DisplaySearch announced it forecasts that LCD TV panel shipments will slide in the fourth quarter of 2011.

DisplaySearch announced it forecasts that LCD TV panel shipments will slide in the fourth quarter of 2011.

For more information visit: www.displaysearch.com

Unedited press release follows:

LCD TV Panel Shipments Expected to Slide in Q4’11

LCD TV Vendor Demand Peaks in October; Securing Stable Supply a Priority

SANTA CLARA, Calif., November 10, 2011 — Over the past few months, TFT LCD panel makers have been controlling production to minimize inventories and reduce losses. Despite this, the DisplaySearch MarketWise-LCD Industry Dynamics report shows an increase in loading rates in October, to 75% from 68% in September.

The uptick in October fab loading rates mainly came from Korean panel makers, who increased loading to 84-85%, aiming to fulfill demand in October (the peak month in the year). The increase mainly stemmed from TV panel production to meet increased LCD TV orders for Q4’11, especially for Samsung. In addition, both LG Display and Samsung are increasing shipments to Chinese customers, with consecutive monthly shipment growth in November and December.

Taiwanese panel makers also raised their fab loading rates in October, but are only at a 65% loading rate on average and plan to operate at the same level in Q4, reflecting the cautious outlook of their TV customers and a prioritization of finances over market share. Japanese panel makers are still struggling with inventory issues and have made further cuts in fab utilization for Q4’11.

Loading rates differ by fab generation, with Gen7/7.5 increasing to 86% in October, up from a record low of 76% in September, and Gen8/8.5 increasing from 64% to 72%.

Table 1: Global TFT-LCD Panel Capacity Loading Rate Forecast

|

Fab Size |

Sep’11 (A) |

Oct’11 (F) |

Nov’11 (F) |

Dec’11 (F) |

Jan’12 (F) |

|

Gen 5/5.5 |

68% |

79% |

78% |

77% |

80% |

|

Gen 6 |

61% |

61% |

60% |

59% |

62% |

|

Gen 7/7.5 |

76% |

86% |

85% |

84% |

87% |

|

Gen 8/8.5 |

64% |

72% |

71% |

70% |

73% |

|

Gen 10 |

94% |

90% |

85% |

80% |

75% |

|

Total |

68% |

75% |

74% |

72% |

74% |

Source: DisplaySearch MarketWise-LCD Industry Dynamics

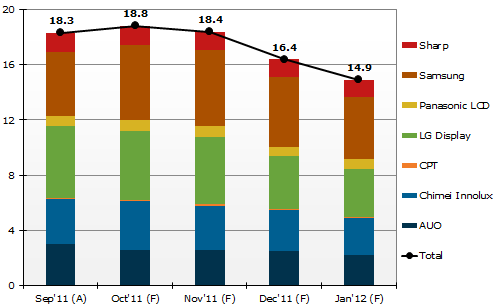

Large-area panel shipments, particularly for LCD TVs, are likely to show a peak in October and decline by 2% M/M in November before scaling down significantly at the end of the year.

The planned increases in panel shipments in October were encouraged by healthy sell-through results during the Golden Week holidays in China. There were hopes that TV sales in China would surge before the China home appliance subsidy program ended in late November, and that inventory rebuilding may be stronger than after Golden Week last year.

According to Deborah Yang, Research Director of DisplaySearch, “There is a risk of oversupply as loading rates are based on panel makers’ sales targets and on optimistic expectations rather than on a realistic demand forecast.” Yang added, “A decline in large-area panel shipments is forecast for December 2011 and January 2012, as the holiday demand will already have been met.”

Figure 1: LCD TV Panel Shipment Plans (units in millions)

The DisplaySearch MarketWise-LCD Industry Dynamics report delivers concise, relevant information for decision-makers who need to quickly understand the entire large-area TFT LCD supply chain. Presented in a dashboard format, this report highlights the status of every aspect of the supply chain, from components to the end-market, covering the ever-changing dynamics of panels, brands, capacity, production, prices and more.

For more information about the report, please contact Charles Camaroto at 1.888.436.7673 or 1.516.625.2452 or e-mail contact@displaysearch.com or contact your regional DisplaySearch office in China, Japan, Korea or Taiwan or more information.

About DisplaySearch

Since 1996, DisplaySearch has been recognized as a leading global market research and consulting firm specializing in the display supply chain, as well as the emerging photovoltaic/solar cell industries. DisplaySearch provides trend information, forecasts and analyses developed by a global team of experienced analysts with extensive industry knowledge. In collaboration with the NPD Group, its parent company, DisplaySearch uniquely offers a true end-to-end view of the display supply chain from materials and components to shipments of electronic devices with displays to sales of major consumer and commercial channels. For more information on DisplaySearch analysts, reports and industry events, visit us at www.displaysearch.com. Read our blog at www.displaysearchblog.com and follow us on Twitter at @DisplaySearch.

About The NPD Group, Inc.

The NPD Group is the leading provider of reliable and comprehensive consumer and retail information for a wide range of industries. Today, more than 1,800 manufacturers, retailers, and service companies rely on NPD to help them drive critical business decisions at the global, national, and local market levels. NPD helps our clients to identify new business opportunities and guide product development, marketing, sales, merchandising, and other functions. Information is available for the following industry sectors: automotive, beauty, commercial technology, consumer technology, entertainment, fashion, food and beverage, foodservice, home, office supplies, software, sports, toys, and wireless. For more information, contact us or visit www.npd.com and www.npdgroupblog.com. Follow us on Twitter at @npdtech and @npdgroup.