iSuppli Corp. announced that it projects LCD TV shipments to the Russian Federation to reach 5.9 million sets at the end of 2010, up 18% from 2009.

iSuppli Corp. announced that it projects LCD TV shipments to the Russian Federation to reach 5.9 million sets at the end of 2010, up 18% from 2009.

For more information visit: www.isuppli.com

Unedited press release follows:

Russian LCD-TV Sales Continue to Soar

El Segundo, Calif., November 9, 2010 — With their hold intensifying on the Russian TV market, LCD-TVs will cause the sales of older tube-type CRTs to disappear in the country within four to five years, according to the market research firm iSuppli Corp.

Shipments of LCD-TVs to the Russian Federation, the world’s biggest country by area, are projected to reach 5.9 million sets at the end of 2010, up a solid 18 percent from 5.0 million in 2009.

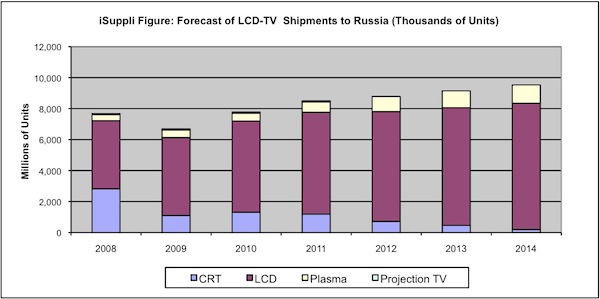

“In a market that iSuppli believes is 98 percent saturated—with nearly every Russian household owning at least one TV set—the popularity of LCD TVs continues to draw new buyers,” said Riddhi Patel, director and principal analyst for TV systems at iSuppli. “In contrast, CRT-TVs are on a steady decline.” Although still comprising the second largest television segment in Russia in 2010, shipments of CRT-TVs will plunge to a mere 193,000 by 2014, down from 1.3 million units this year. Unit share of shipments for CRT-TVs will fall to just 4 percent in 2014, down from 16 percent in 2010, while LCD-TVs will expand by 3 points to 79 percent. As the Russian market increasingly transitions to flat-panel TVs, the CRT-TV segment will vanish into insignificance after 2015, iSuppli television research shows.

For their part, plasma TVs—at present the smallest segment of the Russian TV market—will see their share of unit shipments grow from the current 13 percent to slightly more than one-fifth of the total market, or 21 percent, in just four years.

Source: iSuppli Corp. November 2010

Larger-Sized LCD TVs Gain Popularity

Among LCD-TVs, the 32-inch model is the most popular screen size in the Russian market, making up 43 percent of total LCD-TV shipments in 2010, iSuppli data indicate. However, while leading the way in LCD-TV market growth for the next three to four years, the 32-inch market will yield gradually to 40-inch-and-larger models after that, especially as prices retreat for the bigger sizes. In particular, the Winter Olympics sports event—scheduled to be held in the southwest Russian city of Sochi in 2014—is expected to contribute to a significant increase in sales of large-sized TVs.

Unlike the great popularity of the overall LCD-TV market, the newer technology represented by the LED backlit sub-segment is still making its way slowly through the country. Nonetheless, LED market share is projected to increase substantially in the coming years, with the energy savings of the sets proving attractive to consumers.

By 2014, iSuppli estimates that LED-backlit LCD-TVs will comprise more than 50 percent of all LCD-TV shipments in Russia.

Already, market leaders such as Samsung Electronics, Toshiba Corp., LG Electronics, Sony Corp. and Philips Electronics have started producing or importing LED models. Local manufacturers likewise have included LED backlit sets in their latest product portfolios.

For 3-D, televisions featuring the technology are considered a premium item and account for less than 2 percent of total LCD-TV shipments in 2010. With the development of 3-D content, however, share is anticipated to climb to almost one-third of total LCD-TV shipments by 2014.

Overall, manufacturers have restarted production facilities while also increasing the number of TVs being produced in the country. LCD manufacturers such as Samsung and LG are either making the sets in their own facilities, or are assigning them for production to contract manufacturers like Sony and Philips. Panasonic Corp., which imports a range of plasma TVs into Russia, also has plans to start manufacturing in the country in the near future, according to research from iSuppli.

The average selling price in the country for LCD-TVs this year will rise approximately 7 percent from 2009 to reach $726. In comparison, the average monthly income of the Russian population in 2009 was $536.

iSuppli’s market intelligence helps technology companies achieve market leadership. iSuppli’s compelling TV research, 3-D TV forecasts, touch screen displays analysis, etc can be used as essential tools for strategic planning and success in the electronic display market. Contact us on +1.310.524.4007 for more details.