IHS announced its latest research suggests that Americans continue to spend an ever declining amount on DVD and Blu-ray Disc (BD) video purchases and rentals.

IHS announced its latest research suggests that Americans continue to spend an ever declining amount on DVD and Blu-ray Disc (BD) video purchases and rentals.

For more information visit: www.isuppli.com

Unedited press release follows:

Spending by US Households on Physical Media Video Continues to Decline

El Segundo, Calif., June 1, 2012 — In another sign that American viewing tastes are shifting away from discs and toward online video, U.S. households in 2011 decreased their spending on physical media purchases and rentals at a double-digit rate, according to the IHS Screen Digest Video Intelligence Service from information and analytics provider IHS (NYSE: IHS).

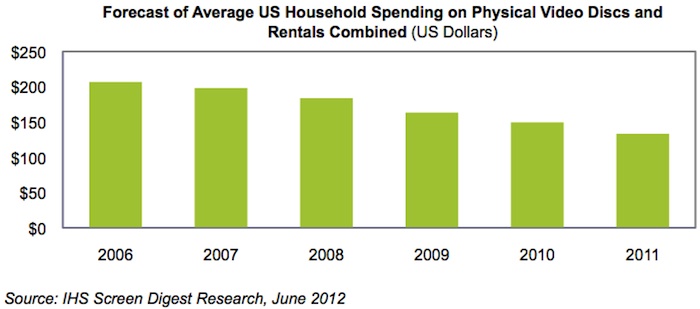

Average spending on physical video media per U.S. video household owning either a DVD or Blu-ray Disc (BD) player slipped to $133.31 in 2011, down 11 percent from $149.53 in 2010, as shown in the figure below. In 2006, at the time the BD format was launched, per-household spending was $73.47 higher, reaching an average of $206.78. Spending levels, which have declined since 2004, are expected to retreat again this year to $123.50. Of the 2011 spending total, 61 percent—equivalent to $81 per video home—went to buying discs; the remaining $52 was spent on the cheaper option of rentals.

Overall, total spending last year by Americans on packaged retail video amounted to $8.8 billion, down 12 percent from $9.9 billion in 2010. Total spending also fell on rental video, although at a smaller 7.3 percent to $5.7 billion.

Consumer spending on packaged video will keep declining through 2016, reaching slightly more than $11.4 billion by the end of that year—a neighborhood last seen in pre-DVD 1994. Of that total, retail spending in 2016 is estimated to amount to slightly less than $5.4 billion—the level in 1997 when DVDs were first launched. Rental spending will be at a hair more than $6 billion, similar to what was reached in 1990, well before the 2001 rental peak.

IHS analysis suggests that Americans will pay to consume more movies online in 2012 than they will on physical video formats. That would mark the first year that consumption of legal, Internet-delivered movies will outstrip those of DVDs and BDs combined.

The legal, paid consumption of movies online in the United States is projected to reach 3.4 billion views in 2012, approximately 1.0 billion views higher than the 2.4 billion combined retail and rental physical video transactions. It is important to note, however, that comparing digital views to physical retail and rental transactions is like comparing apples to oranges, as purchased and rented discs are often viewed more than one time per retail or rental transaction.

Non-physical realities

“The overall view for U.S. video spending is less bleak when other forms of transactional and on-demand subscription video are added to the mix,” said Michael Arrington, senior analyst for U.S. video at IHS. “If revenue were to be added from other viewing options such as video-on-demand, Internet-based sales and rentals, and subscription streaming from providers like Netflix and Hulu Plus—alternatives to physical disc purchases and rentals that consumers have been steadily gravitating toward for the past several years—consumer spending across all outlets of home video would amount to nearly $17.2 billion, a much more substantial figure.”

Prospects for the physical video market could likewise improve this year compared to 2011, especially as U.S. consumer spending at the box office in March was up more than 20 percent from the same time last year. Given hit movies such as “The Hunger Games,” “Twilight: Breaking Dawn Part 2” and “The Avengers,” a real potential exists for a lift in the video market this year that could minimize the overall projected decline.

Rental market is also changing

Despite the success of the kiosk channel led by Coinstar’s Redbox, rentals took a nosedive last year as traditional rental stores continued to close. Moreover, Netflix caused many subscribers to shift their spending away from discs and toward streaming—first by offering streaming-only plans for $7.99 per month in late 2010; and then by separating the service completely from physical-disc rentals, on which it raised prices in mid-2011.

Those moves by Netflix resulted in customers leaving the subscription-disc rental world in droves, with subscription customers estimated to be down to 14 million by the end of 2011, compared to 18 million the same time a year ago. Some of those that left transferred to the Blockbuster Online subscription rental service, now operated by new parent Dish Network. Many more stopped renting physical disks altogether or took their business back to stores and kiosks.

Kiosks have seen their share of the rental action increase, especially as the number of traditional stores fell to less than 6,000 by the end of last year—down from slightly less than 10,000 the year before. Kiosks in 2011 accounted for roughly 34 percent of all U.S. consumer spending on physical rentals, up from 22 percent the year before. This year, more than 41 percent of rental dollars will go through kiosks, a figure which is expected to climb to nearly 52 percent by 2015.

About IHS (www.ihs.com)

IHS (NYSE: IHS) is the leading source of information, insight and analytics in critical areas that shape today’s business landscape. Businesses and governments in more than 165 countries around the globe rely on the comprehensive content, expert independent analysis and flexible delivery methods of IHS to make high-impact decisions and develop strategies with speed and confidence. IHS has been in business since 1959 and became a publicly traded company on the New York Stock Exchange in 2005. Headquartered in Englewood, Colorado, USA, IHS employs more than 5,500 people in more than 30 countries around the world.