DisplaySearch announced that, according to its research, consumers buy new television sets in order to get a larger picture or better performance, not to partake of the latest and greatest features.

DisplaySearch announced that, according to its research, consumers buy new television sets in order to get a larger picture or better performance, not to partake of the latest and greatest features.

For more information visit: www.displaysearch.com

Unedited press release follows:

New TV Features Not Strong Drivers of New TV Purchases

Internet Connectivity, LED Backlights and 3D are Hoped-for Drivers of the Next TV Replacement Cycle, but Consumers Report Weak Connections to Upgrades, According to DisplaySearch Global TV Replacement Study

Santa Clara, Calif., June 8, 2011—According to the DisplaySearch Global TV Replacement Study, the main reasons why people decide to buy a new TV are the same ones that have been cited for years: to have a newer, bigger and better performing TV, and not just to replace a broken TV, although that can be a motivator. In an effort to drive even faster replacement activity, TV set makers have been developing new features to entice consumers to trade in even recently purchased sets that are just a few years old.

“While it is valuable to know how often people are upgrading or adding new TVs to the home, it’s also important to understand why,” noted Paul Gagnon, Director of North America TV Research at DisplaySearch. “Some of the findings from this study show that newer features are not yet strong drivers of new TV purchases compared to fundamentals like trading up in size or getting a flat panel TV.”

LED backlights promise thinner form factors and lower power consumption for LCD TVs, but at a higher cost, while internet connectivity expands the range of content TV viewers have access to. Finally, 3D was pitched as the next revolution in TV viewing, akin to the move to HDTV. These features add capability to TVs, along with cost, but the hope by many participants in the TV industry was that these features could nudge recent flat panel TV buyers back into the market for a new set earlier. The findings from the DisplaySearch study show that more work needs to be done to educate and convince consumers on the merits of these new features.

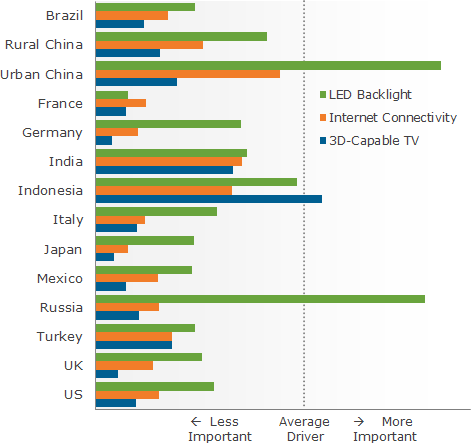

Figure 1: Importance of New Features by Country, Relative to the Other 14 Drivers of TV Replacement

Source: Global TV Replacement Study

LED Backlights Most Important of Three Advanced Feature Drivers, But Only Above-Average in Importance in Two Countries

In the majority of countries studied, LED was a below average driver of new TV replacements, but ranked stronger than internet connectivity and 3D in most cases. Only Urban China and Russia had an above-average incidence of LED being a reason to upgrade an existing TV, with Indonesia following closely behind. The reasoning could be low awareness or understanding of the value offered by LED backlighting (lower power, thinner, lighter), but also an unwillingness to upgrade just to get this feature when price premiums are still 20% or higher.

Internet Connectivity a Below-Average Upgrade Driver in Every Case

As a wide range of devices come with internet connectivity, and internet video consumption grows every year, upgrading a TV to gain internet connectivity may seem like a strong draw. But a very confusing marketplace and lack of embedded wireless connectivity mean that most view it as a nice feature to have, but certainly not a principle reason to upgrade a TV. Many of the countries that showed a higher level of interest were also emerging economies, so the lack of a strong traditional broadcast infrastructure may actually increase the relative importance of getting video content via the internet, and therefore make an internet-connected TV more of a motivating factor to upgrading existing sets.

3D Capability One of the Weakest Drivers of New TV Replacements, Contrary to Set Makers’ and Retailers’ Hopes

Few new TV features have garnered as much attention in the last year as 3D has. TV brands and TV retailers had been expecting the availability of 3D TVs to kick off a new boom in TV replacement, akin to the HD and flat panel booms. Although 3D TV shipments showed strong growth in 2010, the study results indicate that consumers aren’t looking to make a new TV upgrade just to get 3D. The study results do indicate that 3D is a more important criterion for consumers who are already looking to purchase a new set. Even Japanese consumers, long considered to be early adopters, cited 3D as a relatively unimportant factor when deciding to buy a new TV. More likely, the lack of broadly available 3D content is making 3D a future-proof feature, but not a main reason to upgrade in the first place.

DisplaySearch Global TV Replacement Study Now Available

How quickly are consumers replacing their TVs? Which countries have the shortest replacement cycles? And what key factors are driving TV sales? The DisplaySearch Global TV Replacement Study offers a focused view of TV replacement trends in 14 global markets. This study also provides insight into the reasons why consumers are replacing their CRT and flat panel TVs.

Important information in this report helps businesses to

• Identify which markets are replacing and adding the most TVs and why

• Understand the TVs currently in the home, by technology, brand, size, age, and location

• Determine which devices, besides TVs, consumers are using to watch TV, movies, and video, such as iPads, smart phones, notebook PCs, and more

• Identify how local TV replacement trends will impact product planning and the supply chain

• Reveal plans for TV purchases over the next 12 months.

The report is available for all 14 markets or by individual market:

China – Urban

China – Rural

India

Indonesia

Japan

UK

France

Turkey

Germany

Italy

Brazil

US

Mexico

Russia

This unique global study provides clients with country-level insights and information based on nationally representative samples of more than 14,000 TV owners. The study combines DisplaySearch TV analyst expertise with the advanced consumer survey design expertise of its parent company, The NPD Group.

For more information, contact Charles Camaroto at 1.888.436.7673 or 1.516.625.2452, e-mail contact@displaysearch.com, or contact your regional DisplaySearch office in China, Japan, Korea or Taiwan for more information.

About DisplaySearch

Since 1996, DisplaySearch has been recognized as a leading global market research and consulting firm specializing in the display supply chain, as well as the emerging photovoltaic/solar cell industries. DisplaySearch provides trend information, forecasts and analyses developed by a global team of experienced analysts with extensive industry knowledge. In collaboration with The NPD Group, its parent company, DisplaySearch uniquely offers a true end-to-end view of the display supply chain from materials and components to shipments of electronic devices with displays to sales of major consumer and commercial channels. For more information on DisplaySearch analysts, reports and industry events, visit us at http://www.displaysearch.com/. Read our blog at http://www.displaysearchblog.com/ and follow us on Twitter at @DisplaySearch.

About The NPD Group, Inc.

The NPD Group is the leading provider of reliable and comprehensive consumer and retail information for a wide range of industries. Today, more than 1,800 manufacturers, retailers, and service companies rely on NPD to help them drive critical business decisions at the global, national, and local market levels. NPD helps our clients to identify new business opportunities and guide product development, marketing, sales, merchandising, and other functions. Information is available for the following industry sectors: automotive, beauty, commercial technology, consumer technology, entertainment, fashion, food and beverage, foodservice, home, office supplies, software, sports, toys, and wireless. For more information, contact us or visit http://www.npd.com/ and http://www.npdgroupblog.com/. Follow us on Twitter at @npdtech and @npdgroup.