NPD DisplaySearch announced that it has increased its forecast for LCD TV area demand to 85 million square meters in 2012, nearly 2% higher than its previous estimate.

NPD DisplaySearch announced that it has increased its forecast for LCD TV area demand to 85 million square meters in 2012, nearly 2% higher than its previous estimate.

For more information visit: www.displaysearch.com

Unedited press release follows:

New Sizes Increase LCD TV Area Demand Outlook

LCD TV Area Demand to Reach 116 Million Square Meters in 2018

Santa Clara, Calif., January 23, 2012 — The LCD TV market saw a rapid shift toward sizes larger than 40” at the end of 2011, as consumers, particularly in North America and China, took advantage of new sizes and more affordable prices. As larger sizes such as 46”, 47”, 55”, 60” and 65” are being adopted by consumers, panel makers are also developing other new large size TV panels, including 43”, 48”, 50”, 70”, and even 75”, 80” and larger.

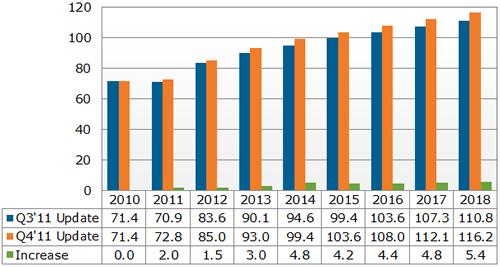

In response to the strong end-market adoption, NPD DisplaySearch has increased its forecast for LCD TV area demand. According to the NPD DisplaySearch Quarterly Worldwide FPD Shipment and Forecast Report, LCD TV panel demand will reach 85 million square meters in 2012, nearly 2% higher than the previous forecast. NPD DisplaySearch has also increased the area demand forecast from 2013 to 2018 to account for increased 40”+ LCD TV demand.

Figure 1: LCD TV Demand Area – Q3’11 and Q4’11 (Millions m²)

Source: NPD DisplaySearch Quarterly Worldwide FPD Shipment and Forecast Report

“Strong promotions and robust sales of 40”+ LCD TVs at the end of 2011 represent the increase in popularity of large LCD TVs,” said David Hsieh, Vice President of NPD DisplaySearch. Hsieh added, “Particularly in North America and China, the two largest global LCD TV markets, consumers are responding to promotions to buy larger sizes. Panel makers are working to push this trend further by producing larger panels more efficiently. The increase in LCD TV area demand means more capacity consumption. This will be an important aspect in balancing TFT LCD supply/demand.”

In the Quarterly Worldwide FPD Shipment and Forecast Report, NPD DisplaySearch points to several factors that are driving the increase in LCD TV area:

• New panel sizes such as 39”, 43”, 48”, 50” and 65” are being manufactured in the same Gen 6 through Gen 8 fabs, but now offer better glass substrate utilization efficiency. More LCD TV brands are developing products around these new sizes and introducing them to the end-market this year.

• Promotions of large sizes including 58”, 60”, 65”, 70”, 71”, 72”, 75”, 80”, 82” and 84”, some are with high-end features and specifications such as 21:9 cinema form factor or 4Kx2K resolution. As more large sizes are presented to consumers at attractive prices, consumers will be encouraged to upgrade to larger sizes.

• Features like smart interactive TV, 3D viewing, ultra-slim bezel and direct-type LED backlights are also encouraging end-users to choose larger sizes for a better viewing experience.

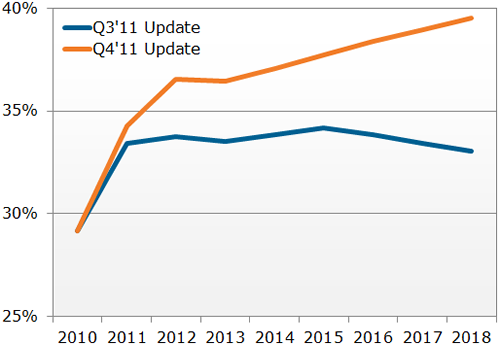

• The percentage of 40”+ in LCD TV demand has been increasing as consumers continue to adopt larger sizes. In 2015, 40”+ sizes are expected to account for 38% of total LCD TV panel demand, which was previously forecasted at 34%.

“The increase in LCD TV demand area is exciting for LCD panel and TV industries. It will bring added value to the TV and consume more panel production capacity,” added Hsieh.

Figure 2: 40”+ LCD TV Percentage in Total LCD TV –Q3’11 and Q4’11 (Unit Basis)

Source: NPD DisplaySearch Quarterly Worldwide FPD Shipment and Forecast Report

The NPD DisplaySearch Quarterly Worldwide FPD Shipment and Forecast Report covers quarterly worldwide shipments of all major flat panel applications. With over 140 FPD producers across 10+ countries, this report analyzes historical shipments and forecast projections to provide some of the most detailed information and insights available.

For more information on this report, please contact Charles Camaroto at 1.888.436.7673 or 1.516.625.2452, or contact@displaysearch.com or contact your regional DisplaySearch office in China, Japan, Korea or Taiwan.

About NPD DisplaySearch

Since 1996, NPD DisplaySearch has been recognized as a leading global market research and consulting firm specializing in the display supply chain, as well as the emerging photovoltaic/solar cell industries. NPD DisplaySearch provides trend information, forecasts and analyses developed by a global team of experienced analysts with extensive industry knowledge and resources. In collaboration with The NPD Group, its parent company, NPD DisplaySearch uniquely offers a true end-to-end view of the display supply chain from materials and components to shipments of electronic devices with displays to sales of major consumer and commercial channels. For more information on NPD DisplaySearch analysts, reports and industry events, visit us at http://www.displaysearch.com/. Read our blog at http://www.displaysearchblog.com/ and follow us on Twitter at @DisplaySearch.

About The NPD Group, Inc.

The NPD Group is the leading provider of reliable and comprehensive consumer and retail information for a wide range of industries. Today, more than 1,800 manufacturers, retailers, and service companies rely on NPD to help them drive critical business decisions at the global, national, and local market levels. NPD helps our clients to identify new business opportunities and guide product development, marketing, sales, merchandising, and other functions. Information is available for the following industry sectors: automotive, beauty, commercial technology, consumer technology, entertainment, fashion, food and beverage, foodservice, home, office supplies, software, sports, toys, and wireless. For more information, contact us or visit http://www.npd.com/ and http://www.npdgroupblog.com/. Follow us on Twitter at @npdtech and @npdgroup.