DisplaySearch announced it forecasts that TV applications will dominate the demand for Light Emitting Diodes (LEDs) through 2013.

DisplaySearch announced it forecasts that TV applications will dominate the demand for Light Emitting Diodes (LEDs) through 2013.

For more information visit: www.displaysearch.com

Unedited press release follows:

TV Applications to Dominate LED Demand through 2013, then LED Lighting Will Take Over in 2014

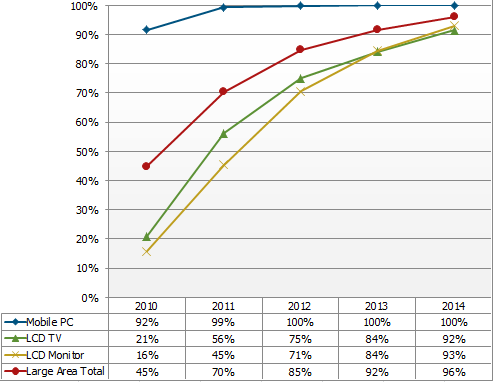

LED Penetration Rate in Large-Area Backlight Forecast to Reach 70% in 2011

Santa Clara, California, April 28, 2011—Demand for LEDs continues to rise, with TV applications forecast to dominate LED demand through 2013, accounting for nearly 50% of total LED backlight market demand. According to the DisplaySearch Quarterly LED Supply/Demand Market Forecast Report, LED lighting will capture the lead by 2014, as demand for LEDs in LCD TV backlights falls. This drop is expected due to a decrease in the number of LED packages per set—a result of efficacy enhancements and cost reductions.

“The market for LED backlights continues to grow as manufacturers leverage the technology for large display applications like notebooks, monitors, and TVs,” noted Leo Liu, Senior Analyst at DisplaySearch. “In addition, there are a growing number of emerging applications for LEDs, such as lighting, signal, and automotive applications.”

Currently, LED backlights are used in all small/medium LCDs, and LED penetration in mobile PCs is nearly 100%. Penetration of LEDs in LCD monitors and LCD TVs continues to grow, while the number of LED packages per set is decreasing. After more than doubling to 12.9 in 2010, the average number of chips per set is increasing more slowly, and is expected to peak at 15.1 in 2012. This is driven by the increasing efficacy of LEDs, even as the cost per chip decreases. This virtuous cycle drives LED penetration higher in LCD backlights, as well as illumination.

Figure 1. DisplaySearch Large-Area LED Market Penetration Forecast by Application (Shipments)

Source: Quarterly LED Supply/Demand Market Forecast Report

The LED lighting penetration rate in 2010 was 1.4%, and is forecast to reach 9.6% in 2014. In terms of LED lighting, spotlights and LED street lights are forecast to have higher penetration in lighting due to government incentive programs like the 12th Five Year Policy in China, as well as growth in commercial applications. In addition, LED bulbs and fluorescent tubes are growing in Japan due to government incentive programs (Eco-Point) and energy consciousness.

Quarterly chip supply will nearly double from the beginning of 2010 to the end of 2011, as both existing and new suppliers ramp up MOCVD lines. In Q1’11, Samsung and LG were the top two LED suppliers in terms of 500 x 500 µm chip size. However, led by Epistar in the #3 position, Taiwan will pass Korea as the largest source of supply in 2011. The tight supply situation experienced in 2010 has turned into an oversupply, as chip production has increased while LED TV penetration did not grow as fast as expected, reaching only 21% in 2010.

The Quarterly LED Supply/Demand Market Forecast Report analyzes the entire LED industry supply and demand, including backlight and lighting applications, on a quarterly basis. From chip prices to LED maker roadmaps, clients get a clear outlook and reliable forecasts of LED supply/demand and impacts on pricing. Forecasts in this report include detailed backlight and lighting supply/demand, pricing cost structure and more. The report covers:

• Rolling 16 quarter forecasts for LED backlights by size, resolution, and application

• Rolling 16 quarter forecasts for LED lighting by power, light input, and installation

• LED supply chain analysis for backlights and lighting

• Global MOCVD technology and investment updates

• LED supply/demand forecasts and analysis

• LED package, backlight, and lighting price and cost structure forecasts

• LED technology updates

• LED makers roadmap updates

For more information on this report, please contact Charles Camaroto at 1.888.436.7673 or 1.516.625.2452, or contact@displaysearch.com, or contact your regional DisplaySearch office in China, Japan, Korea or Taiwan.

About DisplaySearch

Since 1996, DisplaySearch has been recognized as a leading global market research and consulting firm specializing in the display supply chain, as well as the emerging photovoltaic/solar cell industries. DisplaySearch provides trend information, forecasts and analyses developed by a global team of experienced analysts with extensive industry knowledge. In collaboration with the NPD Group, its parent company, DisplaySearch uniquely offers a true end-to-end view of the display supply chain from materials and components to shipments of electronic devices with displays to sales of major consumer and commercial channels. For more information on DisplaySearch analysts, reports and industry events, visit us at http://www.displaysearch.com/. Read our blog at http://www.displaysearchblog.com/ and follow us on Twitter at @DisplaySearch.

About The NPD Group, Inc.

The NPD Group is the leading provider of reliable and comprehensive consumer and retail information for a wide range of industries. Today, more than 1,800 manufacturers, retailers, and service companies rely on NPD to help them drive critical business decisions at the global, national, and local market levels. NPD helps our clients to identify new business opportunities and guide product development, marketing, sales, merchandising, and other functions. Information is available for the following industry sectors: automotive, beauty, commercial technology, consumer technology, entertainment, fashion, food and beverage, foodservice, home, office supplies, software, sports, toys, and wireless. For more information, contact us or visit http://www.npd.com/ and http://www.npdgroupblog.com/. Follow us on Twitter at @npdtech and @npdgroup.