RealD Inc. announced financial results for the second quarter of its fiscal year 2013, ended September 21, 2012.

RealD Inc. announced financial results for the second quarter of its fiscal year 2013, ended September 21, 2012.

For more information visit: www.reald.com

Unedited press release follows:

RealD Inc. Reports Financial Results for Second Quarter of Fiscal 2013

LOS ANGELES — RealD Inc. (NYSE:RLD), a leading global licensor of 3D technologies, today announced financial results for its second quarter of fiscal 2013 ended September 21, 2012.

“We continued to advance our key growth initiatives during the quarter, although we had a very challenging comparison versus last year’s second quarter that included exceptional contributions from Harry Potter and Transformers,” said Michael V. Lewis, Chairman and Chief Executive Officer of RealD. “We demonstrated our confidence in RealD’s future by repurchasing approximately 2.4 million common shares during the quarter, funded by cash flows from operations.”

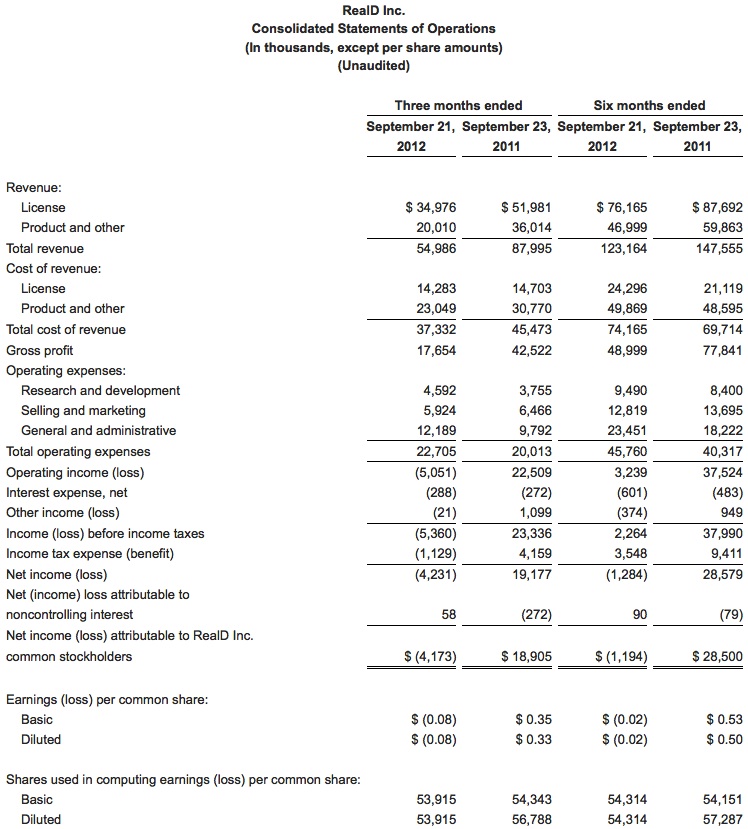

Second Quarter Fiscal 2013 Financial Highlights

• Total revenue was $55.0 million, comprised of license revenue of $35.0 million and product and other revenue of $20.0 million. For the second quarter of fiscal 2012, total revenue was $88.0 million, comprised of license revenue of $52.0 million and product and other revenue of $36.0 million.

• GAAP net loss attributable to common stockholders was $4.2 million, or $0.08 per share, compared to GAAP net income attributable to common stockholders of $18.9 million, or $0.33 per diluted share, for the second quarter of fiscal 2012.

• Cost of license revenue for the second fiscal quarter of 2013 included an impairment charge of $3.5 million (equivalent to approximately $0.06 per share) related to a non-cancelable purchase commitment for a specific configuration of 3D cinema systems.

• Adjusted EBITDA was $13.8 million, compared to $44.4 million in the second quarter of fiscal 2012.

• Adjusted EBITDA is defined within the section of this press release entitled “Use of Non-GAAP Financial Measures,” which includes a reconciliation to its most comparable GAAP measure, net income (loss).

Six-Month Fiscal 2013 Financial Highlights

• Total revenue was $123.2 million, comprised of license revenue of $76.2 million and product and other revenue of $47.0 million. For the six months ended September 23, 2011, total revenue was $147.6 million, comprised of license revenue of $87.7 million and product and other revenue of $59.9 million.

• GAAP net loss attributable to common stockholders was $1.2 million, or $0.02 per share, compared to GAAP net income of $28.5 million, or $0.50 per diluted share, for the six months ended September 23, 2011.

• Adjusted EBITDA was $36.9 million, compared to $70.4 million for the six months ended September 23, 2011.

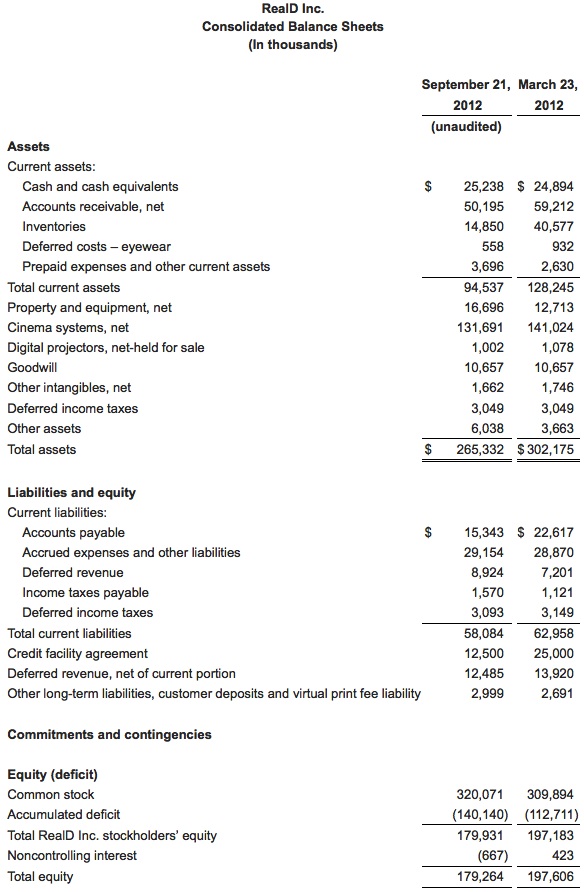

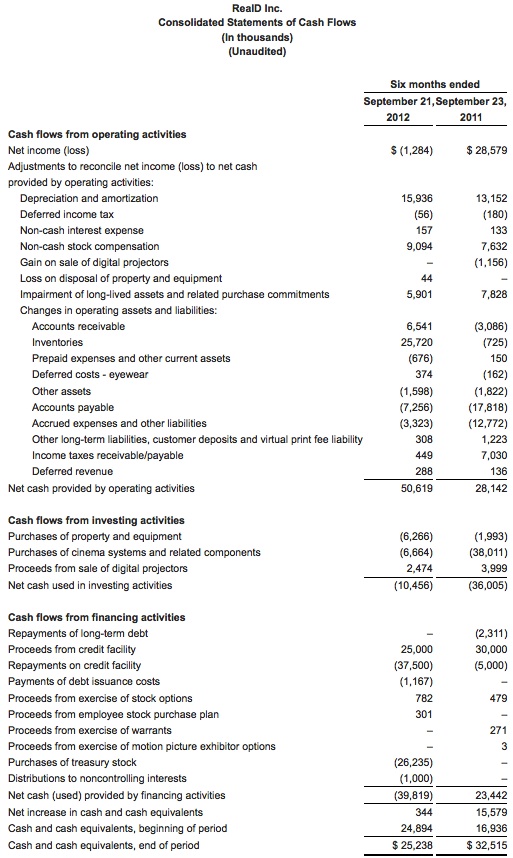

Cash Flows, Stock Repurchases and Balance Sheet Highlights

• For the six months ended September 21, 2012, cash flows from operating activities were $50.6 million and total capital expenditures were $12.9 million, resulting in free cash flow of $37.7 million. The Company expects that its future cash flows will vary considerably from quarter to quarter, due to box office seasonality, among other factors.

• Free cash flow is defined within the section of this press release entitled “Use of Non-GAAP Financial Measures,” which includes a reconciliation to its most comparable GAAP measure, net cash provided by operating activities.

• During the quarter, the Company repurchased approximately 2,426,000 common shares for $24.6 million, representing an average cost of $10.16 per share.

• To-date, the company has repurchased approximately 2,560,000 common shares under its $50 million stock repurchase program. As of September 21, 2012, $23.8 million remained available under the repurchase authorization.

• Cash and cash equivalents as of September 21, 2012 were $25.2 million. The decrease of $20.3 million from June 22, 2012 primarily reflects the Company’s stock repurchases and debt repayment.

• Total debt as of September 21, 2012 was $12.5 million, a decrease of $12.5 million from June 22, 2012.

Key Metrics

• International markets generated 61% of license revenue, compared to 56% of license revenue in the second quarter of fiscal 2012.

• International markets generated 44% of product and other revenue, compared to 41% of product and other revenue in the second quarter of fiscal 2012.

• As of September 21, 2012, the Company had deployed approximately 21,500 RealD-enabled screens, an increase of 15% from approximately 18,700 screens as of September 23, 2011, and an increase of 800 screens, or 4%, from approximately 20,700 screens as of June 22, 2012.

• As of September 21, 2012, the Company had approximately 12,300 domestic screens at approximately 2,700 domestic theater locations and approximately 9,200 international screens at approximately 2,600 international theater locations.

Updated Guidance for Fiscal Year 2013 Operating Expenses

• The Company has updated its outlook for fiscal 2013 operating expenses. The Company currently expects total fiscal 2013 operating expenses to be in the range of $95 million to $100 million, a decrease from its prior expectation of $105 million to $110 million disclosed on RealD’s first quarter of fiscal 2013 results investor conference call held on July 30, 2012.

• The Company’s moderated expectations for growth in fiscal 2013 operating expenses primarily reflect slower than-anticipated growth in headcount, a shift in the timing for certain initiatives, and operating efficiencies that contributed to lower-than-expected growth in operating expenses during the second quarter and six months ended September 21, 2012.

Proposed New Quarter End Dates for RealD

• Historically, RealD’s fiscal year has included four 13-week periods for a total of 52 weeks. As a result, the timing of the end of RealD’s quarterly periods has often differed significantly compared to other publicly-traded companies.

• In the future, RealD intends to slightly adjust its quarterly periods to coincide with traditional calendar quarterly reporting periods. For example, the Company’s third quarter of fiscal 2013 would end on December 31, 2012, and its fourth quarter of fiscal 2013 would end on March 31, 2013. In Fiscal 2014, RealD’s quarters would end on June 30, 2013; September 30, 2013; December 31, 2013; and March 31, 2014.

3D Theatrical Release Schedule for Fiscal 2013

(As of October 29, 2012 – Domestic)

Fiscal Q1 2013 Film Domestic Release Date

(ended 6/22/12) Wrath of the Titans 3/30/2012

Titanic (re-release) 4/4/2012

The Pirates! Band of Misfits 4/27/2012

The Avengers 5/4/2012

Men in Black III 5/25/2012

Piranha 3DD 6/1/2012

Madagascar 3: Europe’s Most Wanted 6/8/2012

Prometheus 6/8/2012

Brave 6/22/2012

Abraham Lincoln: Vampire Hunter 6/22/2012

Fiscal Q2 2013 Film Domestic Release Date

(ended 9/21/12) Amazing Spiderman 7/3/2012

Katy Perry: Part of Me 3D 7/5/2012

Ice Age: Continental Drift 7/13/2012

Step Up Revolution 7/27/2012

Nitro Circus: The Movie 8/8/2012

ParaNorman 8/17/2012

Resident Evil: Retribution 9/14/2012

Finding Nemo (re-release) 9/14/2012

Dredd 9/21/2012

Fiscal Q3 2013 Film Domestic Release Date

(ending 12/31/12) Hotel Transylvania 9/28/2012

Frankenweenie 10/5/2012

Silent Hill: Revelation 3D 10/26/2012

Wreck-It Ralph 11/2/2012

Rise of the Guardians 11/21/2012

Life of Pi 11/21/2012

The Hobbit: An Unexpected Journey 12/14/2012

Monsters, Inc. (re-release) 12/19/2012

Cirque du Soleil: Worlds Away 12/21/2012

Fiscal Q4 2013 Film Domestic Release Date

(ending 3/31/13) The Texas Chainsaw Massacre 3D 1/4/2013

Hansel and Gretel: Witch Hunters 1/25/2013

Escape from Planet Earth 2/14/2013

Jack the Giant Slayer 3/1/2013

Oz: The Great and Powerful 3/8/2013

The Croods 3/22/2013

G.I. Joe: Retaliation 3/29/2013

Sources: Rentrak and imdb.com.

Conference Call Information

Members of RealD management will host a conference call to discuss the Company’s financial results for the second quarter of fiscal 2013, beginning at 4:30 pm ET (1:30 pm PT), today, October 29, 2012. To access the call via telephone, interested parties should dial (877) 407-0789 (U.S.) or (201) 689-8562. (International) ten minutes prior to the start time and use conference ID 401081.

The conference call will also be broadcast live over the Internet, hosted at the Investor Relations section of the Company’s website at www.reald.com. An archived replay of the call will be available via webcast at www.reald.com or by dialing (877) 870-5176, or (858) 384-5517 for international callers. The conference ID for the telephone replay is 401081.

Cautionary Note on Forward-Looking Statements

This press release includes forward-looking information and statements, including but not limited to: statements concerning anticipated future financial and operating performance; RealD’s ability to continue to derive substantial revenue from the licensing of RealD’s 3D technologies for use in the motion picture industry, as well as RealD’s relationships with consumer electronics manufacturers and its ability to generate substantial revenue from the licensing of RealD’s 3D technologies for use in the 3D consumer electronics market; 3D motion picture releases and conversions scheduled for fiscal 2013 ending March 31, 2013, their commercial success and consumer preferences; our ability to increase the number of RealD-enabled screens in domestic and international markets and market share; our ability to supply our solutions to our customers on a timely basis; RealD’s relationships with its exhibitor and studio partners and the business model for 3D eyewear in North America; the progress, timing and amount of expenses associated with RealD’s research and development activities; market and industry trends, including growth in 3D content; RealD’s projected operating results; and competitive pressures in domestic and international markets. These statements are based on our management’s current expectations and beliefs, as well as a number of assumptions concerning future events. Such forward-looking statements are subject to known and unknown risks, uncertainties, assumptions and other important factors, many of which are outside management’s control that could cause actual results to differ materially from the results discussed in the forward-looking statements. The Company’s Annual Report on Form 10-K for the twelve months ended March 23, 2012, the Company’s Quarterly Report on Form 10-Q for the first fiscal quarter ended June 22, 2012 and other documents filed with the SEC include a more detailed discussion of the risks and uncertainties that may cause actual results to differ materially from the results discussed in the forward-looking statements.

RealD undertakes no obligation to update publicly the information contained in this press release, or any forward-looking statements, to reflect new information, events or circumstances after the date they were made, or to reflect the occurrence of unanticipated events.

Use of Non-GAAP Financial Measures

To supplement RealD’s financial statements presented on a GAAP basis, RealD provides Adjusted EBITDA and free cash flow as supplemental measures of its performance. The Company defines Adjusted EBITDA as net income (loss), plus net interest expense, income and other taxes, and depreciation and amortization, as further adjusted to eliminate the impact of share based compensation expense, exhibitor option expense and certain other items not considered by RealD management to be indicative of the company’s core operating performance. The Company defines free cash flow as net cash provided by operating activities less total capital expenditures in a given period (e.g. purchases of cinema systems and property and equipment on a combined basis).

RealD presents Adjusted EBITDA in reporting its financial results to provide investors with additional tools to evaluate RealD’s operating results in a manner that focuses on what RealD’s management believes to be its ongoing business operations. RealD presents free cash flow to provide investors a metric for our capacity to generate cash from our operating and investing activities to sustain our operating activities. RealD’s management does not itself, nor does it suggest that investors should, consider any such Non-GAAP financial measures in isolation from, or as a substitute for, financial information prepared in accordance with GAAP. Adjusted EBITDA and free cash flow are used by management for planning purposes, including: the preparation of internal budgets, forecasts and strategic plans; in analyzing the effectiveness of business strategies; to evaluate potential acquisitions; in making compensation decisions; and in communications with its Board of Directors concerning financial performance. Because not all companies use identical calculations, the Company’s presentation of Adjusted EBITDA and free cash flow may not be comparable to similarly titled measures of other companies. Adjusted EBITDA is not intended to be a measure of free cash flow for management’s discretionary use, as it does not consider certain cash requirements such as tax and debt service payments. Adjusted EBITDA also differs from the amounts calculated under the similarly titled definition in our credit agreement, which is further adjusted to reflect certain other cash and non-cash charges and is used to determine compliance with financial covenants and the Company’s ability to engage in certain activities, such as incurring additional debt and making certain restricted payments.

About RealD Inc.

RealD is a leading global licensor of 3D technologies. RealD’s extensive intellectual property portfolio is used in applications that enable a premium 3D viewing experience in the theater, the home and elsewhere. RealD licenses its RealD Cinema Systems to motion picture exhibitors that show 3D motion pictures and alternative 3D content. RealD also provides its RealD Display, active and passive eyewear, and RealD Format technologies to consumer electronics manufacturers and content producers and distributors to enable the delivery and viewing of 3D content. RealD’s cutting-edge technologies have been used for applications such as piloting the Mars Rover.

RealD was founded in 2003 and has offices in Beverly Hills, California; Boulder, Colorado; London, United Kingdom; Shanghai, China; Hong Kong; Tokyo, Japan; and Moscow, Russia. For more information, please visit our website at www.reald.com.

© 2012 RealD Inc. All Rights Reserved.