![]() Rimage Corporation announced financial results for the second quarter ended June 30, 2012.

Rimage Corporation announced financial results for the second quarter ended June 30, 2012.

Rimage trades on the NASDAQ under the symbol RIMG.

For more information visit: www.rimage.com

Unedited press release follows:

Rimage Reports Second Quarter 2012 Financial Results

Qumu Gaining Traction with Significant Increase in Backlog of Contracted Commitments

Board Declares Quarterly Cash Dividend of $0.17 Per Share, Payable September 14

MINNEAPOLIS — Rimage Corporation (NASDAQ: RIMG) today reported its financial results for the second quarter ended June 30, 2012.

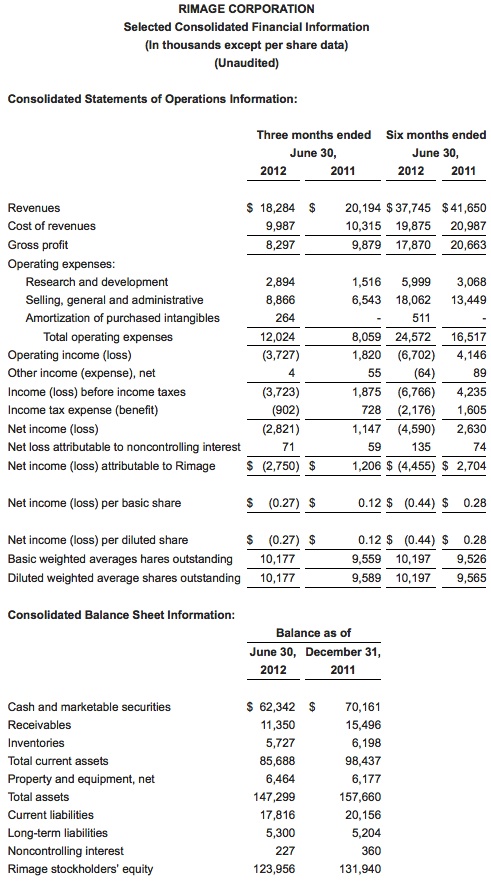

• Second quarter 2012 revenues totaled $18.3 million, a decrease of 9% from $20.2 million in revenues in the second quarter of 2011. The decrease reflected lower revenues from disc publishing, partially offset by revenues from Qumu, acquired on October 10, 2011.

• Qumu revenues totaled $1.4 million in the second quarter. Qumu ended the quarter with a $6.6 million backlog of contracted commitments, compared with $1.5 million at the end of the first quarter. Included in the quarter-end backlog of contracted commitments is a multi-year, multi-million dollar transaction supporting a Fortune 50 company.

• Disc publishing revenues in the recent second quarter were $16.9 million, down 16% compared with revenues in the second quarter of 2011. The decline was primarily attributable to a 28% decrease in hardware revenues, the result of continued economic softness in Europe and the delay of several transactions in North America. Recurring revenues were down 9.3% from the second quarter of last year. The decrease reflects the comparison of consumables sales against a strong second quarter a year ago, which included stocking by customers concerned with supply disruptions due to the Japan tsunami.

• Gross margin for the recent second quarter was 45% compared with 49% in the same quarter last year. The decline was mainly due to lower disc publishing hardware revenues as a percentage of total sales and underabsorption of fixed costs from lower volumes. Operating expenses in the quarter increased to $12.0 million from $8.1 million in the comparable quarter last year, reflecting the addition of $4.1 million of operating expenses associated with Qumu.

• The net loss for the second quarter of 2012 was $2.8 million, or $(0.27) per diluted share. This compares with net income of $1.2 million in the second quarter of 2011, or $0.12 per diluted share. Excluding the amortization of intangibles associated with Qumu, the net loss per share was $(0.24) in the recent second quarter.

• Cash and marketable securities totaled $62 million at June 30, 2012 compared with $67 million at March 31, 2012. During the second quarter, the Company paid out $1.7 million in dividends and used $0.9 million to repurchase stock. Second quarter 2012 cash used in operations was $0.7 million.

Sherman L. Black, president and CEO, said, “Disc publishing revenues in the second quarter were disappointing and reflected weaker than anticipated demand in Europe and funding challenges with several financial services and government customers that resulted in the delay of several transactions. In the third quarter, we expect to close on several transactions in the pipeline and disc publishing revenues to increase from the second quarter level.”

“Qumu is demonstrating strong traction with its enterprise video communications solution,” Mr. Black continued. “It ended the second quarter with a contracted commitment backlog of $6.6 million, which includes the largest transaction in Qumu’s history. Subsequent to the end of the quarter, we closed another multi-year, multi-million dollar transaction with a large European telecommunications provider. Revenues from both the transactions will be recognized over the next several quarters.

“We are also seeing good response to Signal, our online publishing product introduced last quarter. Our initial focus for this product is on the protection of pre-release content for the media and entertainment market and on existing enterprise customers and targets for Qumu.”

“Looking ahead, we are confident about the outlook for our software products. The two significant multi-million dollar Qumu orders that we received in the last 60 days confirm the market need for our Qumu solution. With the stronger outlook for Qumu and higher third quarter disc publishing revenues we expect overall third quarter company revenues to be higher than either the first or second quarters of this year,” concluded Mr. Black.

Dividend Approved

On July 24, 2012, the Company’s Board of Directors approved a $0.17 per share quarterly cash dividend, payable on September 14, 2012, to shareholders of record on August 31, 2012. Based on the current stock price, this dividend represents a 9% yield. During the second quarter, the Company paid out $1.7 million in dividends and $0.9 million to repurchase shares.

Financial Guidance

For the third quarter 2012, the Company expects revenues of between $20 and $22 million and the net loss per share is expected to be between $(0.05) and $(0.13). Excluding amortization of Qumu intangibles, non-GAAP net loss per share is expected to be between $(0.02) and $(0.10). For the full year 2012, the Company expects Qumu contracted commitments to grow significantly from 2011; however, a significant portion of these contracted commitments will be recognized into revenue in 2013 and 2014. The Company defines contracted commitments as the dollar value of signed customer purchase commitments. With this shift in the Qumu revenue model combined with weak first half disc publishing revenues, 2012 overall Company revenues are expected to decline slightly from 2011. 2012 disc publishing revenue is now expected to decrease close to 10% for the year. In addition, the Company expects 2012 cash flow from operations at approximately break even for the year.

The Company also expects to continue to return cash to shareholders in 2012. The Company anticipates 2012 dividend payments of approximately $7 million. In addition, as of June 30, 2012, the Company had more than 247,000 shares available to be repurchased under its existing authorization.

Note to reconcile non-GAAP financial measures to GAAP

Management believes non-GAAP financial information provides meaningful supplemental information regarding the Company’s financial performance by excluding the amortization of Qumu acquisition intangibles that may not be indicative of the core business operating results. Rimage believes that this additional financial information is useful to management and investors in assessing the Company’s historical and future performance.

Conference Call

The Company has scheduled a conference call and webcast to review its second quarter results and recent corporate developments today, July 26, 2012 at 10:00 a.m. Eastern Time. The dial-in number for the conference call is 877-941-6010 for domestic participants and 480-629-9643 for international participants. Investors can also access a webcast of the live conference call by linking through the investor relations section of the Rimage website, www.rimagecorp.com. Webcasts will be archived on Rimage’s website.

Forward-Looking Statements

This press release contains forward-looking statements that are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Any statements contained in this press release that are not statements of historical fact may be deemed to be forward-looking statements. Without limiting the foregoing, words such as “may,” “will,” “expect,” “believe,” “anticipate,” or “estimate” or comparable terminology are intended to identify forward-looking statements. Such forward-looking statements include, for example, statements about: the Company’s future revenue and operating performance, the integration of the Qumu business, anticipated synergies between Rimage and Qumu businesses, the effect of changes in technology, or the development and marketing of new products. The statements made by the Company are based upon management’s current expectations and are subject to certain risks and uncertainties that could cause the actual results to differ materially from those described in the forward-looking statements. These risks and uncertainties include the risk factors described in the Company’s Annual Report on Form 10-K for the year ended December 31, 2010 and other factors set forth in the Company’s filings with the Securities and Exchange Commission.

About Rimage Corporation

Founded in 1978, Rimage Corporation (NASDAQ: RIMG) helps businesses deliver digital content directly and securely to their customers, employees, and partners. Rimage’s Qumu business is well established in the rapidly growing enterprise video communications market. Rimage’s Signal online publishing platform automatically pushes secure mobile content to nearly any mobile device or computer. Qumu and Signal, in combination with Rimage’s CD, DVD and Blu-ray-Disc™ publishing solutions, enable businesses to securely deliver their videos, documents, audio files and images in today’s multi-platform, multi-device world. Rimage supplies thousands of customers in North America, Europe and Asia with industry-leading solutions that increase engagement, collaboration and control. Additional information can be found at www.rimagecorp.com.

Blu-ray Disc™ is a trademark of the Blu-ray Disc Association.