![]() Rimage Corporation reported its financial results for the third quarter and nine months ended September 30, 2012.

Rimage Corporation reported its financial results for the third quarter and nine months ended September 30, 2012.

For more information visit: www.rimage.com

Unedited press release follows:

Rimage Reports Third Quarter 2012 Financial Results

Qumu Doubles Revenue from Second Quarter 2012

Software Contracted Commitment Backlog Grows 27% from Second Quarter to $8.4 Million

Board Expands Share Repurchase Authorization by 2 Million Shares

MINNEAPOLIS — Rimage Corporation (NASDAQ: RIMG) today reported its financial results for the third quarter and nine months ended September 30, 2012.

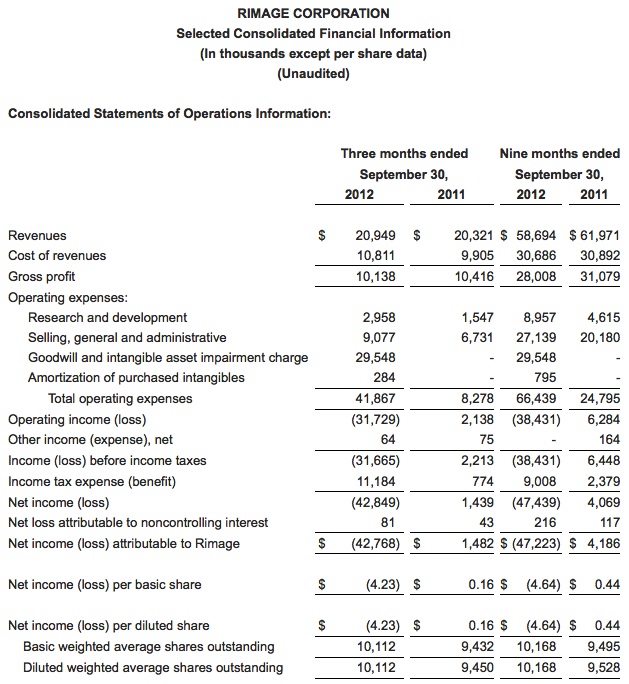

• Third quarter 2012 revenues totaled $20.9 million, a 3% increase from $20.3 million in revenues in the third quarter of 2011 and within previously established financial guidance. The increase was attributable to the revenues from Qumu, acquired October 10, 2011, partially offset by lower disc publishing revenues.

• Qumu revenues totaled $2.8 million in the recent third quarter with contracted commitments in the third quarter of $4.5 million. Qumu’s backlog of contracted revenue grew to $8.4 million at September 30, 2012 compared with $6.6 million at June 30, 2012.

• Disc publishing revenues in the recent third quarter were $18.2 million, a decrease of 10% from revenues in the third quarter of 2011. Foreign exchange impacts reduced revenues by 3% compared to the prior year’s third quarter. The remaining decline reflected lower hardware revenues in North America from the government sector.

• Gross margin for the 2012 third quarter was 48% compared with 51% in the same quarter last year and 45% in the second quarter of 2012. The decline compared to last year was mainly due to the mix of lower government hardware disc publishing revenues during the quarter.

• Operating expenses in the quarter were $41.9 million compared with $8.3 million in the third quarter last year, reflecting a $29.5 million non-cash goodwill and intangible asset impairment charge and the addition of $4.4 million of operating expenses associated with Qumu. Excluding these noncash impairment charges and the impact of Qumu, operating expenses were below last year’s third quarter.

• During the third quarter, the Company booked three non-cash charges to its financial statements. It recorded a $22.2 million goodwill impairment charge eliminating all the goodwill on the balance sheet and a $7.3 million impairment charge for the reduction in the fair market value of its amortizing intangible assets. In addition, the Company established a non-cash valuation allowance against its deferred tax assets resulting in a charge to income tax expense of $11.2 million. The total of these non-cash charges was $40.7 million.

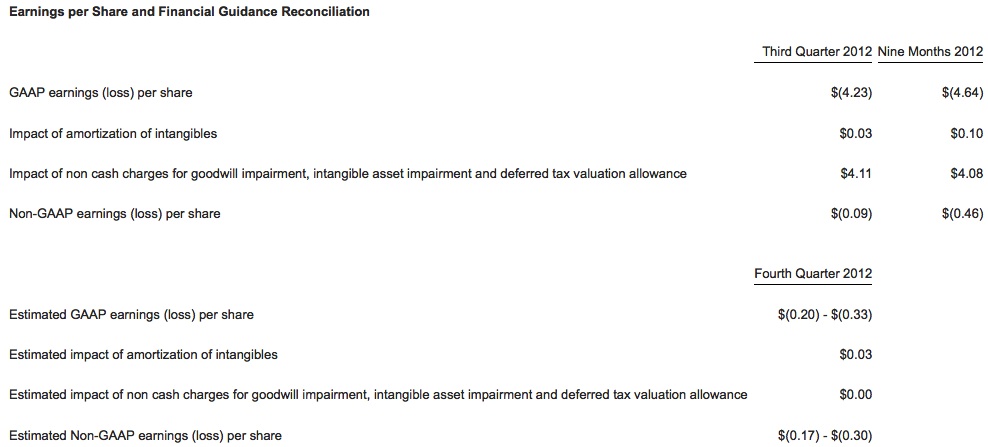

• The net loss for the third quarter of 2012 was $42.8 million, or $(4.23) per share. Excluding the non-cash charges and the amortization of intangibles associated with the Qumu acquisition, the net loss for the quarter was $0.9 million, or $(.09) per share, within previously established financial guidance. This compares with net income of $1.5 million in the third quarter of 2011, or $0.16 per diluted share.

• Cash and marketable securities totaled $59 million at September 30, 2012 compared with $62 million at June 30, 2012. During the third quarter, the Company paid out $1.7 million in dividends and used $0.4 million to repurchase stock. Cash used in operations during the third quarter totaled $0.3 million.

• Year to date, 2012 revenues were $58.7 million, compared with $62.0 million in the comparable period of 2011. The Company reported a net loss of $47.2 million, or $(4.64) per share, for the first nine months of 2012. Excluding the non-cash charges and the amortization of intangibles associated with the Qumu acquisition, the year to date net loss in 2012 was $4.7 million, or $(0.46) per share versus net income of $4.2 million, or $0.44 per diluted share, in the first nine months of 2011.

Sherman L. Black, president and CEO, said, “We were pleased with the progress our software business demonstrated during the quarter. Revenues doubled over last quarter and we added $4.5 million of contracted commitments resulting in a backlog of $8.4 million. This was the level of performance we anticipated when we acquired Qumu last year.”

“Rimage’s software strategy continues to evolve,” continued Mr. Black. “We are confident that we can reach beyond video communications and become a successful participant in the fast growing social enterprise ecosystem. The Signal product achieved first revenue this quarter with a win in the media and entertainment market. The combination of Qumu and Signal is a very unique offering that can greatly enhance today’s leading enterprise communication and collaboration platforms. Our customers need seamless integration with their current infrastructure. We cost effectively solve hard problems such as integrating video into existing collaboration platforms. Our on-premise and cloud offerings make it easy for our customers to securely deliver confidential content to the desktop and tablets of their employees, customers and partners.”

“Disc publishing revenues in the quarter increased from the second quarter but declined compared to last year reflecting government funding delays that reduced our hardware revenues in North America and softness in our international operations. While we expect continued softness due to technology substitution, there are use cases and workflows with high switching costs. As a result, demand for disc publishing will remain. We will continue to invest to stay current with our product offerings. In addition, we believe that properly sized, disc publishing will be a significant cash generator as we continue to transform the Company.

“Our team has made effective sales and marketing adjustments to our software business that should continue to produce solid results going forward. The engineering teams are focused on integration of Qumu and Signal, and unlocking the synergy of the combined offering. These efforts will position us well in the rapidly expanding social enterprise software market. Combining the growth of our software business along with the cash generation ability of our disc publishing business creates potential that we don’t believe is reflected in our current stock price. As a result, the Board has chosen to terminate the Company’s quarterly cash dividend and instead focus our capital distribution efforts on more aggressive repurchasing of Rimage stock under an expanded authorization approved by the Board,” Mr. Black concluded.

Expanded Stock Repurchase Program

On October 26, 2012, the Company’s Board of Directors approved the repurchase of an additional 2,000,000 shares of the Company’s common stock under the Company’s stock repurchase program. With the approximate 182,000 shares that remain under the previous authorization by the Board, there are now approximately 2,182,000 shares authorized for repurchase. Under the stock repurchase program, shares can be purchased at prevailing market prices in private transactions or in open market transactions including block trades. Repurchases are subject to market conditions, share price, trading volume and other factors. The Company also intends to implement a Rule 10b5-1 plan in connection with the repurchase program in order to give the Company the ability to repurchase its shares at times when it otherwise might be prevented from doing so under insider trading laws or because of self-imposed blackout periods.

Non-Cash Impairment Charges

The Company is required to test for impairment annually or more frequently if a triggering event has occurred. In the third quarter, the Company experienced a triggering event with the sustained stock price decline over an extended period. In recognition of this triggering event, the Company undertook an evaluation of its goodwill and potential impairment. As a result, the Company booked three non-cash charges to its financial statements. It recorded a $22.2 million goodwill impairment charge, eliminating all the goodwill on the balance sheet from the Qumu acquisition. The Company reduced the fair market value of its amortizing intangible assets — customer relationships, developed technology and trademarks — for a charge of $7.3 million. In addition, it established a non-cash valuation allowance against its deferred tax assets resulting in a charge to income tax expense of $11.2 million related to its recent losses. The total of these three non-cash charges was $40.7 million.

Financial Guidance

For the fourth quarter 2012, the Company expects revenues of between $18 and $20 million and the net loss per share is expected to be between $(0.20) and $(0.33). Excluding amortization of Qumu intangibles, non-GAAP net loss per share is expected to be between $(0.17) and $(0.30). These loss projections reflect a minimal tax benefit due to the establishment of the tax valuation allowance for book purposes. Qumu contracted commitment backlog is expected to continue to grow in the fourth quarter compared with the level at the end of the third quarter. A significant portion of these contracted commitments will be recognized into revenue in 2013 and 2014. The Company defines contracted commitments as the dollar value of signed customer purchase commitments.

Note to reconcile non-GAAP financial measures to GAAP

Management believes non-GAAP financial information provides meaningful supplemental information regarding the Company’s financial performance by excluding the amortization of Qumu acquisition intangibles that may not be indicative of the core business operating results and by excluding non-cash charges relating to the impairment of goodwill, a reduction of the value of amortizing intangible assets and the establishment of a valuation allowance against its deferred tax assets that are not related to the operation of the Company’s business and such charges are non-recurring, infrequent or unusual. Rimage believes that this additional financial information is useful to management and investors in assessing the Company’s historical and future performance.

Conference Call

The Company has scheduled a conference call and webcast to review its second quarter results and recent corporate developments today, October 29, 2012 at 4:30 p.m. Eastern Time. The dial-in number for the conference call is 877-941-6009 for domestic participants and 480-629-9819 for international participants. Investors can also access a webcast of the live conference call by linking through the investor relations section of the Rimage website, www.rimagecorp.com. Webcasts will be archived on Rimage’s website.

Forward-Looking Statements

This press release contains forward-looking statements that are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Any statements contained in this press release that are not statements of historical fact may be deemed to be forward-looking statements. Without limiting the foregoing, words such as “may,” “will,” “expect,” “believe,” “anticipate,” or “estimate” or comparable terminology are intended to identify forward-looking statements. Such forward-looking statements include, for example, statements about: the Company’s future revenue and operating performance, the integration of the Qumu business, anticipated synergies between Rimage and Qumu businesses, the effect of changes in technology, or the development and marketing of new products, or repurchases under the Company’s expanded stock repurchase program. The statements made by the Company are based upon management’s current expectations and are subject to certain risks and uncertainties that could cause the actual results to differ materially from those described in the forward-looking statements. These risks and uncertainties include the risk factors described in the Company’s Annual Report on Form 10-K for the year ended December 31, 2011 and other factors set forth in the Company’s filings with the Securities and Exchange Commission.

About Rimage Corporation

Founded in 1978, Rimage Corporation (NASDAQ: RIMG) helps businesses deliver digital content directly and securely to their customers, employees, and partners. Rimage’s Qumu business is well established in the rapidly growing enterprise video communications market. Rimage’s Signal online publishing platform automatically pushes secure mobile content to nearly any mobile device or computer. Qumu and Signal, in combination with Rimage’s CD, DVD and Blu-ray-Disc™ publishing solutions, enable businesses to securely deliver their videos, documents, audio files and images in today’s multi-platform, multi-device world. Rimage supplies thousands of customers in North America, Europe and Asia with industry-leading solutions that increase engagement, collaboration and control. Additional information can be found at www.rimagecorp.com.