IHS announced it reckons that Vizio has reclaimed its lead over rival Samsung in U.S. LCD TV shipments.

IHS announced it reckons that Vizio has reclaimed its lead over rival Samsung in U.S. LCD TV shipments.

For more information visit: www.isuppli.com

Unedited press release follows:

Vizio Retakes Lead in U.S. LCD TV Market; Samsung Maintains Overall TV Dominance

El Segundo, Calif. (July 12, 2012) — One year after falling to second place, Vizio Inc., in the first quarter reclaimed leadership in the U.S. liquid crystal display television (LCD TV) market as consumers flocked to buy its affordable sets, according to the IHS Screen Digest Television service at information and analytic s provider IHS (NYSE: IHS).

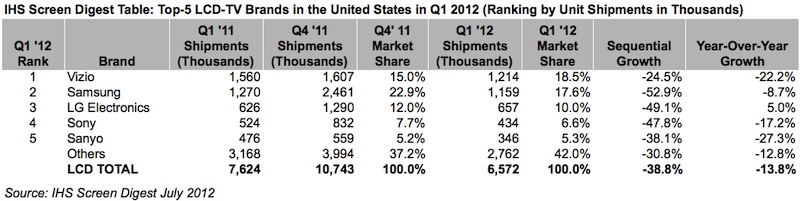

California-based Vizio during the first three months of 2012 shipped 1.21 million LCD TVs in the United States, compared to 1.15 million units for chief rival Samsung Electronics Co. Ltd., of South Korea, as presented in the table attached. In the fourth quarter of 2011, Samsung led with shipments of 2.5 million units, compared to just 1.6 million for Vizio. The last time Vizio led the U.S. LCD TV market was one year earlier, in the first quarter of 2011.

Vizio’s recapturing of its first-place ranking came during a period of weak sales and shipments in general for LCD TVs. U.S. LCD-TV market shipments in the first quarter amounted to 6.6 million units, down 13 percent from 7.6 million in the first quarter of 2011. Shipments were also down 39 percent from the fourth quarter of 2011, although a sequential decline in shipments is normal following the peak holiday selling season.

“The U.S. television market became saturated with higher-end products at the end of 2011,” observed Tom Morrod, senior analyst and head of TV Technology at IHS. “When sales dropped according to normal seasonal patterns in the first quarter, shipments also fell for most brands. However, because of its low-cost product mix that appeals to mainstream consumers, Vizio was able to prevent its shipments from declining by a large margin.”

Vizio’s television shipments in the first quarter declined by 25 percent compared to the fourth quarter, lower than the industry average, and represented the smallest rate of contraction among the Top 5 brands. This allowed Vizio’s market share to climb to 19 percent in the first quarter, up sharply from 15 percent in the fourth quarter.

“Vizio benefitted from its focus on midrange and smaller sizes for LCD TVs that are sold at relatively low prices compared to larger, more feature-laden sets,” Morrod said. “Vizio, in fact, dominates in the U.S. market for 32-inch and 42-inch sets—the most popular sizes in the country for LCD TVs.”

Samsung maintains TV lead as a whole

While it moved down to second place in LCD TVs, Samsung maintained its lead in the overall U.S. television market. Unlike Vizio, which only sells LCD TVs, Samsung also competes in the plasma television market. The plasma business generated significant shipment volume for Samsung in the first quarter, allowing the South Korean electronics giant to maintain its hold on the top rank.

“Samsung is very well positioned, not just in the U.S. LCD TV segment, but also globally in all television technologies, including plasma and emerging displays like active matrix organic light-emitting diodes (AMOLED),” Morrod said. “Overall, Samsung is the world’s leading brand, and its scale and scope mean that it can always compete in markets such as the United States. Samsung is also very well-positioned at the top end of the market, which has helped it generate profits over several years.”

Samsung shipped a total of 1.4 million LCD TV and plasma sets combined in the United States in the first quarter, allowing it to best Vizio’s total.

For more information on this topic, see the report entitled, “Plasma TV Market Begins to Decline”.

About IHS (www.ihs.com)

IHS (NYSE: IHS) is the leading source of information, insight and analytics in critical areas that shape today’s business landscape. Businesses and governments in more than 165 countries around the globe rely on the comprehensive content, expert independent analysis and flexible delivery methods of IHS to make high-impact decisions and develop strategies with speed and confidence. IHS has been in business since 1959 and became a publicly traded company on the New York Stock Exchange in 2005. Headquartered in Englewood, Colorado, USA, IHS employs more than 6,000 people in more than 30 countries around the world.