![]() Rimage Corporation announced operating results for its third quarter of 2011 ended September 30, 2011.

Rimage Corporation announced operating results for its third quarter of 2011 ended September 30, 2011.

Rimage trades on the NASDAQ under the symbol RIMG.

For more information visit: www.rimage.com

Unedited press release follows:

Rimage Reports Third Quarter 2011 Financial Results

MINNEAPOLIS–Rimage Corporation (NASDAQ:RIMG) today reported its financial results for the third quarter ended September 30, 2011. These results do not include financial results for Qumu, Inc. which Rimage acquired on October 10, 2011.

• Results for disc publishing operations achieve management guidance provided in the second quarter earnings release on July 28th

• Revenues in the third quarter of 2011 totaled $20.3 million compared with $23.4 million in the third quarter of 2010. Retail revenues were down $3.2 million from last year primarily because last year’s revenues included the shipment of a large hardware order under a now completed $10.6 million agreement for a major national retailer’s disc publishing systems. Excluding this shipment, revenues increased 1%.

• Gross margin increased to 51% from 50% reflecting reduced service support costs and a more favorable sales mix.

• Operating expenses totaled $8.3 million compared with $8.2 million in the third quarter of 2010. Included in the 2011 operating expenses was approximately $419,000 of transaction expenses related to the Company’s recently announced acquisition of Qumu. Excluding the transaction expenses, operating expenses were 4% below the prior year.

• Overall, third quarter net income totaled $1.5 million, or $0.16 per share, compared to $2.3 million, or $0.24 per share, in last year’s third quarter.

• Excluding transaction expenses from the acquisition of Qumu, third quarter 2011 earnings per share were $0.19 compared with $0.24 in the third quarter of 2010. These results were in line with the financial guidance provided on July 28 in the second quarter 2011 earnings release.

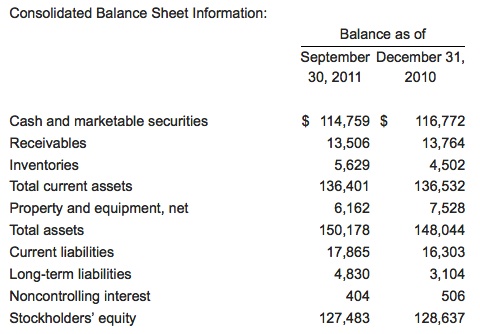

• The Company generated $2 million in cash from operations in the quarter and ended the third quarter with $115 million in cash and marketable securities. Subsequent to the end of the quarter, Rimage paid $39 million in cash for the acquisition of Qumu. The remaining $13 million of the $52 million transaction price was paid through the issuance of Rimage stock.

Sherman L. Black, president and CEO, said, “The third quarter was a very busy and productive period for Rimage, as we completed the evaluation and planning for the recently announced acquisition of Qumu. Our financial results for the quarter came in as we anticipated. Excluding the decline in retail revenues, third quarter revenues increased 1% from the prior year, reflecting growth in North America and Asia Pacific. In addition, we shipped a $1.7 million surveillance solution order for equipment and service to a major law enforcement agency during this year’s third quarter. Recurring revenues grew 3% as strong growth in service contracts was partially offset by a decline in consumable supplies. Our gross margin increased to 51% due to lower service costs and a more favorable mix of products. Operating expenses were well contained. Excluding the transaction costs related to the Qumu acquisition, operating expenses were 4% below the prior year. We generated $2 million in cash from operations during the quarter, paid out $2 million for two dividend payments and paid $4 million to repurchase shares. Our cash balance at the end of September totaled $115 million.”

Mr. Black added, “With the Qumu acquisition, Rimage is well-positioned as a leader in the growing market for enterprise video communications and social applications. We are actively working to complete the integration and to realize the customer and technology synergies between Qumu’s offerings, our disc publishing business and our virtual publishing initiative. Response from Rimage and Qumu customers, distributors, and partners so far has been very positive and we are excited about the growth opportunities offered by this combination.”

On October 7, 2011, the Company announced that its Board of Directors had approved a 70% increase in the quarterly cash dividend to $0.17 per share, payable on December 15, 2011 to shareholders of record on November 30, 2011. Based on the current stock price, this dividend represents a 6% yield.

In addition, in July the Company announced a 500,000 share increase in its share repurchase authorization. In the third quarter 2011, 292,000 shares were repurchased, leaving 513,000 shares remaining on this and prior authorizations.

Financial Guidance

For the fourth quarter 2011, the Company expects revenues of $24 to $26 million and earnings per share are expected to be between -$0.02 and $0.01, including the contribution from Qumu and transaction related expenses.

For the full year 2011, revenues are expected to be between $86 and $88 million and earnings per share between $0.42 and $0.45. Excluding the Qumu contribution and transaction expenses, revenues and earnings per share from the Company’s disc publishing business are in line with the Company’s earlier 2011 forecast, reiterated on July 28, 2011, of $80 to $85 million in revenues and earnings per share of $0.55 to $0.65.

Conference Call

The Company has scheduled a conference call and webcast to review its third quarter results and recent corporate developments today, October 27, 2011 at 10:00 a.m. Eastern Time. The dial-in number for the conference call is 877-941-1465 for domestic participants and 480-629-9723 for international participants. Investors can also access a webcast of the live conference call by linking through the investor relations section of the Rimage website, www.rimagecorp.com. Webcasts will be archived on Rimage’s website.

Forward-Looking Statements

This press release contains forward-looking statements that are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Any statements contained in this press release that are not statements of historical fact may be deemed to be forward-looking statements. Without limiting the foregoing, words such as “may,” “will,” “expect,” “believe,” “anticipate,” or “estimate” or comparable terminology are intended to identify forward-looking statements. Such forward-looking statements include, for example, statements about: the Company’s future revenue and operating performance, the integration of the Qumu business, estimated transaction expenses, anticipated synergies between Rimage and Qumu businesses, the effect of changes in technology, or the development and marketing of new products. The statements made by the Company are based upon management’s current expectations and are subject to certain risks and uncertainties that could cause the actual results to differ materially from those described in the forward-looking statements. These risks and uncertainties include the risk factors described in the Company’s Annual Report on Form 10-K for the year ended December 31, 2010 and other factors set forth in the Company’s filings with the Securities and Exchange Commission.

About Rimage Corporation

Founded in 1978, Rimage Corporation (NASDAQ:RIMG) helps businesses deliver digital content directly and securely to their customers and employees. Its disc publishing business, based in Minneapolis, Minnesota, supplies more than 10,000 customers in North America, Europe and Asia with industry-leading solutions that archive, distribute and protect content on CDs, DVDs and Blu-Ray Discs™. With its acquisition of Qumu, Rimage is a leader in the rapidly growing enterprise video communications market. The combination of Qumu and Rimage’s disc publishing business and virtual publishing initiative enables businesses to securely deliver their videos, documents, audio files and images in today’s multi-platform, multi-device world. Additional information can be found at www.rimagecorp.com.

Blu-ray Disc™ is a trademark of the Blu-ray Disc Association.