IHS iSuppli announced it forecasts that global shipments of media and PC-type tablets will hit 242.3 million units in 2015, up from 19.7 million in 2010.

IHS iSuppli announced it forecasts that global shipments of media and PC-type tablets will hit 242.3 million units in 2015, up from 19.7 million in 2010.

For more information visit: www.isuppli.com

Unedited press release follows:

Global Tablet Shipments to Rise by Factor of 12 by 2015

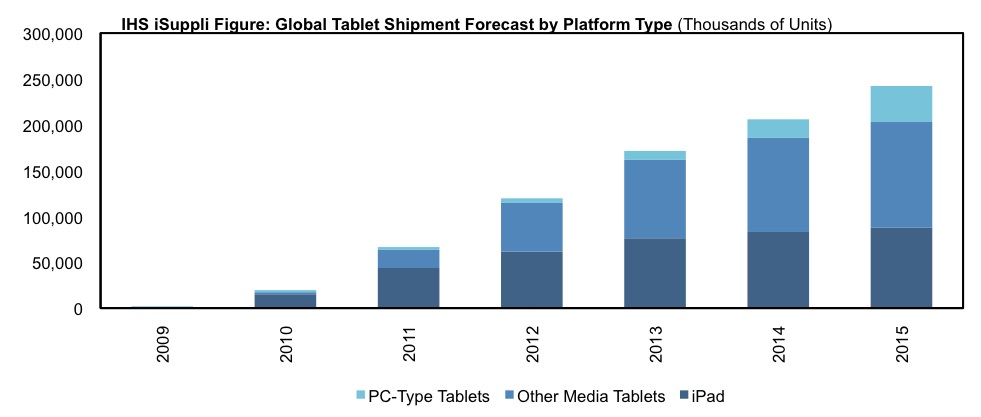

El Segundo, Calif., February 4, 2011 — Global shipments of tablets—a segment consisting of media tablets like Apple Inc.’s iPad as well as PC-type tablets—are set to rise to 242.3 million units in 2015, up by a factor of more than 12 from 2010, new IHS iSuppli research indicates.

Media tablet shipments will grow to more than 202 million units in 2015, up from 17.4 million in 2010. Shipments of PC-type tablets—i.e., tablets that have full PC functionality implemented via PC operating systems—will climb to 39.3 million units in 2015, up from 2.3 million in 2010.

Total shipments of tablets will amount to 242.3 million units in 2015, up from the newly finalized IHS iSuppli estimate of 19.7 million in 2010.

The attached figure presents the IHS iSuppli forecast of global media and PC-type tablets.

“The remarkable expansion of the tablet market from 2010 to 2015 will be driven by three successive waves of growth,” said Rhoda Alexander, director of monitor research at IHS. “The first wave, which is hitting in 2010 and 2011, was created by the arrival of the iPad and the ensuing tsunami of demand for the device. The second wave, arriving in 2011 and 2012, will be propelled by a deluge of iPad competitors, particularly Android-based models. The third wave, which will turn up in 2013, will consist of a flood of models based on the Windows operating system that will expand the reach of tablets into traditional computer markets.”

While the iPad will lead annual tablet shipments through 2012, the increasing strength of media-tablet rivals combined with the advent of PC-type platforms will cause Apple to lose its majority of total unit shipments starting in 2013.

Wave hello to iPad

Prior to the introduction of the iPad in 2010, the tablet market represented a sleepy niche of the mobile PC market, with small volumes, negligible growth, and sales limited to small group of users in professional markets. Shipments of these PC-type tablets amounted to less than 2 million units in 2009. The arrival of the iPad changed all that, helping tablet sales surge by a factor of 10 in 2010.

The iPad’s huge head start both in unit share and ecosystem development will allow it to maintain its market dominance in 2011 and throughout most of 2012 despite the influx of competitors.

Android ahoy

New model introductions in 2011 and 2012 will continue to boost iPad volumes and allow Apple to maintain a premium for its newest models. However, Apple will face increasing price competition from competing media tablets, many of them incorporating the Android operating system. Some of those tablets will enter the market with features more comparable—or in some cases, superior—to the current version of the iPad. Furthermore, Google is spearheading an effort to speed development of tablet-oriented content for Android-based devices.

“At least three of the major Android tablets released at the Consumer Electronics Show in January featured built-in support for a 4G wireless communications technology: long-term evolution (LTE),” said Francis Sideco, principal analyst, wireless communications at IHS. “With iPad only supporting 3G for now, it will be interesting to see the outcome of the battle pitting the allure of technology—i.e. LTE—against the appeal of usability—i.e. the iPad’s benchmark user friendliness.”

Aside from the LTE differentiator, Google also is spearheading an effort to speed development of tablet-oriented content and the user interface for Android based devices.

The rising tide of PC tablets

By 2013, the iPad will decline to less than 50 percent of overall tablet shipments, as it faces the double jeopardy of increasing competition from Android-based tablets combined with the rise of devices using PC operating systems, possibly including some from Apple.

“The year 2013 will mark a critical juncture, as the tablet market turns into a battleground between media tablets using mobile operating systems, and PC-type tablets employing the Windows operating system,” Alexander said. “Add to this mix the competition from ever-improving smart phones, and the mobile device market will get very interesting.”

Microsoft likely will introduce a tablet-oriented version of its Windows operating system in late 2012 or in 2013 that not only will be better suited to touch-screen applications, but also will allow for content-creation tasks. The expected expansion of the current consumption-oriented media tablets to incorporate more creation applications is placing growing pressure on traditional low-end mobile PCs, and the existing Windows solutions are struggling to gain traction in the tablet market.

“Microsoft and the PC makers will engage in a vicious battle to fight off the ongoing share grab from media tablets, even as many of these vendors offer media tablet solutions of their own,” Alexander said. “Expect to see a blend of slates, convertibles and dual- and potentially tri-screen solutions as alternatives to the media tablet onslaught.”

The wide variety of solutions—and intense battle among operating systems and types of platforms—will continue to fuel the expansion of the tablet market in 2014 and 2015.

About IHS iSuppli Products & Services

IHS iSuppli technology value chain research and advisory services range from electronic component research to device-specific application market forecasts, from teardown analysis to consumer electronics market trends and analysis and from display device and systems research to automotive telematics, navigation and safety systems research. More information is available at www.isuppli.com and by following on twitter.com/iSuppli.

About IHS (www.ihs.com)

IHS (NYSE: IHS) is a leading source of information and insight in pivotal areas that shape today’s business landscape: energy, economics, geopolitical risk, sustainability and supply chain management. Businesses and governments around the globe rely on the comprehensive content, expert independent analysis and flexible delivery methods of IHS to make high-impact decisions and develop strategies with speed and confidence. IHS has been in business since 1959 and became a publicly traded company on the New York Stock Exchange in 2005. Headquartered in Englewood, Colorado, USA, IHS employs more than 4,400 people in more than 30 countries around the world.