IHS Screen Digest announced that, according to its research, Pace plc of the United Kingdom sold more Set-Top Boxes (STBs) in 2010 than any of its competitors.

IHS Screen Digest announced that, according to its research, Pace plc of the United Kingdom sold more Set-Top Boxes (STBs) in 2010 than any of its competitors.

For more information visit: www.screendigest.com

Unedited press release follows:

IHS Screen Digest News Flash: Pace Surpasses Motorola to Take Set-Top Box Lead

Pace plc of the United Kingdom in 2010 became the world’s No. 1 seller of set-top boxes (STBs) in terms of unit shipments for the first time ever on an annual basis, surpassing Motorola Inc. of the United States, new IHS Screen Digest research indicates. Pace’s STB shipments surged by 21.1 percent in 2010 to 20.7 million units, up from 17.1 million in 2009, as presented in Table 1 in the attached file. Motorola’s shipments rose only 4.2 percent to 19 million units, up from 18.2 million in 2009.

“Pace’s strong unit shipment growth in 2010 mostly was driven by huge growth in cable shipments to both North and South America,” Morrod said. “Pace has been voraciously taking market share from U.S. incumbents with high-volume deals such as selling boxes to Comcast. The company also fostered new big-volume customers like Net Servicios in Brazil.”

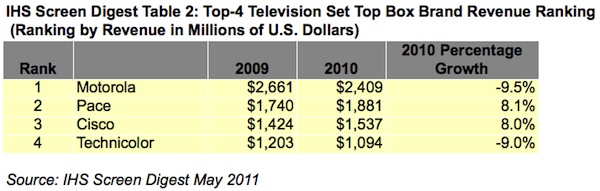

Despite Pace’s strong shipment growth, Motorola managed to hold on to the lead in STB revenue. Motorola’s STB revenue amounted to $2.4 billion in 2010, down 9.5 percent from $2.7 billion in 2009, as presented in Table 2 in the attached file. Pace’s revenue rose to $1.9 billion, up 8.1 percent from $1.7 billion in 2009.

U.S. STB brands Motorola and Cisco Systems Inc. have average sales prices (ASP) around 60 percent higher than the European vendors Pace and Technicolor. However, for all four vendors, ASPs declined by between 2 and 12 percent in 2010.

“The U.S. STB makers command higher ASPs for their STBs than their European rivals because they tend to have more established relationships with the high-volume, advanced cable operators in the Unites States. Both Cisco and Motorola benefit from high ASPs associated with Internet Protocol Television (IPTV) boxes, an area that they dominate,” Morrod said.

Of the 19 million STBs shipped by Motorola in 2010, 5 million were Digital Terminal Adapters (DTAs), which are low-cost set-top boxes that convert digital TV signals to analog. Most of the DTAs were for Comcast’s project Cavalry, which converts analog channels to digital-only delivery in order to reclaim analog spectrum to deliver new services. To give cable customers who don’t have digital service access to programming, Comcast is offering an STB and two DTAs at no additional cost.

Other STB brands also provided DTAs for project Cavalry, including Pace, with 3.5 million units; Technicolor, with 2.5 million; and Cisco, with 1.5 million. Other cable operators, such as Mediacom and Cogeco, are commencing DTA rollouts, indicating that the market opportunity for these low-cost boxes will continue even after the end of Comcast’s project Calvary.

For more information on this topic, see IHS Screen Digest’s TV Technology Intelligence service and the H2 2010 Set-Top Box Market Monitor report, “Set-Top Boxes Continue to Deliver the Goods—and Pictures—in 2010”.

About IHS Screen Digest Products & Services

IHS Screen Digest technology value chain research and advisory services range from electronic component research to device-specific application market forecasts, from teardown analysis to consumer electronics market trends and analysis and from display device and system research to automotive telematics, navigation and safety systems research. More information is available at www.isuppli.com and by following on twitter.com/iSuppli.

About IHS (www.ihs.com)

IHS (NYSE: IHS) is the leading source of information and insight in critical areas that shape today’s business landscape, including energy and power; design and supply chain; defense, risk and security; environmental, health and safety (EHS) and sustainability; country and industry forecasting; and commodities, pricing and cost. Businesses and governments around the globe rely on the comprehensive content, expert independent analysis and flexible delivery methods of IHS to make high-impact decisions and develop strategies with speed and confidence. IHS has been in business since 1959 and became a publicly traded company on the New York Stock Exchange in 2005. Headquartered in Englewood, Colorado, USA, IHS employs approximately 5,100 people in more than 30 countries around the world.