NPD DisplaySearch announced it forecasts Smart TV shipments to grow 15% worldwide in 2012.

NPD DisplaySearch announced it forecasts Smart TV shipments to grow 15% worldwide in 2012.

For more information visit: www.displaysearch.com

Unedited press release follows:

Smart TV Shipments Grow 15% Worldwide in 2012, According to NPD DisplaySearch

North America Has Lowest Market Penetration but Consumes Highest Levels of Internet-Based Video, Preferring On-Demand Services

SANTA CLARA, CALIF., October 17, 2012 — Smart TVs are moving from a novelty to mainstream, with shipments expected to grow 15% worldwide in 2012. With the shift, regional preferences and TV consumption habits are changing, according to the latest NPD DisplaySearch Quarterly Smart TV Shipment and Forecast Report.

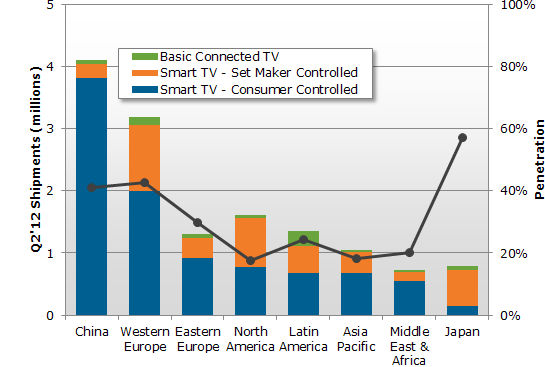

Critical to the development of connected TV has been the accessibility of content and broadcast services, which have helped propel penetration in Europe and Japan. In China, the availability of attractive free content on the internet has had a similar effect. Connected TV’s shipment shares were 26% in China and 34% in Western Europe in 2011. In 2012, it has grown to more than 40% in both regions. Japan has the highest penetration with more than 55%.

Smart and connected TV shipments account for a large percentage of TVs in most regions, but North America seems to be pursuing a different direction. Penetration is hovering around 20%, which is the lowest level of any region.

“North American households consume the highest levels of internet video, averaging over 30 GB per household every month according to Cisco, yet they don’t seem attracted to connected TVs,” said Paul Gray, Director, European TV Research. “We find that North America leads by far in paid on-demand services, which tend to be tied to set-top boxes.”

Smart TV shipments are tightly linked to content consumption habits. For consumers in China, there is plenty of free content on the internet and few structured services. This favors TVs with built-in browsers. Furthermore, Chinese consumers consider a TV to be a prestigious purchase and are prepared to invest more in them.

Figure 1: Q2’12 Smart TV Shipments by Region (000s)

Source: NPD DisplaySearch Quarterly Smart TV Shipment and Forecast Report

Conversely, Western Europe consumes more free content every month than North America does. Terrestrial broadcasters’ catch-up services are beginning to dominate in Western Europe. These broadcasters have no interest in hardware, so connected TVs are flourishing with open standards like HbbTV rapidly gaining acceptance and evolving with new features. The development of the Ginga standard in Brazil is following a similar path in Europe, with commercial broadcasters uniting around a common platform.

“TV brands want to add more functionality to their TV sets.” Gray added. “Smart TVs that have browsers and can access the open internet are rapidly gaining share. Many TV brands introduced this function in their 2012 products.”

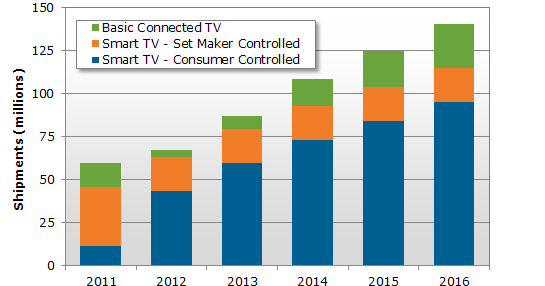

Nearly 9.5 million consumer-controlled (open internet access) smart TVs shipped in Q2’12, with 43 million expected to ship in 2012. This figure is forecast to grow to 95 million in 2016.

Figure 2: Smart TV Shipment Forecast

Source: NPD DisplaySearch Quarterly Smart TV Shipment and Forecast Report

At the same time, basic sets that link to the HbbTV and Ginga services will enter at the lowest price points in Europe and Latin America. The challenge for brands will be to bring enough value to their sets with extra functions. New open standards such as HTML-5 will help solve the problem of software updates and obsolescence in smart TVs, which should enable such sets to compete with cheap streaming boxes.

The NPD DisplaySearch Quarterly Smart TV Shipment and Forecast Report provides a quarterly update of shipments in this market. Rapid shifts in smart TV feature developments are forecast, and the report also examines smart and connected TV shipments and internet traffic by region, analyzing industry and service trends. For more information about the report, please contact Charles Camaroto at 1.888.436.7673 or 1.516.625.2452, e-mail contact@displaysearch.com or contact your regional NPD DisplaySearch office in China, Japan, Korea or Taiwan.

About NPD DisplaySearch

Since 1996, NPD DisplaySearch has been recognized as a leading global market research and consulting firm specializing in the display supply chain, as well as the emerging photovoltaic/solar cell industries. NPD DisplaySearch provides trend information, forecasts and analyses developed by a global team of experienced analysts with extensive industry knowledge. In collaboration with The NPD Group, its parent company, DisplaySearch uniquely offers a true end-to-end view of the display supply chain from materials and components to shipments of electronic devices with displays to sales of major consumer and commercial channels. For more information on DisplaySearch analysts, reports and industry events, visit us at http://www.displaysearch.com/. Read our blog at http://www.displaysearchblog.com/ and follow us on Twitter at @DisplaySearch.

About The NPD Group, Inc.

The NPD Group is the leading provider of reliable and comprehensive consumer and retail information for a wide range of industries. Today, more than 2,000 manufacturers, retailers, and service companies rely on NPD to help them drive critical business decisions at the global, national, and local market levels. NPD helps our clients to identify new business opportunities and guide product development, marketing, sales, merchandising, and other functions. Information is available for the following industry sectors: automotive, beauty, entertainment, fashion, food, home and office, sports, technology, toys, video games, and wireless. For more information, contact us or visit https://www.npd.com/ and http://www.npdgroupblog.com/. Follow us on Twitter: @npdtech and @npdgroup.