IHS announced it forecasts that PC Solid-State Drive (SSD) shipments will rise to 227 million units in 2017, up more than 600% from 2012, while shipments of hard disk drives (HDDs) will decline to 410 million units in 2017, down 14% from 2012.

IHS announced it forecasts that PC Solid-State Drive (SSD) shipments will rise to 227 million units in 2017, up more than 600% from 2012, while shipments of hard disk drives (HDDs) will decline to 410 million units in 2017, down 14% from 2012.

Additionally, shipments of optical disc drives will amount to 262.6 million units this year, down from 287.4 million from 2012.

For more information visit: www.isuppli.com

Unedited press release follows:

SSDs to Account for One-Third of Worldwide PC Storage Shipments by 2017

El Segundo, Calif. (May 2, 2013) — Global shipments of solid state drives (SSD) in PCs are set to rise by a factor of seven by 2017, allowing them to claim more than one-third of the market for PC storage solutions by that time, according to an IHS iSuppli Storage Market Tracker Report from information and analytics provider IHS (NYSE: IHS).

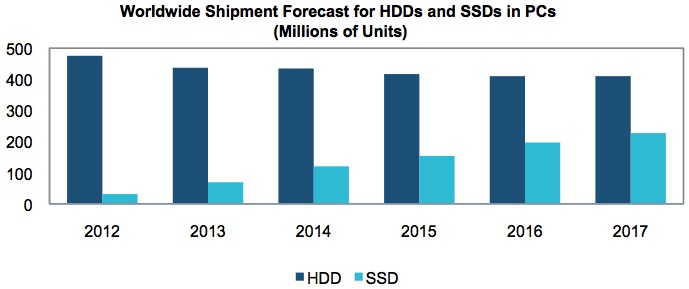

SSD shipments in PCs will rise to 227 million units in 2017, up more than 600 percent from 31 million in 2012, as presented in the attached figure. Meanwhile, shipments of PC hard disk drives (HDD) will decline to 410 million in 2017, down 14 percent from 475 million in 2012.

The divergent outlook for the two products will allow SSDs to climb and claim 36 percent of the PC storage market in 2017, up from just 6 percent in 2012. At the same time, HDDs will see their long-term dominance in PCs erode, with their share falling to 64 percent in 2017, down from a commanding 94 percent in 2012.

The SSD space includes the cache SSD segment where NAND flash is used alongside a hard disk drive, as well as a separate segment in which NAND flash is embedded on top of an HDD in an integrated, hybrid form factor.

“For SSDs, the major factors driving growth this year will be Ultrabooks and other ultrathin notebook PCs, especially as Intel’s upcoming Haswell processors bring about a robust combination of performance and efficiency for the superthin computers,” said Fang Zhang, analyst for storage systems at IHS. “In the coming years, Ultrabooks and ultrathins—combined with appealing touch-screen displays and convertible form factors—are likely to become more compelling as the machines attempt to lure consumers away from smartphones and tablets, boosting demand for SSDs used in these systems. Meanwhile, SSDs will become more attractive to PC makers and buyers alike as costs decline for the NAND flash memory at the heart of the storage devices.”

Hard times for hard drives

PC HDD shipments in 2013 are forecast to decline to 436.9 million units, down 8 percent from 475.4 million last year. In comparison, SSD shipments in PCs will jump to 68.9 million units, up a resounding 122 percent from 31.1 million. From 2012 to 2017, the compound annual growth rate for PC HDD shipments will be in negative territory at -2.9 percent, while that for PC SSDs comes out to an enviable 48.0 percent.

“The HDD industry is suffering the multilayered effects of a depressed market, resulting from a weak global economy, upgrades not being made for desktop and notebook PCs alike as replacement cycles get extended, and cannibalization by flashier devices like mobile handsets and tablets,” Zhang observed.

PC HDD revenue is expected to decline to $26.4 billion in 2013, down from last year’s record of $30.6 billion that resulted mainly from higher average selling prices after the devastating floods in Thailand.

State of euphoria for solid-state drives

Meanwhile the SSD space has been extremely competitive, closing out last year on record-high revenue and with the vigorous enterprise SSD segment enjoying dramatic expansion. The fourth quarter last year was a particularly strong period for computer-related SSDs with shipments of 12 million units, boosting year-end revenue to $6.8 billion. By 2017, PC SSD industry revenue of $22.6 billion will come close to PC HDD revenue of $23.5 billion.

Silver linings

Despite the rapid adoption of SSDs, hard disk drives will continue to lead the overall storage market because of their cost advantage on higher densities and dollars-per-gigabyte pricing. HDD shipments also will gradually pick up in the second half this year as Windows 8 and Ultrabooks gain traction among consumers, after failing to perform as expected upon launch last year.

In the enterprise HDD segment, competition is set to heat up as archrivals Western Digital and Seagate Technology contend for leadership, and Western Digital is expected to launch a 5-terabyte HDD sporting the new helium technology for higher disk capacity and lower power consumption. Other new HDD technologies are on the horizon as well, including nearline and hybrid hard disk drives.

HDDs also will continue to play a major role in cloud storage, remaining the final destination for the majority of digital content.

ODDs are DOA

While HDDs retain dominance despite declining shipments and SSDs maintain impressive growth momentum, a third segment of the storage industry is mired in poor results and deteriorating prospects.

Optical disk drives (ODD), used for playing CDs and DVDs in PCs, continue to worsen on both shipment and revenue terms. ODD shipments this year will amount to 262.6 million units, down from 287.4 million in 2012; while revenue will slip to $7.4 billion from $8.6 billion. By 2017, ODD shipments will shrink a further 100,000 units compared to 2012 levels, and revenue will reduce by half.

About IHS (www.ihs.com)

IHS (NYSE: IHS) is the leading source of information, insight and analytics in critical areas that shape today’s business landscape. Businesses and governments in more than 165 countries around the globe rely on the comprehensive content, expert independent analysis and flexible delivery methods of IHS to make high-impact decisions and develop strategies with speed and confidence. IHS has been in business since 1959 and became a publicly traded company on the New York Stock Exchange in 2005. Headquartered in Englewood, Colorado, USA, IHS is committed to sustainable, profitable growth and employs 6,700 people in 31 countries around the world.