iSuppli Corp. announced that the battle for the top spot in the U.S. LCD television market heated up in the second quarter as the gap in market share between No. 1 Samsung Electronics Co. Ltd. and No. 2 Vizio Inc. dwindled to less than 1%.

iSuppli Corp. announced that the battle for the top spot in the U.S. LCD television market heated up in the second quarter as the gap in market share between No. 1 Samsung Electronics Co. Ltd. and No. 2 Vizio Inc. dwindled to less than 1%.

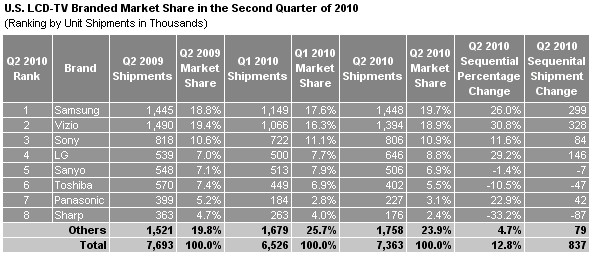

According to the statement, Samsung in the second quarter held a 0.7 percentage point lead over Vizio in terms of U.S. LCD-TV shipments, compared to 1.3 points in the first quarter. U.S. LCD-TV shipments rose by 12.8% in the second quarter to 7.36 million units, up from 6.53 million in the first quarter.

For more information visit: www.isuppli.com

Unedited press release follows:

Samsung Maintains Lead, but Vizio Closes Gap in Q2 U.S. LCD-TV Market

August 18, 2010

The battle for the top spot in the U.S. LCD-TV market heated up in the second quarter as the gap in market share between No. 1 Samsung Electronics Co. Ltd. and No. 2 Vizio Inc. dwindled to less than 1 percentage point, according to the electronic display research firm iSuppli Corp.

Samsung in the second quarter held a 0.7 percentage point lead over Vizio in terms of U.S. LCD-TV shipments, compared to 1.3 points in the first quarter. Both companies in the second quarter dramatically outperformed the overall market by offering sets with advanced features desired by U.S. consumers.

“Leadership in the world’s largest television market—the United States—represents the marquee position for global LCD-TV brands,” said Riddhi Patel. “Because of this, companies are competing intensely to secure every point of market share—with the most closely fought battle occurring between South Korea’s Samsung and U.S.-based Vizio. The two companies have swapped quarterly leadership multiple times during the past few years, and now are virtually tied in the race for market leadership.”

Super-Charged Growth

U.S. LCD-TV shipments rose by 12.8 percent in the second quarter to 7.36 million units, up from 6.53 million in the first quarter.

Samsung’s shipments grew at more than twice the pace of the overall market, rising by 26 percent to 1.45 million units, up from 1.15 million in the first quarter. Vizio grew even faster, with its shipments rising by an industry-leading 30.8 percent to 1.39 million units, up from 1.07 million in the first quarter.

Battle for Value

In the past, the two companies pursued very different strategies to attain LCD-TV market leadership, with Samsung focusing on premium products and Vizio stressing low-cost value-oriented LCD-TVs. However, as U.S. consumer preferences have shifted to higher-end LCD TVs, Vizio has realigned its product line to offer more advanced features.

“Most LCD-TVs purchased in the United States in 2010 are replacements of first-generation flat panels,” Patel said. “Because of this, U.S. consumers are more informed and demand larger LCD-TVs with better picture quality and more premium features, including 3-D, LED backlighting and built-in Internet connectivity. While Samsung continues to lead these technological trends, including the nascent 3-D TV segment, Vizio has significantly closed the feature gap.”

Featured Features

Television research from iSuppli’s U.S. TV Consumer Preference Analysis service, which surveys Americans on their attitudes regarding television purchases, illustrates the rising importance of advanced features when buying a television.

Of consumers surveyed in the second quarter, 17.2 percent said the LCD-TV sets they had purchased used LED backlighting, an increase of 5 percentage points from the first quarter. Furthermore, 60.8 percent of the consumers purchased a 40-inch or larger set in the second quarter of 2010, up from 51 percent during the same period in 2009. Finally, about 32 percent consumers say they connected their new televisions to the Internet.

Inventory Story

While LCD-TV sales continued to rise in the second quarter, some concerns have arisen regarding the third quarter, iSuppli’s electronic display market research indicates.

“Given the rising average prices for LCD-TVs, consumers have become more cautious in their spending,” Patel said. “As a result, higher-than-acceptable levels of inventory have built up in the channel, which could lead to a slower-than-expected third quarter.”