Rovi Corporation announced that it plans to sell off its Rovi Entertainment Store business and has retained the services of a financial advisor to assist in the process.

Rovi Corporation announced that it plans to sell off its Rovi Entertainment Store business and has retained the services of a financial advisor to assist in the process.

For more information visit: www.rovicorp.com

Unedited press release follows:

Rovi Announces Intent to Pursue Sale of Rovi Entertainment Store Business and Narrows Estimates Range for Fiscal 2012

Santa Clara, Calif. – 1/3/2013 – Rovi Corporation (NASDAQ: ROVI) today announced that it intends to pursue the sale of its Rovi Entertainment Store business as part of its ongoing strategic efforts to focus the Company on growth opportunities related to its core enabling technologies and services. The Company has retained GCA Savvian Advisors, LLC as its financial adviser in connection with the potential sale.

“The Rovi Entertainment Store has grown significantly since Rovi acquired it in February 2011, and we believe it will continue to grow and provide an excellent platform for on-demand media delivery as retailers and content owners move to distribute more content online,” said Tom Carson, President and Chief Executive of Rovi Corporation. “However, we are working to drive Rovi’s future growth and increase operational efficiencies around a strategic plan building on our core assets and IP, and to ensure the management team is fully focused on that effort. We are aligning primarily around delivering enabling solutions for our service provider customers and using those efforts to also generate growth with our Consumer Electronics and other customers. Consequently, we have decided to sell the Rovi Entertainment Store business.”

As a result of this decision, Rovi will reclassify the operating results of the Rovi Entertainment Store as discontinued operations, beginning with its fourth fiscal quarter and full fiscal year 2012 results.

Rovi also announced today its updated estimates for fiscal year 2012. Had the Rovi Entertainment Store business been reclassified as discontinued operations when Rovi provided its 2012 estimates during its quarterly earnings conference call on November 1, 2012, such estimates would have been fiscal year 2012 revenue of between $645 million and $655 million, and Adjusted Pro Forma Income Per Common Share of between $2.00 and $2.10. Rovi now estimates that fiscal year 2012 revenue will be between $645 million and $650 million, and Adjusted Pro Forma Income Per Common Share will be between $2.05 and $2.10. Rovi is in the process of completing its customary year-end audit and expects to report its fourth fiscal quarter and full fiscal year 2012 results in February 2013.

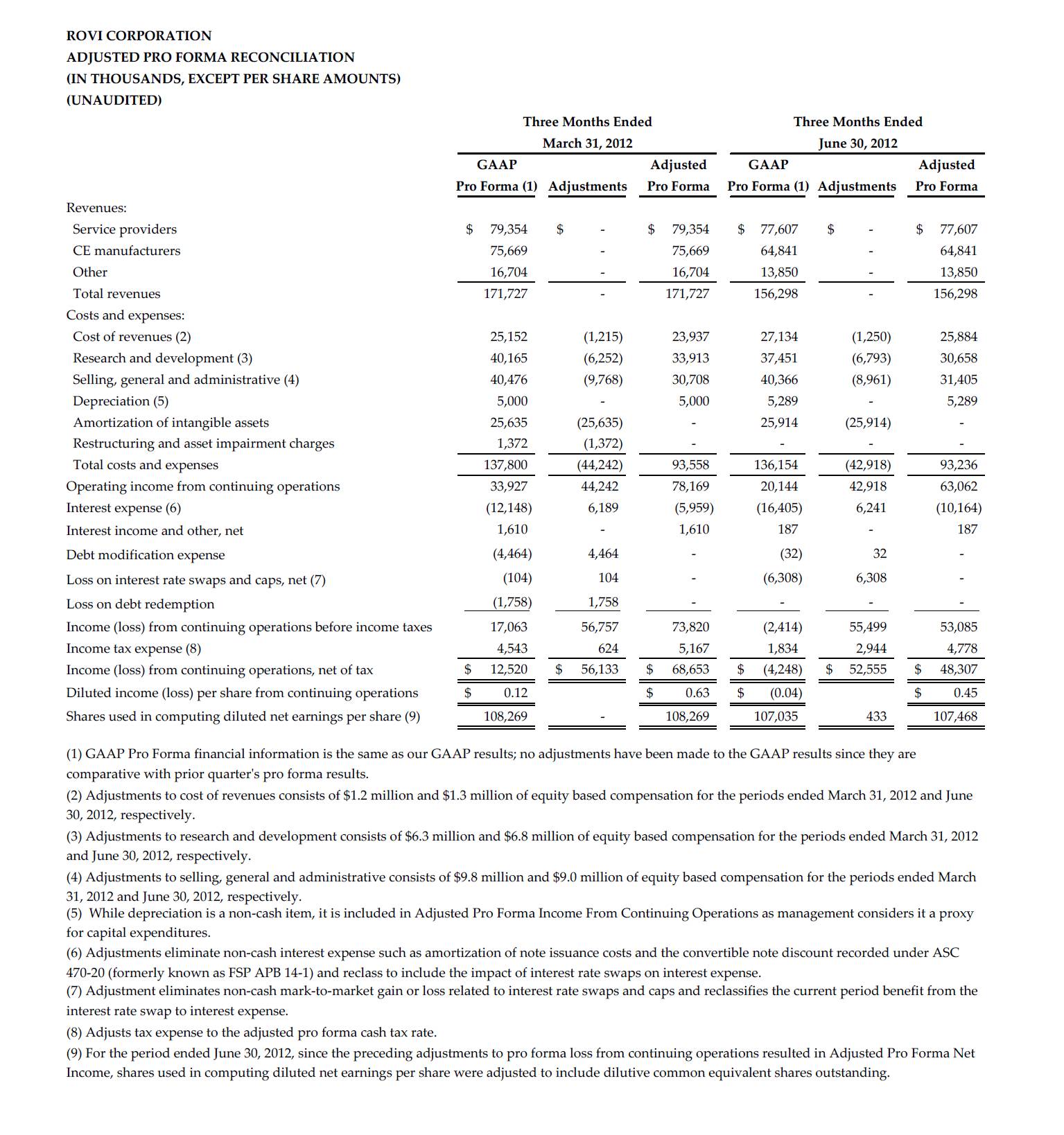

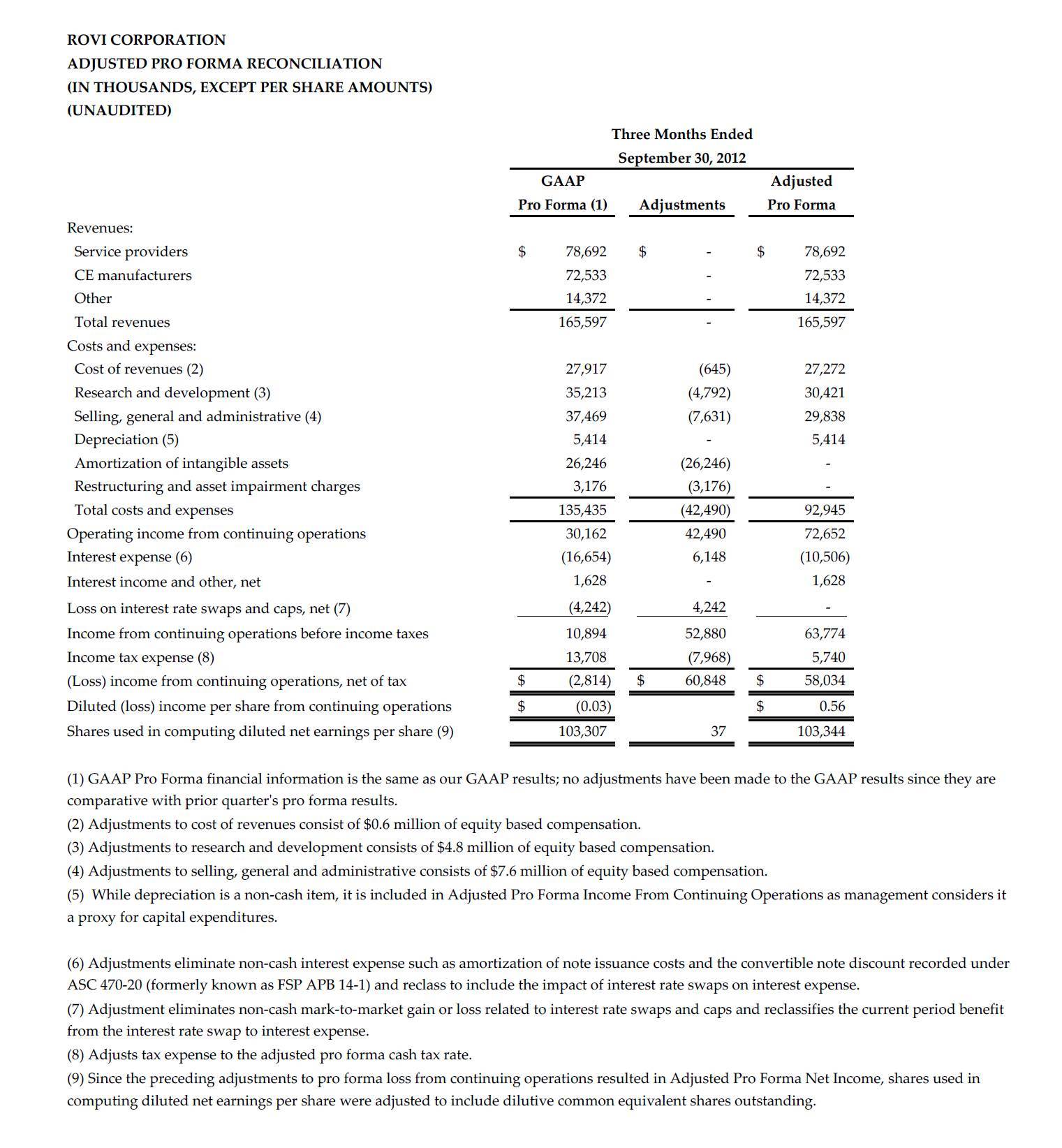

Reconciliations between GAAP pro forma and Adjusted Pro Forma results from operations, excluding the Rovi Entertainment Store business, for the first three quarters of 2012 are provided in the tables below.

Analyst and Investor Meeting at CES

As previously announced, Rovi will host an analyst and investor meeting on January 9, 2013 in Las Vegas during the International Consumer Electronics Show.

At this meeting, the Company will provide an update on the business and provide additional financial information for 2013. A question and answer session will follow the presentation. Adjusted Pro Forma information to be presented at this meeting will exclude the operating results of the Rovi Entertainment Store, as it will now be classified as discontinued operations.

Rovi’s investor meeting will take place at the Caesars Palace Resort, 3570 Las Vegas Blvd. South, Las Vegas, Nevada. Registration will open at 2:00 p.m. PT. The meeting will begin at 2:30 p.m. PT and is expected to last about 90 minutes. Rovi is still accepting RSVPs from investors to attend the meeting in-person.

Investors who are unable to attend the meeting in-person are encouraged to attend the audio webcast at http://tinyurl.com/d95q4c8. A recording of the audio webcast will be made available following the event and can be accessed in the Investor Relations section of the Rovi website at http://www.rovicorp.com/.

Non-GAAP or Adjusted Pro Forma Information

Rovi Corporation provides non-GAAP Adjusted Pro Forma information. References to Adjusted Pro Forma information are references to non-GAAP pro forma measures. The Company provides Adjusted Pro Forma information to assist investors in assessing its current and future operations in the way that its management evaluates those operations. Adjusted Pro Forma Revenue, Adjusted Pro Forma Income and Adjusted Pro Forma Income Per Common Share are supplemental measures of the Company’s performance that are not required by, and are not presented in accordance with GAAP. Adjusted Pro Forma information is not a substitute for any performance measure derived in accordance with GAAP, including, but not limited to, GAAP pro forma information prepared in accordance with ASC 805, Business Combinations.

Adjusted Pro Forma and GAAP pro forma measures assume the Sonic Solutions business combination, the Roxio software and Rovi Entertainment Store business dispositions all occurred on January 1, 2010. Adjusted Pro Forma Income is defined as GAAP pro forma income (loss) from continuing operations, net of tax, adding back non-cash items such as equity-based compensation, amortization of intangibles, amortization or write-off of note issuance costs, non-cash interest expense recorded on convertible debt under Accounting Standards Codification (“ASC”) 470-20 (formerly known as FSP APB 14-1), mark-to-market fair value adjustments for interest rate swaps, caps and foreign currency collars and the reversals of discrete tax items including reserves; as well as items which impact comparability that are required to be recorded under GAAP, but that the Company believes are not indicative of its core operating results such as transaction, transition and integration costs, restructuring and asset impairment charges, payments to note holders and for expenses in connection with the early redemption or modification of debt and gains on sale of strategic investments. While depreciation expense is a non-cash item, it is included in Adjusted Pro Forma Income as a reasonable proxy for capital expenditures.

Adjusted Pro Forma Income Per Common Share is calculated using Adjusted Pro Forma Income and taking into account the benefit of the convertible debt call option when it allows the Company to purchase shares of its own stock at a price below what those shares could be purchased for in the open market.

The Company’s management has evaluated and made operating decisions about its business operations primarily based upon Adjusted Pro Forma Revenue, Adjusted Pro Forma Income and Adjusted Pro Forma Income Per Common Share. Management uses Adjusted Pro Forma Income and Adjusted Pro Forma Income Per Common Share as measures as they exclude items management does not consider to be “core costs” or “core proceeds” when making business decisions. Therefore, management presents these Adjusted Pro Forma financial measures along with GAAP measures. For each such Adjusted Pro Forma financial measure, the adjustment provides management with information about the Company’s underlying operating performance that enables a more meaningful comparison of its financial results in different reporting periods. For example, since Rovi Corporation does not acquire businesses on a predictable cycle, management excludes amortization of intangibles from acquisitions, transaction costs and transition and integration costs in order to make more consistent and meaningful evaluations of the Company’s operating expenses. Management also excludes the effect of restructuring and asset impairment charges, expenses in connection with the early redemption or modification of debt and gains on sale of strategic investments. Management excludes the impact of equity-based compensation to help it compare current period operating expenses against the operating expenses for prior periods and to eliminate the effects of this non-cash item, which, because it is based upon estimates on the grant dates, may bear little resemblance to the actual values realized upon the future exercise, expiration, termination or forfeiture of the equity-based compensation, and which, as it relates to stock options and stock purchase plan shares, is required for GAAP purposes to be estimated under valuation models, including the Black-Scholes model used by Rovi Corporation. Management excludes non-cash interest expense recorded on convertible debt under ASC 470-20, mark-to-market fair value adjustments for interest rate swaps, caps, foreign currency collars, and the reversals of discrete tax items including reserves as they are non-cash items and not considered “core costs” or meaningful when management evaluates the Company’s operating expenses. Management reclassifies the current period benefit or cost of the interest rate swaps from gain or loss on interest rate swaps and caps, net to interest expense in order for interest expense to reflect the swap rates, as these instruments were entered into to control the interest rate the Company effectively pays on its convertible debt. Management includes the benefit of the convertible debt call option, which allows the Company to purchase shares of its own stock at approximately $28.28, and is excluded from GAAP EPS calculation as it is anti-dilutive, because the pragmatic reality is management would exercise this option rather than allow this dilution to occur. This convertible debt call option was exercised in August 2011.

Management is using these Adjusted Pro Forma measures to help it make budgeting decisions, including decisions that affect operating expenses and operating margin. Further, Adjusted Pro Forma financial information helps management track actual performance relative to financial targets. Making Adjusted Pro Forma financial information available to investors, in addition to GAAP financial information, may also help investors compare the Company’s performance with the performance of other companies in our industry, which may use similar financial measures to supplement their GAAP financial information.

Management recognizes that the use of Adjusted Pro Forma measures has limitations, including the fact that management must exercise judgment in determining which types of charges should be excluded from the Adjusted Pro Forma financial information. Because other companies, including companies similar to Rovi Corporation, may calculate their non-GAAP financial measures differently than the Company calculates its Adjusted Pro Forma measures, these Non-GAAP measures may have limited usefulness in comparing companies. Management believes, however, that providing Adjusted Pro Forma financial information, in addition to GAAP financial information, facilitates consistent comparison of the Company’s financial performance over time. The Company provides Adjusted Pro Forma financial information to the investment community, not as an alternative, but as an important supplement to GAAP financial information; to enable investors to evaluate the Company’s core operating performance in the same way that management does. Reconciliations between historical pro forma and Adjusted Pro Forma results of operations are provided in the tables below.

About Rovi Corporation

Rovi powers the discovery, delivery, display and monetization of digital entertainment. With innovative technology solutions for consumer electronics manufacturers, service providers, content producers, advertisers, retailers and websites, Rovi connects people and the entertainment they love. The company holds over 5,000 issued or pending patents worldwide and is headquartered in Santa Clara, California. More information about Rovi can be found at rovicorp.com.