for Black Friday may not influence the market very much, but the price points of new emerging sizes together with simple-feature TV sets cannot be overlooked. These are likely to lead to confusion in the product and value proposition.”

Despite strong sell-through results in North America and China, LCD TV brands are cautiously controlling their inventories. For December through February, LCD TV brands are planning to reduce production to prevent overstocking for the slow season in Q1’12. Global LCD TV production plans of surveyed LCD TV brands will fall to 13.4M in January. LCD TV panel suppliers will need to continuously control their capacity utilization in the coming months, even as panel prices stabilize.

Figure 1: LCD TV Brand Production Forecast (Millions)

Source: NPD DisplaySearch MarketWise – LCD Industry Dynamics

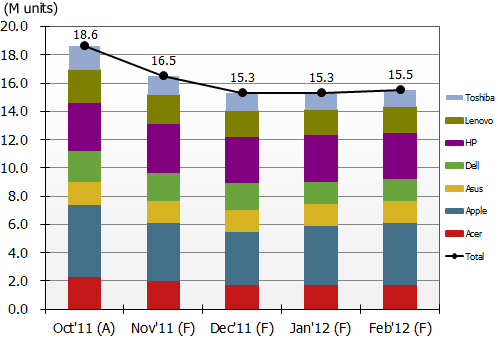

Shortages of hard disk drives (HDDs) caused by the flooding in Thailand are expected to last until Q1’12, impacting production of notebook PCs and LCD monitors. In particular, NPD DisplaySearch foresees mobile PC brands cutting low-margin mobile PC production (netbook PCs or 15.6” mainstream models). “From the beginning of Q2’12, there is a possibility that mobile PC production volumes could increase significantly as a result of channel refilling and new 2012 model launches,” added Yang.

Figure 2: Mobile PC Brand Production Forecast (Millions)

Source: NPD DisplaySearch MarketWise – LCD Industry Dynamics

Monitor brands that have high attach rates to desktop PCs or have higher presence in the China market are being impacted strongly by the HDD shortage and the slowing demand outlook, while stand-alone monitor brands are less affected. However, in the China DIY (PCs built by consumers) market, demand is weakening due to increases in HDD prices.

In addition to LCD TVs, the NPD DisplaySearch MarketWise – LCD Industry Dynamics report tracks mobile PC and desktop monitor applications for large-area TFT LCD panels. The report delivers concise, relevant information for decision-makers who need to quickly understand the entire large-area TFT LCD supply chain. Presented in a dashboard format, the report highlights the status of every aspect of the supply chain, from components to the end-market, covering the ever-changing dynamics of panels, brands, capacity, production, prices and more.

For more information about the report, please contact Charles Camaroto at 1.888.436.7673 or 1.516.625.2452 or e-mail contact@displaysearch.com or contact your regional NPD DisplaySearch office in China, Japan, Korea or Taiwan or more information.

About NPD DisplaySearch

Since 1996, NPD DisplaySearch has been recognized as a leading global market research and consulting firm specializing in the display supply chain, as well as the emerging photovoltaic/solar cell industries. NPD DisplaySearch provides trend information, forecasts and analyses developed by a global team of experienced analysts with extensive industry knowledge and resources. In collaboration with The NPD Group, its parent company, NPD DisplaySearch uniquely offers a true end-to-end view of the display supply chain from materials and components to shipments of electronic devices with displays to sales of major consumer and commercial channels. For more information on NPD DisplaySearch analysts, reports and industry events, visit us at http://www.displaysearch.com/. Read our blog at http://www.displaysearchblog.com/ and follow us on Twitter at @DisplaySearch.

About The NPD Group, Inc.

The NPD Group is the leading provider of reliable and comprehensive consumer and retail information for a wide range of industries. Today, more than 1,800 manufacturers, retailers, and service companies rely on NPD to help them drive critical business decisions at the global, national, and local market levels. NPD helps our clients to identify new business opportunities and guide product development, marketing, sales, merchandising, and other functions. Information is available for the following industry sectors: automotive, beauty, commercial technology, consumer technology, entertainment, fashion, food and beverage, foodservice, home, office supplies, software, sports, toys, and wireless. For more information, contact us or visit http://www.npd.com/ and http://www.npdgroupblog.com/. Follow us on Twitter at @npdtech and @npdgroup.