IHS iSuppli announced it reckons that six major movie studios are barking up the right tree with their UltraViolet initiative.

IHS iSuppli announced it reckons that six major movie studios are barking up the right tree with their UltraViolet initiative.

For more information visit: www.isuppli.com

Unedited press release follows:

Can UltraViolet Revitalize the Video Retail Business?

December 23, 2011 — Warner Home Video’s launch of the first UltraViolet-enabled Blu-ray Disc (BD) titles sounds the starting gun for the studios’ bid to resuscitate the health of their flagging video retail business by enhancing the value of physical media through the addition of enhanced digital access, which buyers can use to play the content on their computers, tablets and mobile phones.

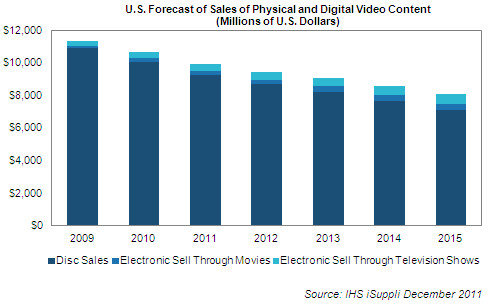

The stakes are enormous for the studios, with combined U.S. consumer purchasing of video content—both physical and electronic—expected to decline to $9.9 billion in 2011, down 29 percent from its $14.1 billion peak in 2004, according to the IHS Screen Digest US Video Intelligence Service from information and analysis provider IHS (NYSE: IHS). Unless there’s a change in the consumer proposition, revenue is expected to continue to fall in the coming years to $8.1 billion in 2015, as presented in the figure below.

“The U.S. video retail business is in decline,” said Tom Adams, principal analyst and director, U.S. media, for IHS. “Although the rate of decrease moderated during the last two years from the double-digit drop in the recessionary year of 2009, we don’t see those declines turning into renewed growth without a fundamental change in the ownership proposition for consumers. UltraViolet delivers that kind of change. In the absence of easy access to all their purchased content across all their proliferating number of screens, consumers have been cutting back on buying discs, while the growing electronic sell-through (EST) market is simply too small to make up the difference.”

Instead, consumers are increasingly turning to the already popular disc-rental option, while consuming more and more on-demand video through both their pay-TV subscriptions and Internet-based subscription services like Netflix, Adams noted. The problem for film and TV producers is that the purchase models—both physical and electronic—produce far more revenue per view than do rentals or subscription services.

That’s why five of the six major studios—all save Disney—have joined in the Digital Entertainment Content Ecosystem (DECE) consortium with leading physical and electronic retailers and key technology companies to develop UltraViolet.

UltraViolet is a common file format and digital rights authentication system designed to allow a digital copy of a film or television show bought from any vendor—physical or electronic—to be played on any one of 12 devices owned by up to six members of a household, either via download or streaming from the cloud.

Warner Home Video kicked off the UltraViolet market in October in the United States with the release of the first Blu-ray Discs (BDs) enabled with the technology. The company rolled out “Horrible Bosses” on Oct. 11 and “Green Lantern” Oct. 14.

“We think it’s important that UltraViolet is being launched not so much as a feature of EST files, but as a value-added feature of the digital disc, on which consumers have spent $113 billion since they were introduced in 1997,” Adams added. “Even if our projections are correct that annual disc sales in the United States will have declined to some $9.3 billion in 2011, that’s still about 14 times the size of the EST business. So, there are two advantages to a disc-focused strategy. First, tens of millions of the studios’ best customers will be quickly exposed to the UltraViolet pitch in the box. Second, if UltraViolet it sparks just a 7 percent increase in consumer disc buying in the years ahead, it would pay off for studios as much as a doubling of the EST business.”

IHS iSuppli’s market intelligence helps technology companies achieve market leadership. Catch the latest media & advertising industry trends from all across the world straight from our immensely experienced analysts. The Media portal at iSuppli provides deeper insights into granular sector analysis of traditional and new media content, distribution and technology strategies for filmed entertainment, TV, broadband, video game and digital media markets. iSuppli provides comprehensive media market research that is rigorous, reliable & relevant. To know more, send us an e-mail on info@isuppli.com or contact us on +1.310.524.4007.