IHS iSuppli announced it speculates that Google’s recent purchase of Motorola Mobility may breath life into the company’s struggling Google TV offering.

IHS iSuppli announced it speculates that Google’s recent purchase of Motorola Mobility may breath life into the company’s struggling Google TV offering.

For more information visit: www.isuppli.com

Unedited press release follows:

Google’s Motorola Mobility Acquisition Boosts Google TV

El Segundo, Calif., September 16, 2011—Google Inc.’s recent acquisition of Motorola Mobility may yet allow the search giant to achieve success with its faltering Google TV product, as Google tries again to penetrate the market for Internet-enabled televisions and set-top boxes—an area projected to more than triple in four years, according to the IHS iSuppli Home & Consumer Electronics Research Service from information and analysis provider IHS (NYSE: IHS).

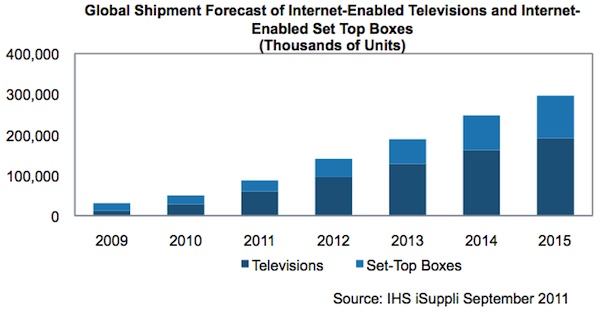

Global shipments of Internet-enabled televisions and set-top boxes are forecast to reach 295.9 million units in 2015, up a resounding 240 percent from 86.9 million this year, as shown in the attached figure.

“Google’s acquisition could pay off in the set-top box space, especially because the company’s own Google TV smart television products seemed headed to an early grave in the wake of a steep dive in pricing,” said Roque Muña, a researcher for consumer electronics and wireless communication at IHS. “Motorola currently is No. 2 in set-top box shipments, and the inclusion of Google TV in this already successful line of products will give Google access to an already established customer base.”

For now, however, Google TV is finding it difficult to gain traction. For instance, the manufacturer suggested retail price (MSRP) for Logitech’s Google TV-enabled Revue set-top box has fallen by as much as 60 percent from its initial price of $249. Meanwhile, Sony Corp.’s integrated Google TV sets are experiencing similar price drops.

The televisions and set-top boxes for both Logitech and Sony were prohibitively expensive devices that lacked the content to meet consumer demand, Muña observed. However, the new value to be created from the combination of Google TV and Motorola set-top boxes likely will please current customers—as long as the new mix doesn’t detract from users’ current mode of accessing content. Thus, while customer acceptance for Google TV is predicated on the availability of content, Google TV-enabled set-top boxes will enjoy solid growth as long as they maintain current functionality and are appropriately priced.

“Integration across several platforms is a driving trend in the consumer electronics market today, with Apple Inc. being the leader in this area,” Muña said. “Google TV in set-top boxes brings another point of integration into the home. Similar to Apple TV, Google will have the flexibility to integrate its newly acquired mobile and tablet platforms with televisions, giving consumers access to Google TV content while possibly providing a secondary interface for apps in the Android market. Furthermore, while Apple TV has been called a mere ‘hobby,’ set-top boxes are already a staple product in households, giving Google TV the foothold needed to inundate the market.”

However, the real challenge in integrating Google TV with Motorola’s set-top boxes concerns the cable operators. Google TV could well impact the operators’ average revenue per user if it allows customers to bypass or eliminate paid media offerings. Once Google TV begins to successfully provide access to a generous amount of free content, the likelihood of customers continuing their cable subscriptions will drop significantly. Without an innovative business model to reconcile the two means of accessing content, operators that sell set-top boxes from Motorola Mobility likely will oppose the adoption of Google TV into the devices.

At this point, even if Google TV doesn’t increase its content, the capability to have an Android ecosystem in the home may be sufficient to satisfy customers, as long as Google provides a value-added product at a price similar to what Motorola customers are currently paying for their set-top boxes. What will be more difficult will be convincing cable operators to sell a product that possibly could cannibalize their business.

To learn more about this topic, see the IHS iSuppli Home & Consumer Electronics Research Service.

About IHS (www.ihs.com)

IHS (NYSE: IHS) is the leading source of information and insight in critical areas that shape today’s business landscape, including energy and power; design and supply chain; defense, risk and security; environmental, health and safety (EHS) and sustainability; country and industry forecasting; and commodities, pricing and cost. Businesses and governments in more than 165 countries around the globe rely on the comprehensive content, expert independent analysis and flexible delivery methods of IHS to make high-impact decisions and develop strategies with speed and confidence. IHS has been in business since 1959 and became a publicly traded company on the New York Stock Exchange in 2005. Headquartered in Englewood, Colorado, USA, IHS employs more than 5,100 people in more than 30 countries around the world.