IHS iSuppli announced it reckons the disruptions caused by the floods that struck Thailand in late 2011 will continue to affect hard disk drive (HDD) production into the third quarter of 2012.

IHS iSuppli announced it reckons the disruptions caused by the floods that struck Thailand in late 2011 will continue to affect hard disk drive (HDD) production into the third quarter of 2012.

For more information visit: www.isuppli.com

Unedited press release follows:

Thai Floods Continue to Impact Hard Drive Manufacturing, with High Prices and Short Supplies Lingering

El Segundo, Calif., February 10, 2012 — Although hard disk drive (HDD) supplies in the first quarter commenced their recovery from the disastrous floods that struck Thailand in late 2011, a full recovery of production is still months away, with unit shipments not expected to return to annual growth until the third quarter, according to IHS iSuppli Memory & Storage research from information and analysis provider IHS (NYSE: IHS).

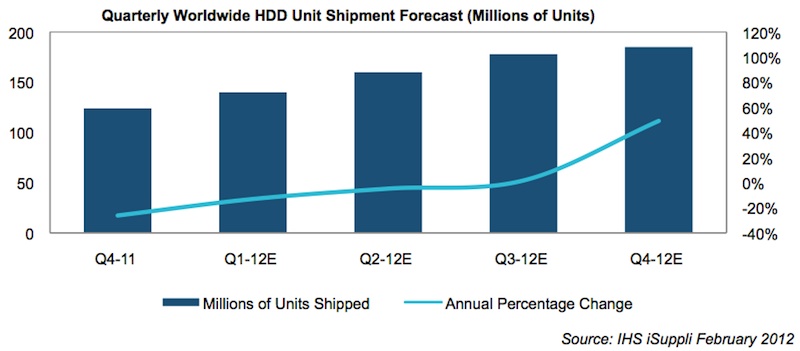

Due to production disruptions at HDD suppliers and at component makers, global hard drive shipments in the fourth quarter of 2011 fell by 26 percent compared to the same period in 2010. Shipments are set to decline by another 13 percent in the first quarter and by 5 percent in the second quarter on an annual basis.

The global HDD market won’t return to year-over-year growth until the third quarter, when shipments rise by 2 percent, followed by a 49 percent surge in the fourth quarter as the industry snaps back from the previous shortage.

On a sequential basis, shipments in the first quarter are expected to increase by 13 percent, a dramatic turnaround from a 29 percent plunge in the fourth quarter of 2011. Shipments are expected to continue to grow by 14 percent sequentially in the second quarter, by 11 percent in the third quarter and by 4 percent in the fourth quarter.

“The recovery of global HDD manufacturing has begun and will continue during each quarter of 2012,” noted Fang Zhang, storage analyst for IHS. “However, the recovery will be prolonged for at least two more quarters, as supply constraints keep unit shipments from climbing on an annual basis until third quarter. Meanwhile, HDD prices will remain inflated and inventories will continue to be depleted, showing that demand is exceeding supply. Supply and demand should return to balance by the end of the third quarter.”

HDD production spins up

Major HDD suppliers have shifted some production to locations outside of Thailand, which has helped ease the shortage situation. At the same time, some of the major HDD component suppliers have resumed a portion of their production in the country and have migrated manufacturing operations to other regions.

Western Digital Corp. (WDC), the HDD manufacturer most impacted by the floods, has increased manufacturing in other countries, and is expected to return to full production by September. Toshiba Corp., which also was hit hard by the disaster, has boosted its production in other countries as well.

Inventories drop, prices rise

However, given the magnitude of the disaster, these moves have been insufficient to make up for the shortfall in production so far. This will result in a plunge in global HDD inventory in the first quarter.

In anticipation of supply constraints, the global average selling price (ASP) for HDDs soared by 28 percent in the fourth quarter. While prices will decline by 3 percent in the first quarter and by 9 percent in the second quarter, they will remain inflated above 2011 levels throughout 2012.

“Prices will remain high for a number of reasons, including the higher costs associated with the relocation of production, as well as higher component costs because of flooding impacts among component makers,” Zhang said. “Furthermore, PC brands have signed annual contacts with HDD makers that have locked them into elevated pricing deals for the rest of the year.”

In addition, given the two megamergers between Seagate/Samsung and WDC/Hitachi GST, IHS expects the HDD industry could hold prices higher than pre-flood levels for a few more quarters because there are fewer competitors in the market.

About IHS (www.ihs.com)

IHS (NYSE: IHS) is the leading source of information, insight and analytics in critical areas that shape today’s business landscape, including energy and power; design and supply chain; defense, risk and security; environmental, health and safety (EHS) and sustainability; country and industry forecasting; and commodities, pricing and cost. Businesses and governments in more than 165 countries around the globe rely on the comprehensive content, expert independent analysis and flexible delivery methods of IHS to make high-impact decisions and develop strategies with speed and confidence. IHS has been in business since 1959 and became a publicly traded company on the New York Stock Exchange in 2005. Headquartered in Englewood, Colorado, USA, IHS employs more than 5,500 people in more than 30 countries around the world.