DisplaySearch announced it forecasts that total TV shipments will not grow from 2010 to 2011 and hold steady at 248 million units.

DisplaySearch announced it forecasts that total TV shipments will not grow from 2010 to 2011 and hold steady at 248 million units.

For more information visit: www.displaysearch.com

Unedited press release follows:

TV Shipments in Developed Markets to Decline in 2011

TV Shipments Forecast to Decline in North America, Japan and Western Europe, but Continue to Grow in Emerging Markets; 2011 LCD TV Shipments Forecast to Reach 206M Units

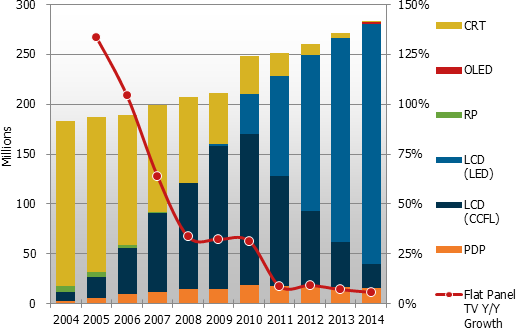

SANTA CLARA, Calif., October 11, 2011—The forecast published by DisplaySearch in its Quarterly Advanced Global TV Shipment and Forecast Report shows a further reduction in the demand outlook for TVs worldwide. Total TV shipments are not forecast to grow from 2010 to 2011, holding at 248 million units. LCD TVs will account for 206M and plasma TV for 17M. The forecast reduction is based on lower business targets for the year from TV manufacturers, and lower than expected demand for key TV components during the peak procurement period leading into the holiday season.

“Demand in regions like North America and Europe has fallen short of expectations as persistent economic problems have made consumers cautious in their spending and highly value-seeking,” noted Paul Gagnon, Director of North America TV Research for DisplaySearch. “Emerging markets continue to show good growth, but it is not strong enough to counteract the weaker demand in developed markets, and as a result, we have lowered our unit forecasts for LCD and plasma TV.”

Although total TV unit demand for 2011 looks to be flat, shipments of flat panel TVs, which excludes CRT and rear projection technologies, will increase about 6% Y/Y. This growth looks likely to improve to 9% in 2012, as the premium for advanced features continues to fall and manufacturers bring low-cost solutions to emerging markets in an effort spur faster replacement of CRT TVs.

Figure 1: Worldwide TV Forecast by Technology

Source: DisplaySearch’ Quarterly Advanced Global TV Shipment and Forecast Report

LCD TV Will Remain the #1 TV Technology, as Backlights Shift from CCFL to LED

LCD shipments will rise from 192M in 2010 to 206M this year, which is less than the previous forecast of 211M and a key reason the overall TV market forecast was reduced.

Gagnon added, “LCD TVs account for more than 80% share of all global TV shipments. LCD TV supply chain participants—including panel makers, OEMs, and TV brands—have all lowered their outlook for 2011 demand, despite a recent drop in LCD panel prices. Long-term, we continue to forecast annual growth in demand for LCD TVs, although generally we expect less than 10% growth each year.”

LED and 3D Features Keep LCD TV Prices Stable

A growing share of new premium features, like LED backlights and 3D, are helping to keep the LCD TV category average prices very stable in 2011, falling just 7% Y/Y on a volume weighted basis. However, with the slower unit growth, total LCD TV revenues are expected to be flat this year. After increasing slightly in 2012, revenues should begin a gradual decline beginning in 2013. The forecast share of LED backlights in LCD TV shipments has been reduced slightly to 46% in 2011, but is still expected to become the dominant backlight technology for LCD in 2012 and reach nearly 100% of shipments by 2015.

Plasma TV Growth Slows

Plasma TV unit growth started slowing in Q2’11, declining 6% Y/Y, and is now expected to see a double-digit unit shipment decline each quarter through the middle of 2012. Because LCD TV prices are falling more quickly than plasma TV prices, the gap in pricing is narrowing and share is shifting away from plasma and towards LCD at several sizes. For example, in Q2’10 a 42” 1080p plasma TV was 32% cheaper than a competitive 42” 1080p 120 Hz LED LCD TV, but that gap fell to just 9% by Q2’11. Total plasma TV unit shipments are expected to fall 9% in 2011 to 17M units and around 5-6% each year thereafter.

OLED TVs Enter the Scene in Late 2012

OLED TV is set to debut around late 2012 as a contender in the 40”+ category, but will only grow to about 2.5% of the 40”+ segment by 2015 due to high prices and limited availability. Current projections are for OLED to debut at about 2-3X the price of a high-end LED-backlit LCD TV.

Emerging regions (China, Asia Pacific, Latin America, Eastern Europe, Middle East, and Africa) will have the strongest flat panel TV growth over the next four years, averaging 11% growth each year, while developed regions decline an average of 1% each year. The Asia Pacific region is positioned for strongest growth as the late-adopting India market begins to boom.

The worldwide forecast for 3D TVs was slightly increased through unexpected growth in emerging markets and Europe, although North America is growing slower than expected. 3D TVs are expected to account for 11% of total TV shipments in North America, but 14% of Western Europe and 12% of China TV shipments. Eventually though, North America will lead 3D adoption due to stronger preference for 40”+ sizes. 3D TV is expected to account for just over 22M in 2011, rising to more than 100M shipped by 2015.

The DisplaySearch Q3’11 Quarterly Advanced Global TV Shipment and Forecast Report includes panel and TV shipments by region and by size for nearly 60 brands, and also includes rolling 16-quarter forecasts, TV cost/price forecasts ,and design wins. This report is delivered in PowerPoint and includes Excel-based data and tables. If you need further information or assistance please contact us at +1.408.418.1900 or sales@displaysearch.com or at the local DisplaySearch offices in China, Japan, Korea, Taiwan and the United Kingdom.

About DisplaySearch

Since 1996, DisplaySearch has been recognized as a leading global market research and consulting firm specializing in the display supply chain, as well as the emerging photovoltaic/solar cell industries. DisplaySearch provides trend information, forecasts and analyses developed by a global team of experienced analysts with extensive industry knowledge. In collaboration with the NPD Group, its parent company, DisplaySearch uniquely offers a true end-to-end view of the display supply chain from materials and components to shipments of electronic devices with displays to sales of major consumer and commercial channels. For more information on DisplaySearch analysts, reports and industry events, visit us at http://www.displaysearch.com/. Read our blog at http://www.displaysearchblog.com/ and follow us on Twitter at @DisplaySearch.

About The NPD Group, Inc.

The NPD Group is the leading provider of reliable and comprehensive consumer and retail information for a wide range of industries. Today, more than 1,800 manufacturers, retailers, and service companies rely on NPD to help them drive critical business decisions at the global, national, and local market levels. NPD helps our clients to identify new business opportunities and guide product development, marketing, sales, merchandising, and other functions. Information is available for the following industry sectors: automotive, beauty, commercial technology, consumer technology, entertainment, fashion, food and beverage, foodservice, home, office supplies, software, sports, toys, and wireless. For more information, contact us or visit http://www.npd.com/ and http://www.npdgroupblog.com/. Follow us on Twitter at @npdtech and @npdgroup.