![]() Rimage Corporation announced financial results for the fourth quarter and full year ended December 31, 2012.

Rimage Corporation announced financial results for the fourth quarter and full year ended December 31, 2012.

Rimage trades on the NASDAQ under the symbol RIMG.

For more information visit: www.rimage.com

Unedited press release follows:

Rimage Reports 56% Sequential Increase in Qumu Fourth Quarter 2012 Revenues

Qumu Contracted Commitment Backlog Increases 50% from Third Quarter to $12.7 Million

Overall Fourth Quarter 2012 Revenues of $20.7 Million Exceed Guidance

MINNEAPOLIS — Rimage Corporation (NASDAQ: RIMG) today reported its financial results for the fourth quarter and full year ended December 31, 2012.

Qumu Fourth Quarter Financial Highlights

• Qumu revenues totaled $4.3 million in the fourth quarter of 2012, 56% above the $2.8 million in the third quarter 2012 and more than double its $1.8 million in revenues in the fourth quarter of 2011.

• Qumu contracted commitments totaled $8.7 million in the 2012 fourth quarter, the best quarterly performance in its history. This compares with $4.5 million in contracted commitments in the recent third quarter. Qumu’s backlog of contracted revenue grew to $12.7 million at December 31, 2012 compared with $8.4 million at September 30, 2012.

Sherman L. Black, president and CEO, said, “The fourth quarter demonstrated the potential of our Qumu secure enterprise video solutions. Qumu’s momentum continued to build during the quarter with strong sequential growth in revenues, contracted commitments and backlog. Six new enterprise customers committed to Qumu’s enterprise video software and services, representing a broad spectrum of industries including food, pharma, high tech, financial services and transportation.”

“Enterprise customers are beginning to see video content used more and more as a means to increase employee engagement and team collaboration. Existing network infrastructure and collaboration tools are not equipped to enable the creation, management and delivery of video,” continued Mr. Black.

“Qumu allows organizations to capture, organize and distribute content across their extended enterprise to a wide variety of endpoints, including mobile devices. Qumu software offers information technology administrators and corporate communication leaders a way to securely address the challenges of video and rich content distribution overwhelming their data networks, while utilizing existing IT infrastructure.”

Disc Publishing Fourth Quarter Financial Highlights

• Disc publishing revenues in the recent fourth quarter totaled $16.4 million, a decrease of 17% from revenues in the fourth quarter of 2011. The decrease continued to reflect softness in demand in Europe and continued funding challenges with the government business in the U.S.

“As expected, our disc publishing business remained challenging during the quarter, reflecting continued softness in the economies throughout Europe and budget issues faced by our government customers. We anticipate continued declines in disc publishing revenues. However, there are use cases like medical imaging and published financial information where there are high switching costs or the other technology alternatives are less viable. As a result, we believe the demand for disc publishing will continue into the future. We took actions in 2012 to reduce expenses in this business and continue to properly size our operating expense base to ensure this business remains a significant cash generator,” Mr. Black continued.

Fourth Quarter 2012 Financial Highlights

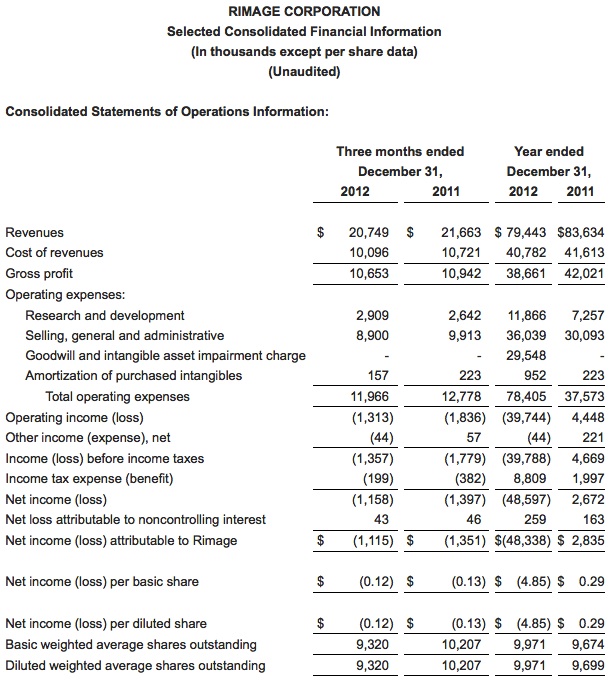

• Total revenues for the fourth quarter 2012 were $20.7 million, above the high end of guidance of $18 to $20 million. Compared with revenues in the 2011 fourth quarter of $21.7 million, recent fourth quarter revenues represented a 4% decline, reflecting a decrease in revenues from disc publishing, offset by higher revenues from Qumu, acquired October 10, 2011.

• Gross margin for the fourth quarter of 2012 was 51%, approximately the same as the gross margin in the fourth quarter of 2011 but improved from 48% in the third quarter of 2012. The improvement from the 2012 third quarter reflected a higher mix of revenue from Qumu software.

• Operating expenses in the quarter were $12.0 million, down from $12.8 million in the fourth quarter of 2011. Included in the recent fourth quarter results was approximately $0.5 million of one-time severance costs.

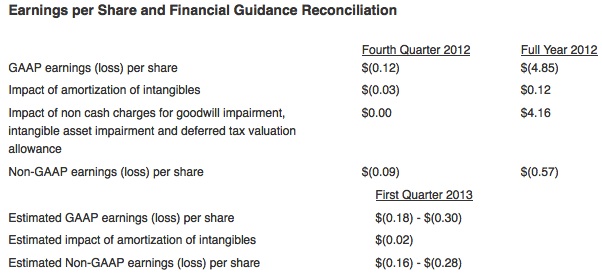

• The net loss for the fourth quarter was $1.1 million, or $(0.12) per share, significantly better than the fourth quarter guidance of a loss between $(0.20) and $(0.33) per share. This compares with a net loss of $1.4 million in the fourth quarter of 2011, or $(0.13) per share.

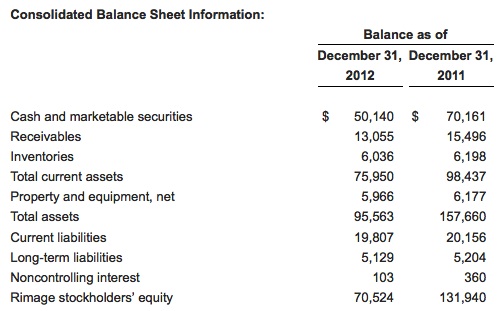

• Cash and marketable securities totaled $50.1 million at December 31, 2012. During the quarter, the Company repurchased 1.4 million shares of Rimage common stock for a total of $8.4 million. Fourth quarter cash used in operations totaled $0.2 million.

Full Year 2012 Highlights

• Full year 2012 revenues were $79.4 million, compared with $83.6 million in 2011, driven by a decline in revenues from the disc publishing operation partially offset by an increase in revenue from Qumu software and services.

• The Company reported a net loss of $48.3 million, or $(4.85) per share, for 2012. Included in the loss were three non-cash charges totaling $40.7 million taken in the third quarter of 2012. These non-cash charges included a $22.2 million goodwill impairment charge that eliminated all the goodwill on the balance sheet, a $7.3 million impairment charge for the reduction in the fair market value of amortizing intangible assets and an $11.2 million charge to establish a valuation allowance against the Company’s deferred tax assets.

• Excluding these non-cash charges and the amortization of Qumu intangibles, the non-GAAP net loss was $5.7 million, or $(0.57) per share in 2012. This compares with net income of $2.8 million, or $0.29 per diluted share, in 2011.

“As we look ahead, we are optimistic about our outlook. Qumu is our growth engine and our success in driving traction in this business in the second half of 2012 confirms our belief that we have strong differentiated solutions in the large and rapidly growing market for enterprise video communications. Our priorities during 2013 are to continue to drive significant revenue growth from Qumu, to maximize the cash generation from disc publishing, to maintain a healthy cash position and to drive toward improved profitability,” concluded Mr. Black.

Stock Repurchase Program

During the quarter, the Company repurchased approximately 1.4 million shares of Rimage common stock for a total cost of $8.4 million. There are approximately 778,000 shares remaining for repurchase under the authorization. As of December 31, 2012, there were 8,653,932 shares outstanding.

Financial Guidance

For the first quarter 2013, the Company expects revenues of between $19 and $21 million and the net loss per share is expected to be between $(0.18) and $(0.30). Excluding amortization of Qumu intangibles, non-GAAP net loss per share is expected to be between $(0.16) and $(0.28). These loss projections reflect no tax benefit due to the establishment of the tax valuation allowance for book purposes.

For total year 2013, the Company expects consolidated revenues to grow compared to 2012. Qumu revenues are expected to grow greater than 50% in 2013 compared to 2012. The Company expects this Qumu growth to be partially offset by a decline in disc publishing revenues. Consolidated cash from operations is expected at approximately break even levels for the year. The Company has approximately 778,000 shares remaining on its repurchase authorization and may repurchase shares from time to time during the year depending on market conditions.

Note to reconcile non-GAAP financial measures to GAAP

Management believes non-GAAP financial information provides meaningful supplemental information regarding the Company’s financial performance by excluding the amortization of Qumu acquisition intangibles that may not be indicative of the core business operating results and by excluding non-cash charges relating to the impairment of goodwill, a reduction of the value of amortizing intangible assets and the establishment of a valuation allowance against its deferred tax assets that are not related to the operation of the Company’s business and such charges are non-recurring, infrequent or unusual. Rimage believes that this additional financial information is useful to management and investors in assessing the Company’s historical and future performance.

Conference Call

The Company has scheduled a conference call and webcast to review its fourth quarter results and recent corporate developments today, February 26, 2013 at 4:30 p.m. Eastern Time. The dial-in number for the conference call is 877-941-0844 for domestic participants and 480-629-9835 for international participants. Investors can also access a webcast of the live conference call by linking through the investor relations section of the Rimage website, www.rimage.com. Webcasts will be archived on Rimage’s website.

Forward-Looking Statements

This press release contains forward-looking statements that are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Any statements contained in this press release that are not statements of historical fact may be deemed to be forward-looking statements. Without limiting the foregoing, words such as “may,” “will,” “expect,” “believe,” “anticipate,” or “estimate” or comparable terminology are intended to identify forward-looking statements. Such forward-looking statements include, for example, statements about: the Company’s future revenue and operating performance, the demand for the Company’s products or software, the integration of the Qumu business, anticipated synergies between Rimage and Qumu businesses, the effect of changes in technology, the development and marketing of new products, or repurchases under the Company’s expanded stock repurchase program. The statements made by the Company are based upon management’s current expectations and are subject to certain risks and uncertainties that could cause the actual results to differ materially from those described in the forward-looking statements. These risks and uncertainties include the risk factors described in the Company’s Annual Report on Form 10-K for the year ended December 31, 2011 and other factors set forth in the Company’s filings with the Securities and Exchange Commission.

About Rimage Corporation

Founded in 1978, Rimage Corporation (NASDAQ: RIMG) helps businesses deliver digital content directly and securely to their employees, customers, and partners. Rimage’s Qumu business is the global leader in the rapidly growing enterprise video communications market and an innovator in the secure mobile delivery of rich content. Rimage’s Disc Publishing business is the global leader in CD, DVD and Blu-ray-Disc™ archiving and distribution solutions. Rimage’s industry-leading solutions help thousands of organizations in North America, Europe and Asia use video and other rich content to increase engagement and collaboration without losing control. Additional information can be found at www.rimage.com.

Blu-ray Disc™ is a trademark of the Blu-ray Disc Association.