IHS announced it forecasts that U.S. flat-panel TV shipments will drop for the first time on an annual basis in 2012, ending an unbroken string of growth since the market began.

IHS announced it forecasts that U.S. flat-panel TV shipments will drop for the first time on an annual basis in 2012, ending an unbroken string of growth since the market began.

For more information visit: www.isuppli.com

Unedited press release follows:

US Flat-Panel TV Shipments Projected to Fall for First Time Ever This Year

El Segundo, Calif., March 27, 2012 — In what appears to be a decisive turning point, U.S. flat-panel TV shipments are projected to dip for the first time on an annual basis this year, ending an unbroken string of growth since the market began.

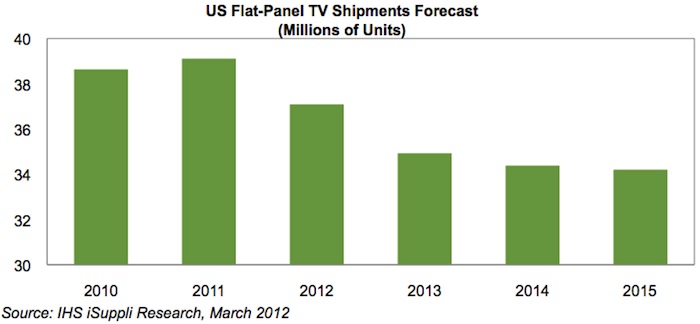

Shipments in 2012 of flat-panel TVs into the American market are forecast to decline to 37.1 million units, down 5 percent from 39.1 million units in 2011, according to an IHS iSuppli U.S. TV Market Tracker report from information and analytics provider IHS (NYSE: IHS). Only last year, shipments had inched up 1 percent from 38.6 million units in 2010.

Shipments of flat-panel TVs—a category covering the dominant liquid crystal display television (LCD TV) sector, the smaller plasma TV segment and the negligible and moribund rear-projection TV market—peaked last year. Shipments are projected to continue to weaken for the next three years until at least 2015, as shown in the figure attached.

“The U.S. flat-panel television market has never declined on an annual basis, even at the height of the recession in 2008 and 2009,” noted Lisa Hatamiya, TV research analyst for IHS. “The decline starting this year suggests that demand may have crested for the mature U.S. TV market. Sales in the United States now are being driven by consumers who are replacing their older flat-panel sets with new models boasting more advanced features. This contrasts with developing regions of the world where vibrant, untapped markets remain for buyers making their first-ever purchase of flat-panel sets.”

Irrational exuberance in 2011 contributes to sales decrease in 2012

Beyond the long-term maturation of the U.S. television market, sales will contract in 2012 because of specific supply and dynamic developments that occurred in 2011.

In retrospect, television brands were also too optimistic last year, contributing to this year’s expected historic downturn. Believing that consumers were finally ready to buy new TVs and part with their money, manufacturers increased shipments in the first quarter last year—only to be proven wrong when the hoped-for sales failed to materialize. A negative chain reaction then ensued that lasted throughout the year, with sets being very aggressively priced toward the third and fourth quarters to make up for a frail first half.

These price cuts hurt profits horribly across the board for almost every vendor.

As a result of last year’s bitter prescriptive, brands will be very cautious in 2012. Manufacturers will attempt to control new shipments into the U.S. market, so that prices remain steady and won’t drive as much demand as last year. The attempt to rein in pricing could also prove dicey, possibly risking the ire of a purchasing public used to discounting or a pattern of gradually lower prices. The overall effect will serve to inhibit shipments this year.

A silver cloud to the lining will be that despite the projected shipment decline, the industry as a whole expects to be more profitable, with less discounting bringing in more revenue.

LED backlighting brightens the market

This year will also see LCD TVs with light-emitting diode (LED) backlighting catapult to dominance in the United States for the first time over older-generation, slightly bulkier LCD sets featuring Cold Cathode Fluorescent Lamp (CCFL) technology. U.S. shipments of LED-backlit sets will reach 23.7 million units, compared to 8.7 million for CCFL models. Only last year, the tables were turned, with CCFL claiming higher shipment numbers at 18.8 million units, against 14.5 million for LED sets.

LED-backlit sets are expected to see rapid double-digit growth in the upcoming years as brands focus on marketing this feature and making LED-based models standard in their lineup. The sets will emerge in small- to medium-sized TV panels—specifically in the sub-40-inch range.

While U.S. flat-panel TV shipments are projected to move down starting this year, the market continues to aim for increasingly more advanced features in new sets being produced, in order to continue luring customers into new purchases. Trends currently taking shape in the U.S. LCD TV market include a continuing transition to larger sizes; a steady move from 120-hertz refresh rates toward 240 Hz and even 480 Hz; standardization of the Full HD 1080p specification in sets; inclusion of Internet-enabled capabilities; and increasing emphasis where 3-D is concerned toward passive 3-D displays that include battery-free, less expensive 3-D glasses.

About IHS (www.ihs.com)

IHS (NYSE: IHS) is the leading source of information, insight and analytics in critical areas that shape today’s business landscape. Businesses and governments in more than 165 countries around the globe rely on the comprehensive content, expert independent analysis and flexible delivery methods of IHS to make high-impact decisions and develop strategies with speed and confidence. IHS has been in business since 1959 and became a publicly traded company on the New York Stock Exchange in 2005. Headquartered in Englewood, Colorado, USA, IHS employs more than 5,500 people in more than 30 countries around the world.