IHS announced it reckons that flat-panel TV prices in the U.S. surged in early 2012 due to a shift in strategy by brands and retailers.

IHS announced it reckons that flat-panel TV prices in the U.S. surged in early 2012 due to a shift in strategy by brands and retailers.

For more information visit: www.isuppli.com

Unedited press release follows:

US Flat-Panel TV Prices Surge in Early 2012 as Brands and Retailers Shift Strategy

El Segundo, Calif., May 8, 2012 — Although flat-panel television shipments are expected to decline in the United States this year, the sophistication of features used in the sets is on the rise, causing a rare, sharp increase in pricing during the first four months of the year, according to an IHS iSuppli U.S. Price and Specifications TV Tracker report from information and analytics provider IHS (NYSE: IHS).

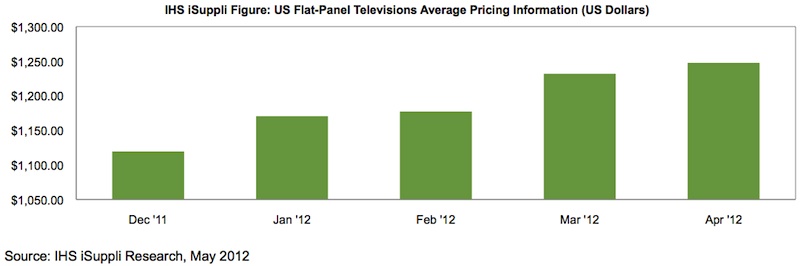

High-end television features like Internet connectivity and light-emitting diode (LED) backlight technology have helped U.S. flat-panel TV prices climb 11.4 percent since December 2011. And in April, average pricing for U.S. flat-panel televisions including liquid crystal display (LCD) and plasma sets reached $1,248, as presented in the figure below.

“Feature-rich TV models are responsible for the ongoing surge in prices, especially as consumers clamor for capabilities such as Internet connectivity and LED-backlighting technology,” said Tom Morrod, head of television technology for IHS. “TV manufacturers and retailers are charging a premium for these features, boosting their pricing and protecting their revenue. This represents a shift in strategy among brands and retailers to hold the line on pricing and encourage consumers to buy more expensive sets.”

Compared to the $1,119 average rate in December, the first month that prices started rising again after a plunge in November, U.S. flat-panel TV prices climbed to $78 at the end of April. This represents the largest increase of any comparable four-month period during the past year.

A gradual rise in prices also occurred from April to July in 2011, but the total increase during that four-month period amounted to only $33. From November 2011 to February 2012, the four-month increase measured slightly more than $63.

April’s average pricing was slightly up from the March level of $1,232. A year ago in March 2011, pricing for U.S. flat-panel sets had tumbled to a low of $1,087.

A farewell to price wars

The current conditions in the U.S. flat-panel market represent a major departure from 2011 and previous years, which were marked by aggressive pricing competition.

“Unlike the costly price wars waged by manufacturers last year that left both suppliers and retailers bloodied, brands and sellers in 2012 are working together to keep money flowing into the industry,” Morrod said. “The industry is able to accomplish this by making consumers pay for features that they want, and by excluding features that buyers are not willing to pay for.”

Such an approach has meant implementation of different pricing strategies from brands and retailers as well controlled inventory into distribution channels—a strategy that has also successfully preventing prices from sliding this year, IHS believes.

In comparison to TVs that gained in pricing, models that featured lower refresh rates or had no Internet connectivity saw their prices decline. For instance, pricing slipped 6 percent in April for 40- and 42-inch sets made by premium brands that used the older LCD technology of cold cathode fluorescent lamp (CCFL), had lower 60-hertz refresh rates and that lacked Internet capabilities.

For TVs that offered the desired advanced functionalities, pricing during the same period ticked up—by 1 percent for the 30- to 39-inch segment, and by 2 percent for both the 40- to 49-inch as well as for the 50-inch-and-larger categories.

The upsell strategy

Sellers have also been working to “upsell’ customers—i.e., to persuade consumers to purchase more expensive television sets. Retailers are working to convince buyers to move up to either a larger-sized TVs or to one using LED-backlit panels—but the price to upgrade carried different costs.

For instance, the extra cost to upgrade a premium-model 32-inch TV without LED backlighting to another 32-inch model with an LED panel is 14 percent. However, the cost to upgrade to the next-bigger size of 40 or 42 inches—but one without LED backlighting—is 21 percent. The larger price premium for upgrading to a bigger TV size indicates the market was aware that buyers were willing to shell out more money to obtain larger-sized sets over a similar-sized TV model with LED backlighting.

Just the same, the forced choice between one or the other option is proving increasingly untenable for consumers, so sellers in the future are expected to close the price gap between the two features. This means that buyers in the future would pay the same price premium—say, 10 percent—to either upgrade to an LED panel or to a bigger size. No longer will upgrading to one option cost more than the other, as is the case today.

Among 3-D LCD TVs, average prices in April rose 3 percent sequentially to $2,492. Prices also rose 3 percent to $1,638 on average for TV sets featuring the LCD rival technology of plasma, which continues to focus on 3-D and larger-than-50-inch sizes.

About IHS (www.ihs.com)

IHS (NYSE: IHS) is the leading source of information, insight and analytics in critical areas that shape today’s business landscape. Businesses and governments in more than 165 countries around the globe rely on the comprehensive content, expert independent analysis and flexible delivery methods of IHS to make high-impact decisions and develop strategies with speed and confidence. IHS has been in business since 1959 and became a publicly traded company on the New York Stock Exchange in 2005. Headquartered in Englewood, Colorado, USA, IHS employs more than 5,500 people in more than 30 countries around the world.