IHS iSuppli announced it forecasts that growth in the global electronic contract manufacturing business will slow in 2011.

IHS iSuppli announced it forecasts that growth in the global electronic contract manufacturing business will slow in 2011.

For more information visit: www.isuppli.com

Unedited press release follows:

Electronics Contract Manufacturing Market Growth Slows in 2011

El Segundo, Calif., January 24, 2011—Following a 33.4 percent increase in revenue in 2010, the global electronic contract manufacturing industry will experience slowing growth in 2011, with sales rising by only 8.5 percent, according to new IHS iSuppli research.

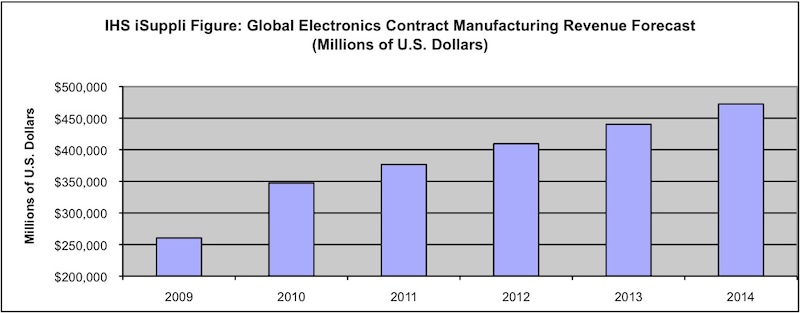

The contract electronics industry, consisting of the electronics manufacturing services (EMS) and original design manufacturing (ODM) segments, will finish 2011 with revenue of $376.7 billion, up from $347.3 billion in 2010, as presented in the attached figure. Revenue will continue to rise at annual rates between 9 percent and 7 percent during the following years, reaching $472.3 billion in 2014.

“The contract manufacturing industry in 2011 is grappling with reduced profit margins for certain consumer-oriented products because of intensified competition for new business,” said Thomas J. Dinges, CFA, principal analyst for outsourced electronics manufacturing at IHS. “EMS and ODM providers with exposure to these areas have been hardest hit, while others with a more balanced end-market portfolio have fared much better.”

Compared to just a few years ago, more high-mix markets have taken center stage. Nearly all of the largest EMS providers report very strong near-term growth in these segments, as well as a widening pipeline for future business.

In particular, the global ODM industry remains highly oriented toward the computing and consumer end markets.

China generates the bulk of growth

Manufacturing operations in China were responsible for more than 75 percent of aggregate industry growth in 2010, and the country is expected to continue carrying the burden of driving worldwide growth in the global outsourced manufacturing market in 2011. The largest outsourced manufacturing provider, Hon Hai Precision Industries, reported nearly 60 percent revenue growth in the first nine months of 2010 compared to the same period in 2009.

With China’s domestic economy expected to grow close to 10 percent in 2011—much faster than either Europe or the United States—such growth will drive higher consumption in the country, the contract manufacturing industry believes. Should growth fail to materialize, however, the industry would be materially impacted.

Margin improvement is now a function of end-market mix. Given the rise of material costs and increasing wages in major manufacturing locations like China, industry margins in 2011 are apt to be heading sideways or even downward. Last year, margin improvement had been more a function of cyclical factors, driven by the stronger-than-expected recovery in revenues.

Offsetting this was higher-than-expected pricing pressure in some consumer-oriented product markets, such as notebook PCs. In the third quarter of 2010, average gross margins for the 10 largest EMS providers rose by 1.30 percent. In contrast, the average gross margins for the 10 biggest ODM providers declined by 1.16 percent because of greater exposure to highly price-sensitive markets.

Of more concern, though, is the fact that only four of the largest companies across both EMS and ODM industries reported sequentially higher margins despite higher revenue. In 2010, outsourced manufacturing providers with a higher proportion of less price-sensitive consumer-oriented product appeared to have a smaller impact on margins.

Margin improvement in 2011 is likely more a factor of product mix, as opposed to pure cyclical aspects such as revenue growth. With the industry starting to add capacity, OEMs have grown more concerned with pricing, and input costs have risen.

About IHS iSuppli Products & Services

IHS iSuppli technology value chain research and advisory services range from electronic component research to device-specific application market forecasts, from teardown analysis to consumer electronics market trends and analysis and from display device and systems research to automotive telematics, navigation and safety systems research. More information is available at www.isuppli.com and by following on twitter.com/iSuppli.

About IHS (www.ihs.com)

IHS (NYSE: IHS) is a leading source of information and insight in pivotal areas that shape today’s business landscape: energy, economics, geopolitical risk, sustainability and supply chain management. Businesses and governments around the globe rely on the comprehensive content, expert independent analysis and flexible delivery methods of IHS to make high-impact decisions and develop strategies with speed and confidence. IHS has been in business since 1959 and became a publicly traded company on the New York Stock Exchange in 2005. Headquartered in Englewood, Colorado, USA, IHS employs more than 4,400 people in more than 30 countries around the world.